The Crypto-Boom Has Found A Winner

Coinbase was founded in 2012 by Brian Armstrong and Fred Ehrsam. By March 2021, it had grown to become one of the largest cryptocurrency exchanges in the world.

- In its last private funding round in 2018, the company was valued at $ 8B

- The company went public in April 2021 and was valued at $ 85B

- It now counts over 56m users, has over $ 223B in assets on the platform and is present in more than 100 countries

CREATING AN OPEN FINANCIAL SYSTEM

Coinbase’s mission is to create an open financial system for everyone. To do so, the company is building what it calls the “Cryptoeconomy”. Which is centralised around crypto-currencies and enables anyone to buy and sell these in a fair, accessible and transparent manner.

“We are building the cryptoeconomy – a more fair, accessible, efficient, and transparent financial system for the internet age that leverages crypto assets: digital assets built using blockchain technology.” Coinbase S1-Filling

The company started in 2012 by easing Bitcoin access and has now transformed itself into the largest crypto-currency exchange by trading volume in the United States. It enables over 50 million retail users, 7,000 institutions and 115,000 ecosystem partners to participate in the cryptoeconomy:

- Retail users: Coinbase offers a trusted and easy-to-use platform to invest, store, spend, earn and use crypto assets

- Institutions: It provides hedge funds, money managers and corporations a one-stop shop for accessing crypto markets through advanced trading and custody technology, built on top of a robust security infrastructure. Coinbase also offers a marketplace with a deep pool of liquidity for transacting in crypto assets

- Ecosystem partners: Coinbase provide developers, merchants and asset issuers a platform with technology and services that enables them to build applications that leverage crypto protocols, actively participate in crypto networks and securely accept cryptocurrencies as payment

MAKING MONEY

Coinbase derives 96% of its revenue from transactions (for the year ended December 31, 2021). This means that it is heavily dependent on the price of crypto-currencies and the volume traded each day.

- As stated by the company itself, the crypto-market evolves in booms-and-busts cycles. The downturns see the value of crypto-currencies plummet and trading volumes decrease. Intensely pressuring Coinbase’s sales

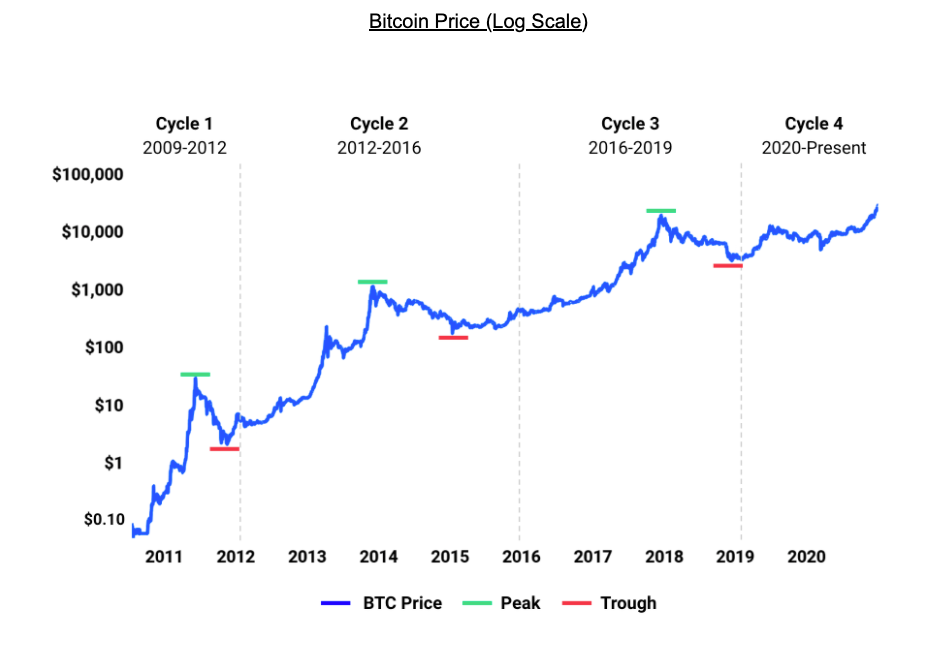

“We have observed four major crypto asset price cycles since 2010. Each cycle has had a variable duration ranging from approximately two to four years, and has increased the overall crypto market capitalization significantly from the prior cycle.” Coinbase S1-Filling

