EQT is a global investment firm created in 1994 that focuses on investing in, developing, and owning businesses in a variety of geographies, industries, and business models. The group invests in private equity, infrastructure, real estate, growth equity, and venture capital throughout Europe, North America, and Asia Pacific with the help of a network of advisors. SEB, AEA Investors, and Investor AB, the Wallenberg family's holding firm, created the company.

- Investor AB owns around 18% of the group while Wallenberg Invest AB owns around 2%

- All of the group's funds have EQT AB as its investment advisor

- It directly employs over 1,200 people and through its more than 180 portfolio companies, it counts more than 300,000 employees

- The firm and its affiliates have offices in a variety of locations, including Amsterdam, Copenhagen, London and New York

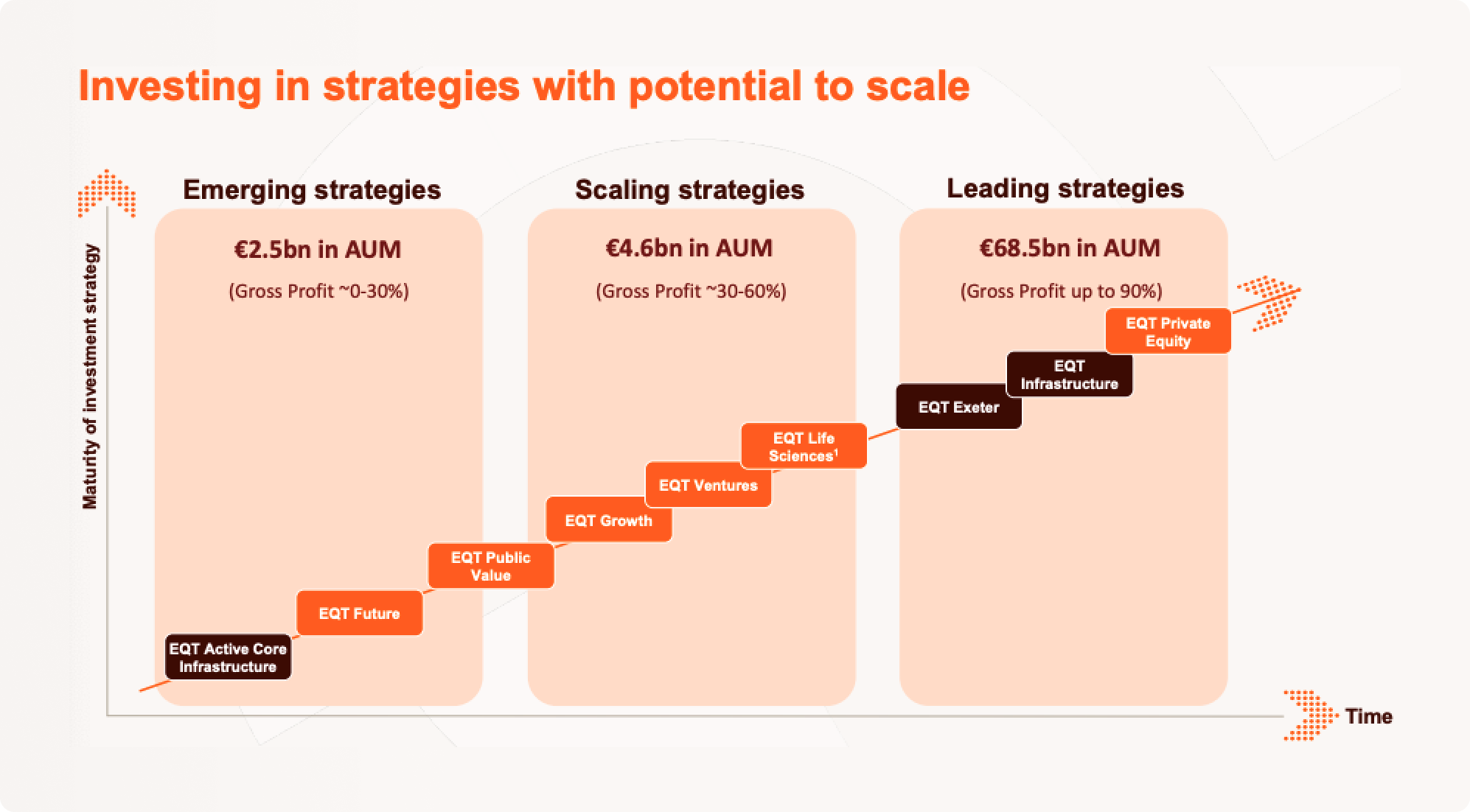

A DIVERSIFIED HOLDING

EQT is a diversified investing company active in private equity, venture capital, life sciences, public investments, infrastructure and real estate. The company currently has more than $ 73B in Assets Under Management (AUM). Throughout its investments, the firm maintains a strong focus on sustainability with around $ 10B invested into greener companies.

EQT Private Equity

- Through its private equity branch, the company seeks to make investments ranging from EUR 200m to EUR 1.6B

- It currently counts over 70 investments lead by more than 120 investment advisory professionals

- With a strong sector-based approach and by maintaining a local-with-locals presence, the EQT Private Equity Advisory Team is well positioned to analyze companies and the markets in which they operate, and to develop proprietary investment opportunities

- The team's operational approach is combined with a clear EQT angle to each investment that leverages the strengths of the EQT platform to drive growth, industry consolidation, structural change as well as take the lead within sustainability and digitalization

EQT Ventures

- Through its EQT Ventures branch, the company seeks to make investments ranging from EUR 2m to EUR 50m

- It currently counts over 100 investments lead by more than 30 investment advisory professionals

- The EQT Ventures Advisory Team aims to support entrepreneurs throughout different stages of growth, providing access to capital and in-depth specialist experience. The EQT Ventures funds employ a multi-stage strategy to make equity investments, typically ranging from late seed rounds all the way to growth rounds. This means the EQT Ventures’ support window is wider than a typical single-phase fund

- The EQT Ventures Advisory Team is based in Stockholm, London, Berlin, Paris and San Francisco. The EQT Ventures funds do not focus on particular markets or industries, as transformational shifts in technology are occurring across all industries. The focus is on ambition and scale

