The Intercontinental Exchange (ICE) is based in the United States and manages worldwide exchanges, clearing houses. The company also provides mortgage technology, data, and listing services. It owns and runs 12 regulated exchanges and marketplaces for financial and commodity markets. The ICE and Liffe futures exchanges, the New York Stock Exchange, equity options exchanges, and OTC energy, credit, and stock markets are all part of this.

- ICE started when Jeffrey Sprecher (Founder, Chairman & CEO), a power plant developer, saw a need for providing transparent pricing for electric power companies

- This lead him to buy Continental Power Exchange in 1997 with the goal of creating an Internet-based platform for OTC energy commodities trading

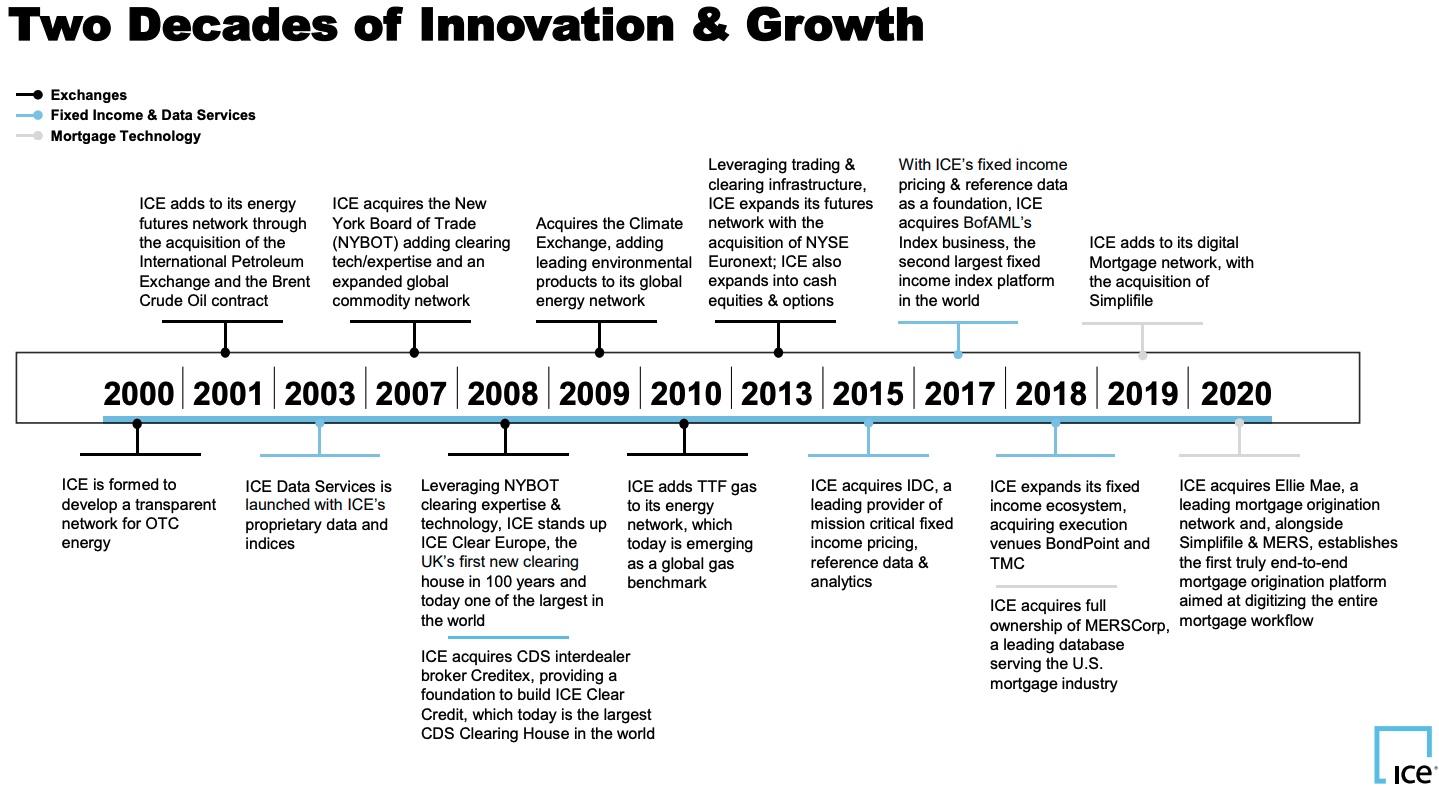

- Through a series of mergers and acquisitions, ICE has expanded into clearing services, mortgage technology and data services

CONSOLIDATION AND EXPANSION

The company has a policy of expanding through acquisitions, some have been successful, while others have failed due to anti-trust concerns. It now runs the New York Stock Exchange and recently took over Ellie Mae in a $ 11B transaction. The company is expanding its capabilities in financial automation, data availability while consolidating its position in the energy market.