- The downturns, also called “crypto-winters” have been historically longer than the upturns. Which could cause Coinbase to experience relatively longer period of low activity (smaller amount of transactions and smaller trades)

FIGHTING FOR FEES

Crypto-exchanges are now fighting for users by lowering their fees, increasing the number of coins supported and providing enhanced liquidity. Binance is far ahead both in terms of volume traded, number of trades and weekly visits.

- Coinbase takes a 0.5% cut on each trade, 3.99% for credit card purchases and 1.49% for Coinbase Wallet or bank account purchases. It also charges $ 10 to $ 25 for wire transfers and withdrawals

- This compares with Binance that charges 0.02 to 0.1% purchase and trading fees, 3% to 4.5% for debit card purchases and $15 per U.S. wire transfer

“Exchanges take fees for executing crypto transactions, and part of the reason Binance is so popular is that its transaction fees are among the lowest in the world. Users pay just 0.1% to execute each of those billions of trades.” by Andrew Lisa for GoBankingrates - Another battle-ground for emerging crypto-exchanges is compliance. Lowering the bar enabled Binance to attract masses of users, improve liquidity and offer a wide range of crypto-currencies.

“[Coinbase] pointed out competitors that choose to operate in jurisdictions with less-stringent local rules are “potentially able to more quickly adapt to trends, support a greater number of crypto assets and develop new crypto-based products.” by Ian Allison for Coindesk - Yet, lowering the bar also has a cost:

“According to Bloomberg, the US Commodity Futures Trading Commission (CFTC) has been investigating whether Binance allowed Americans to make illegal trades on its platform, by letting them buy derivatives linked to digital tokens.” by Kim Lyons for The Verge

THE AWS OF CRYPTOS

Coinbase seeks to diversify its revenue streams away from transactions. It is therefore building a platform that integrates with over 15 blockchain protocols and provides advanced security features. Enabling developers and institutions to get the desired exposure to blockchain protocols.

- 15+ native blockchain integrations: Coinbase has developed custom technology and processes to directly integrate with over 15 blockchain protocols and efficiently support new protocols

- Advanced cybersecurity and cryptography technology: It has pioneered industry-leading standards for managing private cryptographic keys and use sophisticated cybersecurity technologies such as multi-party computation to safeguard a wide range of crypto assets

- Proprietary crypto compliance infrastructure: Coinbase built a transaction monitoring systems to analyze crypto asset transactions in real-time on the blockchain

“And so what I think we can do is start to expose some of these solutions that we've built that other companies can build upon, and we're doing that through a product called Coinbase Cloud. You can imagine it is kind of like our AWS for crypto where we're starting to offer more APIs and services like this that other banks and really any other kind of company can use to integrate with the blockchain” Brian Armstrong, Coinbase CEO on Q1’21 Earnings Call

Coinbase also recently acquired Bison Trails that will allow companies to send and store crypto, accept crypto payments and build their businesses with crypto-native infrastructure.

THE MARKET

The global crypto-currencies market capitalisation reached a high of more than $ 2.6T in the midst of May 2021, coming from its previous peak of $ 800B at the start of 2018. Interest for crypto-currencies is on the rise as major corporations have indicated their interest in Bitcoin.