EQT Life Sciences

- Through its EQT Life Sciences branch, the company seeks to make investments ranging from EUR 10m to EUR 60m

- It currently counts over 50 investments lead by more than 30 investment advisory professionals

- EQT Life Sciences, formerly LSP, is targeting innovative life sciences and health care companies. With a track record going back 30 years, EQT Life Sciences has raised more than €3 billion, and invested in over 150 private companies. Its investment advisors are coming from backgrounds in medicine, science, and industry, EQT Life Sciences backs inventors who have ideas that could make a large of profound difference for patients

PUBLIC AND INFRASTRUCTURE INVESTMENTS

Next to its private holdings, the company also focusses on more mature segments such as public investments, infrastructure and real estate. These represent the largest share of AUM at EQT and (together with its private equity investments), generate the larger share of gross profits.

EQT Infrastructure

- Through its EQT Life Sciences branch, the company seeks to make investments ranging from EUR 500m to EUR 1B

- It currently counts over 520 investments lead by more than 105 investment advisory professionals

- The EQT Infrastructure Advisory Team seeks to identify control or co-control equity investments in infrastructure companies that provide an essential service to society, have long-term stable or growing underlying demand, predictable cash flows and an asset based, contracted and well protected business model

- The EQT value creation toolbox, along with full potential plans, management and organizational health assessments, digital transformation, impact focused sustainability initiatives, and periodic performance reviews are applied to help each company reach its full potential

EQT Exeter

- Through its EQT Life Sciences branch, the company counts 40 offices and has also done more than 700 real estate investments

- It currently counts over 300 investment advisory professionals

- EQT Exeter was created through the combination of EQT’s real estate business and Exeter Property Group in 2021. EQT Exeter is among the largest real estate investment managers in the world, focused on acquiring, developing and managing logistics/industrial, office, life science and residential properties. EQT Exeter applies a thematic investment strategy and value-creation approach

DATA-DRIVEN INVESTING CAPABILITIES

Through its different investment groups, EQT is taking key steps to future proof itself. These include investments in machine learning tools, leading e-commerce actors and sustainability enablers. The company has also developed its own data-tool, called Motherbrain, to identify and invest in start-ups.

