Micron Technology designs, produces, and distributes memory and storage products such as USB flash drives, flash memory, and dynamic random-access memory. It is the fourth largest semiconductor company in the world and has its main office located in Boise, Idaho. In 2021, the company generated revenues of $27.7 billion and had over 43,000 employees worldwide.

Micron's memory and storage technologies comprises of (i) DRAM products, which are dynamic random access memory semiconductor devices with low latency that provide high-speed data retrieval; (ii) NAND products that are non-volatile and re-writeable semiconductor storage devices; and (iii) NOR memory products, which are non-volatile re-writable semiconductor memory devices that provide fast read speeds.

- Micron began in 1978 as a four-person semiconductor design company in the basement of a dental office in Boise, Idaho

- By 1980 Micron had broken ground on its first fabrication plant, and then just a few years later introduced the world’s smallest 256K DRAM

- In 1994, the company earned a spot on the Fortune 500 and steadily grew into an industry leader through technology innovations, key partnerships, and strategic acquisitions around the world

- In 2006, Micron acquired Lexar, an American manufacturer of digital media products

- In 2019, Micron announced the first microSD card with a storage capacity of 1 terabyte

OPERATING SEGMENTS

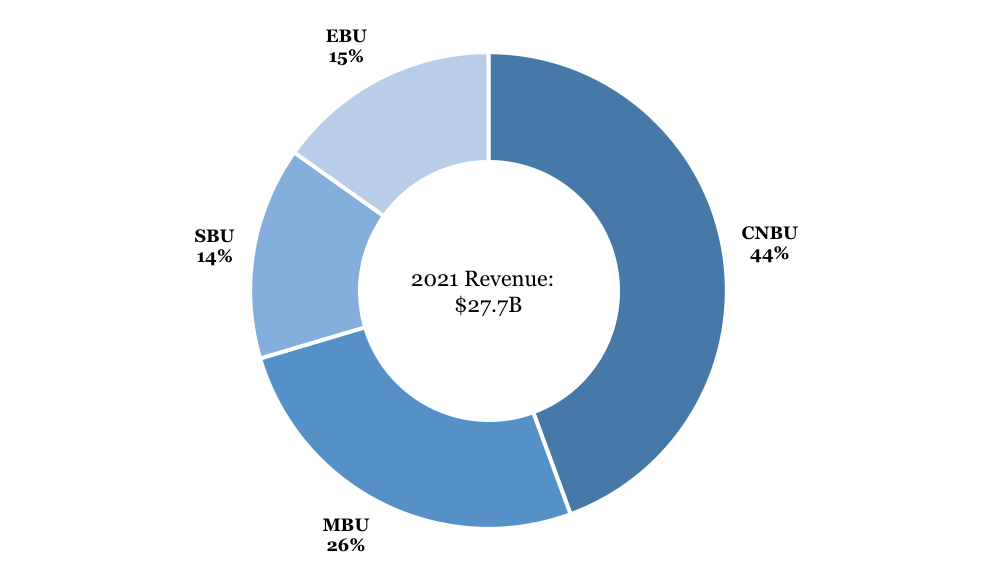

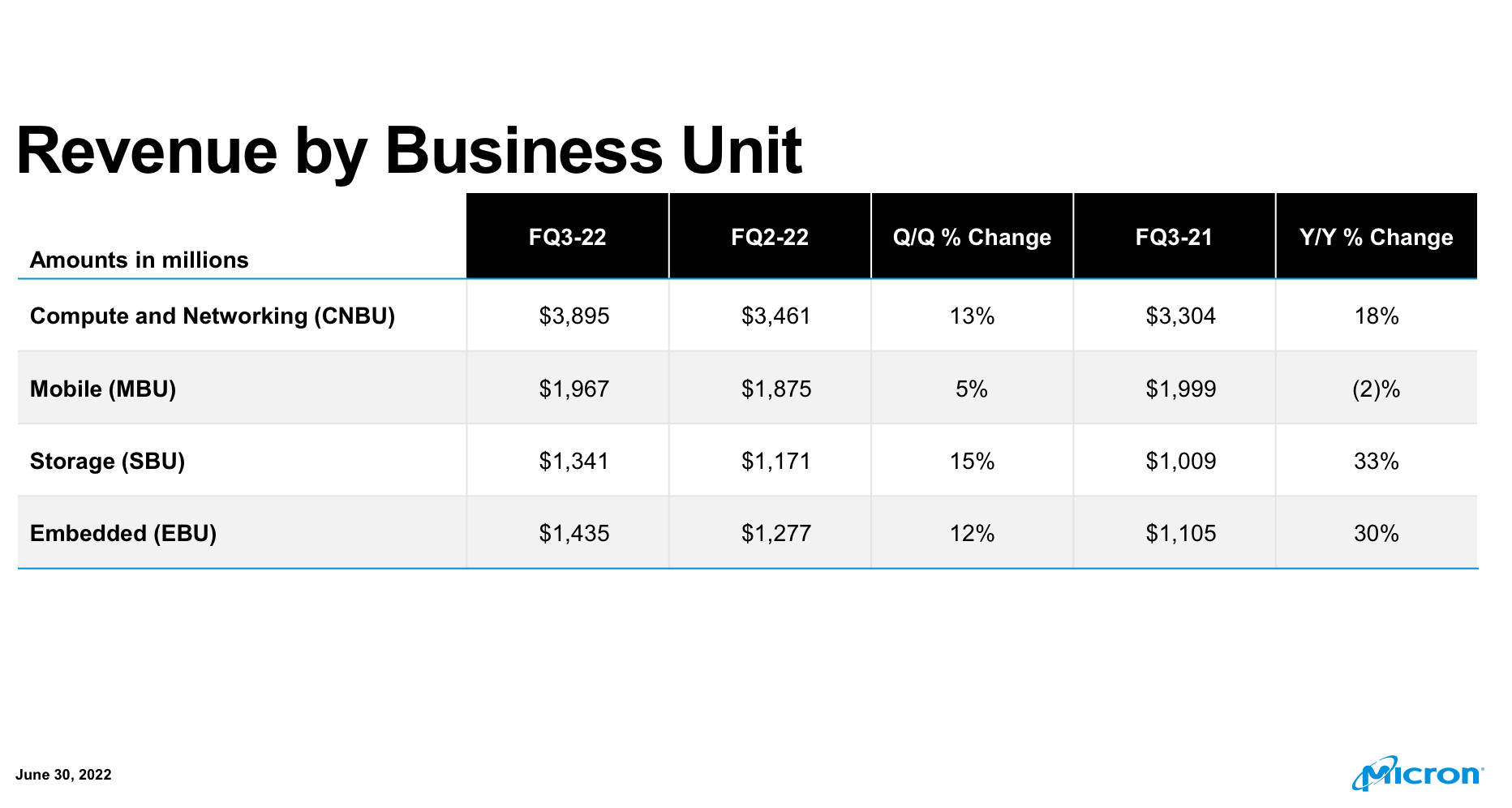

Micron operates through four segments: (i) Compute and Networking Business Unit, (ii) Mobile Business Unit, (iii) Storage Business Unit, and (iv) Embedded Business Unit:

- (i) Compute and Networking Business Unit (CNBU): includes memory products and solutions sold into client, cloud server, enterprise, graphics, and networking markets. CNBU reported revenue of $12.3 billion in 2021, $9.2 billion in 2020, and $10.0 billion in 2019. In 2021, Micron was the first company to introduce products built using 1α DRAM process technology, which offers major improvements in bit density, power, and performance. Micron's 1α DRAM is ramping in various products across PC, server, and mobile

- (ii) Mobile Business Unit (MBU): includes memory products sold into smartphone and other mobile-device markets and includes discrete NAND, DRAM, and managed NAND. MBU reported revenue of $7.2 billion in 2021, $5.7 billion in 2020, and $6.4 billion in 2019. In 2021, Micron started to market a multichip package with LPDDR5, 1α node-based LPDDR4x DRAM and began volume shipments of its 176-layer NAND UFS 3.1 mobile solution. These 3 technologies are, among others, designed to handle data-intensive 5G workloads

- (iii) Storage Business Unit (SBU): includes SSDs and component-level solutions sold into enterprise and cloud, client, and consumer storage markets and discrete NAND sold in component and wafer forms for usage in various markets. SBU reported revenue of $4.0 billion in 2021, $3.8 billion in 2020, and $3.8 billion in 2019. In 2021, Micron began volume shipments of its 176-layer 3D NAND flash memory. The low cost per bit of Micron's NAND QLC technology enabled it to offer SSD products at a competitive price point. During the year, the adoption of QLC SSD continued to grow accounting for the majority of Micron clients' SSD shipments