- In December 2012, ICE stated that it would purchase NYSE Euronext for $8.2 billion, subject to regulatory approval. The acquisition, which took place in 2013, was approved by the boards of directors of both ICE and NYSE Euronext

- Merscorp Holding announced in October 2018 that ICE had acquired it. Merscorp is the owner and operator of the MERS System, a nationwide electronic registry that maintains changes in servicing rights and beneficial ownership interests in mortgage loans originated in the United States

- In May 2019, ICE announced that it had reached an agreement to buy Simplifile for $335 million. Simplifile manages one of the largest networks connecting the agents and jurisdictions that underpin residential mortgage records, acting as an electronic liaison between lenders, settlement agents, and county recording offices to streamline the recording of residential mortgage transactions locally

- ICE stated in August 2020 that it had reached a deal to buy Ellie Mae, a cloud-based platform for the mortgage finance business. The company was owned by Thoma Bravo, a major private equity investment firm, and was valued at around $11 billion in the transaction

- In 2021, ICE sold its 9.85% stake in Euroclear to Silver Lake, a U.S. buyout firm for $ 821m. ICE had started its stake in Euroclear in 2017 when it bought a 4.7% stake for € 275m

FINANCIAL DATA & INDICES

The firm derives over 31% of its sales from its fixed income, data & analytics segment, 24% comes from its exchange data services, mortgage technology generates around 15% of it sales while listings generate 14% of its sales. Finally, other data and network services generate 16% of its sales.

- Exchanges: ICE operates regulated marketplaces for the listing, trading and clearing of a broad array of derivatives contracts and financial securities, such as commodities, interest rates, foreign exchange and equities as well as corporate and exchange-traded funds, or ETFs. It operates multiple trading venues, including 12 regulated exchanges and six clearing houses, which are positioned in major market centers around the world, including the U.S., U.K., European Union, or EU, Canada and Singapore

- Fixed Income and Data Services: It includes the fixed income data and analytics offerings, fixed income execution, or ICE Bonds, CDS clearing and other multi-asset class data and network services. ICE's fixed income pricing and reference data offerings serve as the foundation for a broader fixed income network that provides its customers solutions that span the full workflow including pre- and post-trade analytics, a range of execution protocols and indices