- Motherbrain started in 2016 as a platform for EQT Ventures to be data-driven in finding the best tech start-ups to invest in. As hundreds of new start-ups are founded every year, no human can rate them all

- Motherbrain supports the tracking of company life-cycles rather than deal life-cycles, ending at a fund’s exit. By visualizing and making the data accessible, building on a common corporate memory and collectively trained algorithms, Motherbrain creates structural competitive advantages enabling EQT to make faster and more substantiated decisions

- Motherbrain has helped EQT Ventures find 14 deals so far

- These include Peakon, AnyDesk, CodeSandbox, Griffin, Handshake, WarDucks, Standard Cognition, Netlify and Anyfin. All of these are companies that would not have been identified without Motherbrain

SUSTAINABLE INVESTING

EQT has made extensive progress in improving sustainability in its own business as well as at the EQT funds’ portfolio companies. They have set ambitious greenhouse gas emission reduction targets, encompassing the EQT funds’ portfolio companies as well as its own platform.

- These will form a central part of its active ownership strategy and climate-related value-creation drivers

- In taking this step, EQT became the first private markets firm in the world to formalize science-based targets, as part of the Science Based Targets initiative

In addition, EQT became the first private equity firm to launch a sustainability-linked bond, where the coupon is linked to sustainability performance targets within climate and diversity, both within the EQT AB Group and at the EQT funds’ portfolio companies.