“The short answer is yes, we’re thinking about it, and we’ve even discussed internally. […] So, it’s definitely on the table from a treasury perspective, as well as other investments, as we look across our business and beyond.” Palantir CFO by Sigalos MacKenzie for CNBC

According to Coinbase, the overall market capitalisation of crypto assets grew from less than $500 million to $782 billion between December 31, 2012 and December 31, 2020

- Representing a compound annual growth rate of over 150%. Over the same period, Coinbase’s retail users grew from approximately 13,000 to 43 million

- It also experienced significant growth in the number of institutions, increasing from over 1,000 as of December 31, 2017 to 7,000 as of December 31, 2020

FOUNDER-LED MANAGEMENT

Brian Armstrong is the CEO and founder of Coinbase. He previously worked at Airbnb and Deloitte. Surojit Chatterjee serves as Chief Product Officer and held roles at Flipkart and Google. Emilie Choi serves as Chief Operating Officer and previously worked at LinkedIn. She also serves as a member of the board of directors of Naspers and Prosus.

- Brian Armstrong is the co-founder and serves as Chief Executive Officer since May 2012

- Previously served as a software engineer at Airbnb from May 2011 to June 2012. From August 2003 to May 2012, he served as the founder and Chief Executive Officer of Universitytutor.com. He also served as a consultant for the enterprise risk management division at Deloitte & Touche, an accounting and consulting firm, from July 2005 to November 2005

- Holds a B.A. in Computer Science and Economics and an M.S. in Computer Science from Rice University

- Surojit Chatterjee serves as Chief Product Officer since February 2020

- From February 2017 to February 2020, he served as Vice President of Product Management for Google Shopping. Also served as Senior Vice President and Head of Product at Flipkart, an e-commerce company, from October 2015 to February 2017. Prior to Flipkart, he held various positions at Google, including Global Head of Product, Mobile Search Ads. He also served as Senior Product Manager at Symantec Corporation

- Holds a B. Tech in Computer Science and Engineering from the Indian Institute of Technology, Kharagpur, India and an M.B.A from the MIT Sloan School of Management

- Emilie Choi serves as Chief Operating Officer since June 2019

- Previously served as Vice President of Business, Data and International from March 2018 to June 2019. From December 2009 to March 2018, she served as the Vice President and Head of Corporate Development for LinkedIn. Currently serves as a member of the board of directors of Naspers and Prosus

- Ms. Choi holds a B.A. in Economics from the Johns Hopkins University and an M.B.A from the Wharton School at the University of Pennsylvania

TAKE A BREATH

So… This is a lot of information. Let’s summarise:

- Coinbase was founded in 2012 by Brian Armstrong and Fred Ehrsam. By March 2021, it had grown to become one of the largest cryptocurrency exchange in the world.

- Coinbase’s mission is to create an open financial system for everyone. To do so, the company is building what it call the “Cryptoeconomy”. Which is centralised around crypto-currencies and enables anyone to buy and sell these in a fair, accessible and transparent manner

- Coinbase derives 96% of its revenue from transactions (for the year ended December 31, 2021). This means that it is heavily dependent on the price of crypto-currencies and the volume traded each day

- Crypto-exchanges are now fighting for users by lowering their fees, increasing the number of coins they support and providing enhanced liquidity. Binance is far ahead both in terms of volume traded, number of trades and weekly visits

- Coinbase is also building a platform that integrates with over 15 blockchain protocols and provides advanced security features. Enabling developers and institutions to get the desired exposure to blockchain protocols

FINANCIAL CHECK

- Sales reached $ 1.8B in the first quarter of 2021, up 847% from a year earlier

- Retail Monthly Transacting Users (MTU) grew to 6.1 million in Q1 2021, more than double compared to Q4 2020

- Operating expenses reached $ 813m, up from $ 151m a year earlier (up 438%)

- Net income reached $ 771m, up from $ 31m a year earlier

- The company has $ 8.6B in current assets and $ 7.5B in current liabilities

BENCHMARK'S TAKE

The Good

- The renewed interest in crypto-currencies has boosted trading volumes and helped Coinbase become profitable

- With its Bison Trail acquisition, the company is transforming itself into the AWS of crypto-currencies

The Bad

- Coinbase's position is weakened by competition from less-regulated players such as Binance

- Its transaction-based model makes it heavily dependent on the price and appeal of crypto-currencies

- In the longer term, fees might be compressed and it derives only 4 to 5% of its revenue from non-transactional fees

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Maxim Hopman on Unsplash.