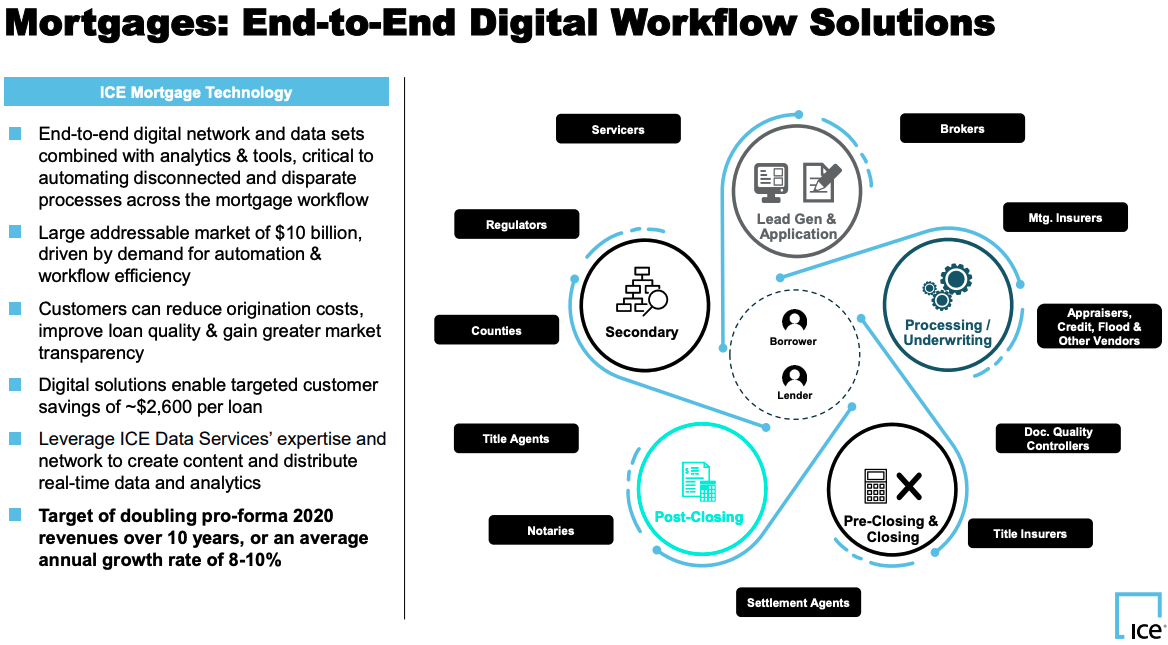

- Mortgage Technology Segment: ICE has constructed an end-to-end network aimed at identifying and solving the inefficiencies that exist in the U.S. residential mortgage market. From application through closing and the secondary market, its network is intended to connect the stakeholders across the mortgage origination workflow and provide its customers with data services and technology that deliver greater transparency and enable significant customer efficiency gains

TRADING TECHNOLOGY

Trading and clearing technology, multi-asset class analytics, risk assessment tools, comprehensive data offerings, mortgage technology, instant messaging capabilities, and flexible connectivity and delivery options are some of the technology solutions which ICE delivers to its clients. The company designs and builds its own systems and writes its own software programs whenever possible. This enables it to keep control over its own technology and to be more responsive to its customers' needs, better support its business's dynamic nature, provide the highest quality technology, and deliver relevant, timely, and actionable data to the markets.

- The NYSE electronic trading platform features an open system architecture that allows users to access ICE's system via one of the many front-end trading applications developed by ISVs. For equity options, it offers a hybrid model of electronic and open outcry trading through NYSE American Options and NYSE Arca Options

- ICE Data Services technology uses integrated platforms to capture, store and process information, perform analytics and maintain connectivity solutions using a single configurable data capture mechanism and flexible delivery capability. Together, the platforms are intended to enable real-time processing and delivery of information, accelerate new product development and improve production reliability

- The ICE Mortgage Technology platform enables lenders to originate, process, fund and deliver residential mortgages using various applications, APIs, data products and other services offered. The platform is developed using industry-leading software technologies and third-party services, including hosting with a combination of public cloud and private data centers

THE MARKET

Through its mortgage technology services, ICE is exposed to growth of the loan servicing market which is poised to grow by 12% each year over the 2021 - 2025 period. At the same time, its financial information business is set to grow by around 9.5% over the next 8 years.

According to Technavio, the loan servicing software market is set to grow by $ 1,878B at a CAGR of almost 12% from 2021 to 2025.

- The market is likely to develop as a result of the necessity to automate the entire loan collection, processing, and appraisal process

- This is designed to help banks, credit unions, and auto lenders, as it lets them set up policies, streamline operations, and boost operational efficiency across the board

According to Bain & Company, the global financial data and analytics market is set to reach $ 60 to 70 billion by 2030. From 2017 to 2020, the global financial data and analytics market grew at a compound annual growth rate of 6.5%, reaching $35 billion.

- Through 2030, Bain & Company forecasts a 5% to 7% annual growth rate, mostly driven by market data but supplemented by an increasing percentage of alternative data, such as carbon, mortgage, or environmental, social, and governance (ESG) data, with a 10 to 20% annual compound annual growth rate

- The management consulting company expects analytics solutions to increase at an annual pace of 8% to 11%

"On the sell side, clients increasingly want data solutions to streamline labor-intensive tasks such as predictive default analytics, liquidity scoring for individual bonds on secondary markets, or “request for quote” auto-pricing based on trading preferences."