THE MARKET

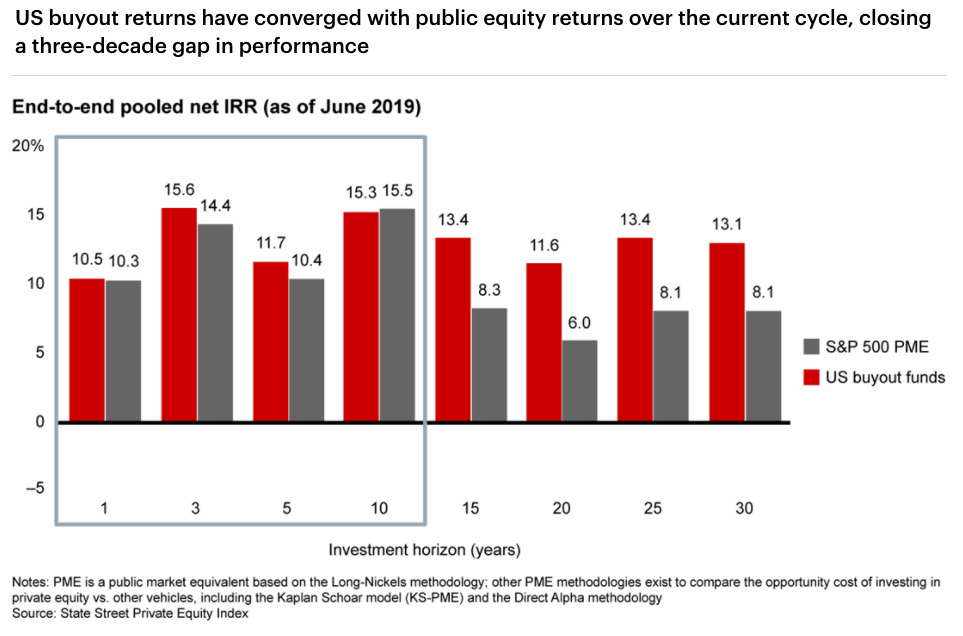

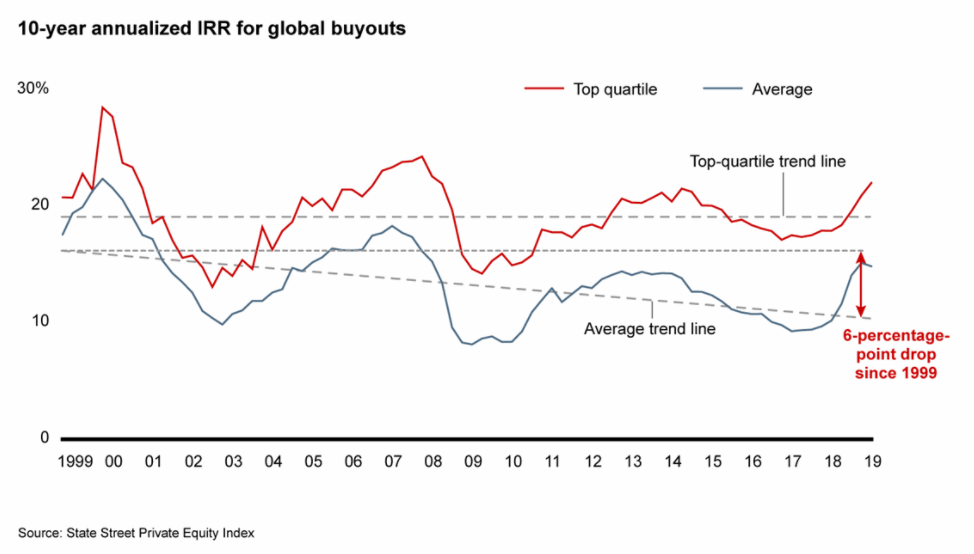

According to Bain & Company, the private equity sector's returns have been pressured by the increased maturity of the market. New incomers push asset prices higher and decrease the returns for the whole market. This decreases returns for PE funds and brings their performance back in line with public markets. Which also offer more liquidity and are less costly.

"While a 15% average annual return net of fees is impressive even by private equity’s own high standard, parity with public markets is not what PE investors are paying for."

"The institutions that allocate increasing portions of their portfolios to buyout funds have good reason to expect a premium. They lock up their money for a period of years with the presumption that professional managers will generate alpha through innovative value-creation strategies and leverage. All things being equal, public equities offer more liquidity at less cost." By Hugh MacArthur, Josh Lerner and State Street Global Markets & State Street Private Equity Index

"To a large degree, this is a function of maturity. As private equity’s relative outperformance attracts increasing amounts of capital from investors, competition for a limited number of high-quality assets increases, driving up average purchase price multiples."

"Buying at premium prices makes it ever more challenging to create value during ownership and exit with an acceptable return. Add in growing pressure from well-heeled corporate buyers, and generating alpha becomes even more daunting." By Hugh MacArthur et al.

Yet, Bain's reports further states that top private equity firms still get a preferred access to the better deals. Meaning they can generate higher returns than their peers and offer the alpha investors are looking for.

"It’s also clear, however, that an elite group of firms has found a way to buck the trend. While average returns have declined over time, top-quartile returns have essentially held steady. This explains why a large majority of the capital flowing into private equity is targeting these top-tier firms."

"For those in the bottom quartiles, raising a fund is already becoming more difficult." By Hugh MacArthur et al.

EXPERIENCED MANAGEMENT

EQT is led by Christian Sinding since January 2019. He holds a bachelor in Commerce from the University of Virginia and joined EQT Parnters in 1998. He has been involved in a number of important EQT investments such as Findus, ISS and InFiber.

- CEO and Managing Partner since January 2019

- Christian Sinding joined EQT Partners in 1998 from AEA Investors, a leading U.S.-based private equity firm, and is CEO and Managing Partner. Prior to joining AEA, Christian was employed as a financial analyst with Bowles Hollowell Conner & Co investment bankers in the U.S. Christian has worked in the Stockholm-, Munich- and Copenhagen- offices of EQT Partners and opened the Oslo office in 2007. He has been involved in a number of investments including Plantasjen, Symrise, Gambro, Vaasan&Vaasan, Findus, ISS, XXL, and InFiber

- Holds a B.Sc. in Commerce with Distinction, University of Virginia 1994

- CFO since October 2018

- Kim started his career at Morgan Stanley in 1994 and left the Nordic M&A team as a Managing Director in 2008. Between 2010 and 2015 Kim held the position as CFO at Munksjö and most recently he was a Partner and Corporate Finance Advisor at Access Partners

- Holds a Master of Science in Economics from Hanken School of Economics

- Deputy Managing Partner since August 2013. Head of Real Assets advisory team since January 2015

- Prior to joining EQT Partners, Lennart was from 2004 to 2007 Managing Director and Senior Banker in the investment bank of Unicredit - HypoVereinsbank in Munich. From 2002 to 2004, Lennart was Managing Director at GE Commercial Finance in London. Between 1987 until 2002, he held various position in the ABB Group, in Zurich such as General Counsel for the ABB Financial Services Group, President and Business Area Manager for ABB Structured Finance and ABB Equity Ventures

- Holds a Master of Laws from Lund University. Academy of American and International Law, University of Dallas

TAKE A BREATH

So… This is a lot of information. Let’s summarise:

- EQT is a global investment firm created in 1994 that focuses on investing in, developing, and owning businesses in a variety of geographies, industries, and business models

- The business invests in private equity, infrastructure, real estate, growth equity, and venture capital throughout Europe, North America, and Asia Pacific with the help of a network of advisors

- SEB, AEA Investors, and Investor AB, the Wallenberg family's holding firm, created the company

- The company currently has over $ 73B in Assets Under Management (AUM)

- Through its different investment groups, EQT is taking key steps to future proof itself. These include investments in machine learning tools, leading e-commerce actors and sustainability enablers

- The company has also developed its own data-tool, called Motherbrain, to identify and invest in start-ups

- EQT has made extensive progress in improving sustainability in its own business as well as at the EQT funds’ portfolio companies and it has around $ 10B invested into greener companies

- They have set ambitious greenhouse gas emission reduction targets, encompassing the EQT funds’ portfolio companies as well as its own platform

FINANCIAL CHECK

Adjusted total revenue amounted to EUR 1,623m for the full year of 2021 (EUR 762m for the previous year), corresponding to an increase of 113% compared to 2020. Total revenue (according to IFRS) was EUR 1,596m (EUR 709m). The increase was primarily driven by management fees from EQT Infrastructure V and EQT IX, management fees from EQT Exeter and carried interest from EQT VIII.

- Adjusted EBITDA amounted to EUR 1,100m (EUR 385m), corresponding to a margin of 68% (51%). EBITDA (according to IFRS) was EUR 970m (EUR 340m), corresponding to a margin of 61% (48%)

- Adjusted net income amounted to EUR 989m (EUR 330m). Net income (according to IFRS) was EUR 909m (EUR 283m)

- Adjusted basic earnings per share amounted to EUR 1.011 (EUR 0.346)

- Financial net cash amounted to EUR 88m (EUR 878m) impacted i.a. by the consideration paid for Exeter

- Assets under management (AUM) increased to EUR 73.4B (EUR 52.5B), primarily driven by the combination with Exeter with AUM of EUR 9.0B at the time of closing and by incremental commitments in EQT Infrastructure V

- EQT Infrastructure V, EQT IX and EQT Exeter Europe Logistics Value IV held final closes at EUR 15.7B, EUR 15.6B and EUR 2.1B in AUM, respectively

THE BOTTOM LINE

The Good

- Private equity is gradually loosing its advantage over public markets but larger and more established firms such as EQT still manage to deliver superior returns

- EQT is using machine learning to guide its growth investments and has a strong pipeline of highly profitable infrastructure and real estate investments

- The firm is also turning itself into a sustainability champion. Which could help it attract funds from institutions in need of green investments

The Bad

- Uncertainty in Europe may prevent some investors from deploying their funds into some of EQT's ventures, which might negatively impact the firm's AUM and its management fees going forward

THE STAKE

We have a stake in EQT AB. EQT is a growing and profitable investment group with a global presence and is active in public and private markets. It leverages data to find better investment opportunities and is acting as a pioneer in sustainability.

- We will increase our stake if it manages to protect its management fees over the next 18 months will growing its AUM and delivering attractive returns to its private investors

- We will clear our stake if its management fees are pressured and it fails to find attractive investment opportunities

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Ana Bórquez on Unsplash.