"In addition, expansion of regulatory reporting requirements on both the sell and buy sides has heightened demand, as has further adoption of AI in the financial sector, which requires huge volumes of data and advanced analytics for use cases such as fraud detection and risk mitigation." Bain & Company

FOUNDER-LED

ICE is lead by Jeffrey Sprecher since its beginnings. He founded the company in 1997 after taking over Continental Power Exchange. Warren Gardinier, a former equity research analyst at Barclays is CFO.

- Chair & Chief Executive Officer since ICE's founding in 1997

- Previously worked Trane and the Western Power Group

- He received a bachelor's degree in chemical engineering from the University of Wisconsin–Madison in 1978 and a Master of Business Administration from Pepperdine University in 1984

- Serves as Chief Financial Officer since May 2021

- He is responsible for all aspects of ICE’s finance and accounting functions, treasury, tax, audit and controls and investor relations. From July 2017 to May 2021, Gardiner served as ICE’s VP of Investor Relations. Before joining ICE in 2017, he served as a research analyst covering Financial Information and Exchanges equities at Evercore. Prior to that, he was an equity research analyst at Barclays

- Gardiner earned a Bachelor of Arts in Managerial Economics from Union College and is a CFA Charterholder

- President of NYSE Group, a wholly-owned subsidiary of ICE. Martin is also Chair of Fixed Income & Data Services at ICE

- Most recently, she was President of Fixed Income & Data Services and earlier served as President of ICE Data Services, COO of ICE Clear U.S., and in a number of leadership roles including CEO of NYSE Liffe U.S. and CEO of New York Portfolio Clearing. Martin began her career at IBM in its Global Services organization

- Martin holds a BS in Computer Science from Manhattan College and an MA in Statistics from Columbia University

TAKE A BREATH

So… This is a lot of information. Let’s summarise:

- The Intercontinental Exchange is a Fortune 500 corporation based in the United States that manages worldwide exchanges, clearing houses, and provides mortgage technology, data, and listing services

- The company has a policy of expanding through acquisitions, some have been successful, while others have failed due to anti-trust concerns. It now runs the New York Stock Exchange and recently took over Ellie Mae in a $ 11B transaction

- The firm derives over 31% of its sales from its fixed income, data & analytics segment, 24% comes from its exchange data services, mortgage technology generates around 15% of it sales while listings generate 14% of its sales

- Trading and clearing technology, multi-asset class analytics, risk assessment tools, comprehensive data offerings, mortgage technology, instant messaging capabilities, and flexible connectivity and delivery options are some of the technology solutions which ICE delivers to its clients

- Through its mortgage technology services, ICE is exposed to growth of the loan servicing market which is poised to grow by 12% each year over the 2021 - 2025 period. At the same time, its financial information business is set to grow by around 9.5% over the next 8 years

FINANCIAL CHECK

For the full year of 2021 consolidated net income attributable to ICE was $4.1 billion on $7.1 billion of consolidated revenues less transaction-based expenses. Full year 2021 GAAP diluted EPS were $7.18, up 90% year-over-year. On an adjusted basis, net income attributable to ICE for the year was $2.9 billion and adjusted diluted EPS were $5.15, up 17% year-over-year

- Fourth quarter consolidated net revenues were $1.8 billion, up 10% year-over-year, including exchange net revenues of $1.0 billion, fixed income and data services revenues of $480 million and ICE Mortgage Technology revenues of $346 million

- Consolidated operating expenses were $960 million for the fourth quarter of 2021

- Consolidated operating income for the fourth quarter was $880 million and the operating margin was 48%. On an adjusted basis, consolidated operating income for the fourth quarter was $1.1 billion and the adjusted operating margin was 59%

THE BOTTOM LINE

The Good

- ICE is leading provider of clearing, listing and mortgage services and technology. It also provides financial data to a vast number of clients at a global scale

- Through a series of acquisitions, the company has morphed itself into an extremely profitable $ 75B giant

- Demand for mortgage technology, data and clearing services is experiencing a steady growth as demand for these is expected to increase by around 9.5% a year until 2030

The Bad

- Anti-trust concerns may prevent the company from acquiring new targets

THE STAKE

We have a position in ICE. ICE is a leading provider of mortgage technology, clearing services and financial markets information. It is growing through a series of acquisitions and currently owns the NYSE and Ellie Mae.

- We will increase if it manages to sustain its sales growth over time

- We will sell our stake if some of its acquisitions get blocked by regulators

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Jennifer Bonauer on Unsplash.