- (iv) Embedded Business Unit (EBU): includes memory and storage products sold into industrial, automotive, and consumer markets and includes discrete and module DRAM, discrete NAND, managed NAND, SSDs, and NOR. EBU reported revenue of $4.2 billion in 2021, $2.8 billion in 2020, and $3.1 billion in 2019. Strong trends of digitization and connectivity continue to drive demand for new technologies in Micron's EBU

A R&D POWERHORSE

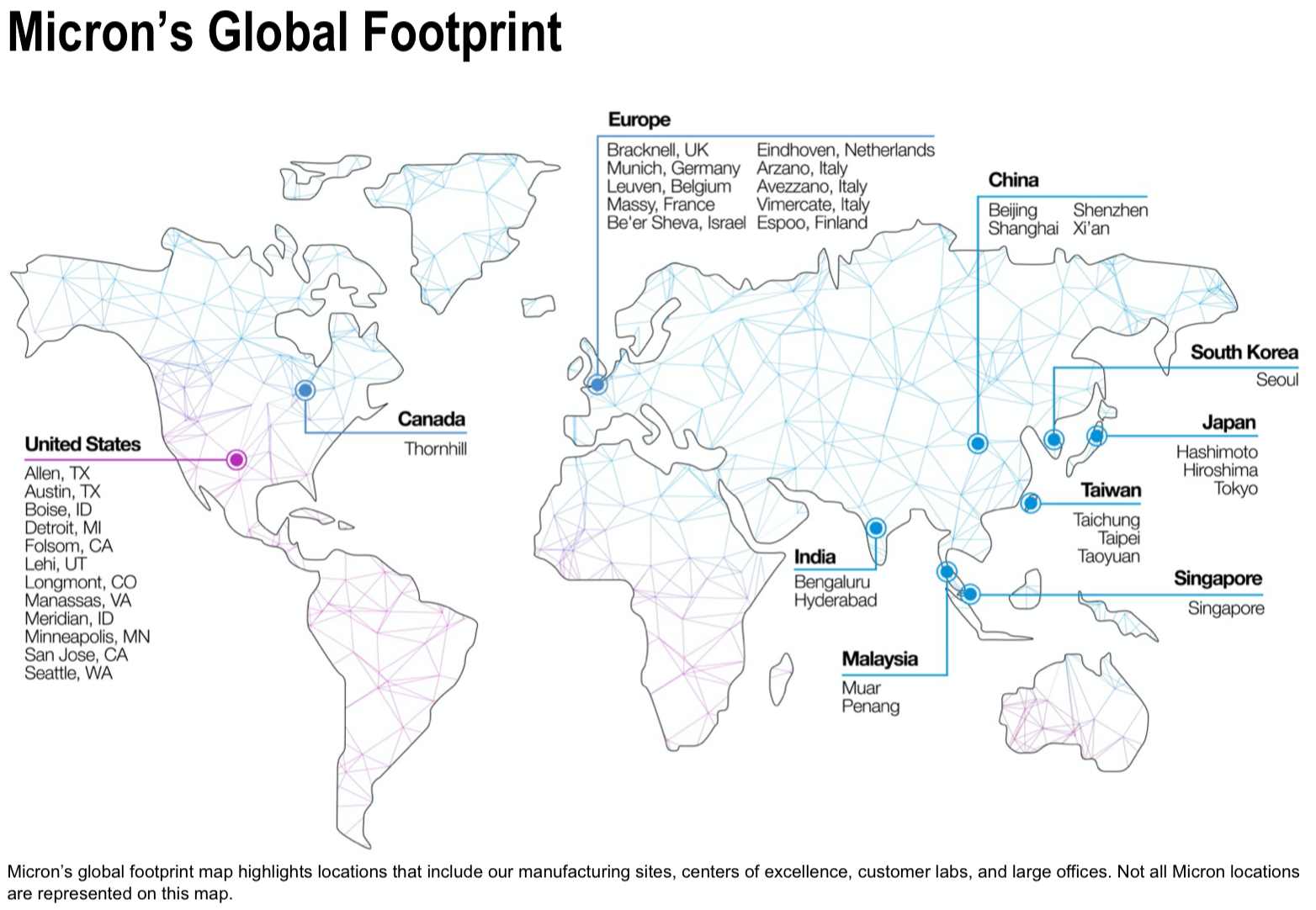

Due to the highly competitive nature of the memory and storage industry, Micron must continuously develop new technologies and processes to keep an edge over its rivals. Micron's R&D efforts are concentrated around the globe with its primary R&D centers located in Boise, Idaho, Singapore, Japan, Taiwan, Italy, China, India, Germany and other sites in the United States.

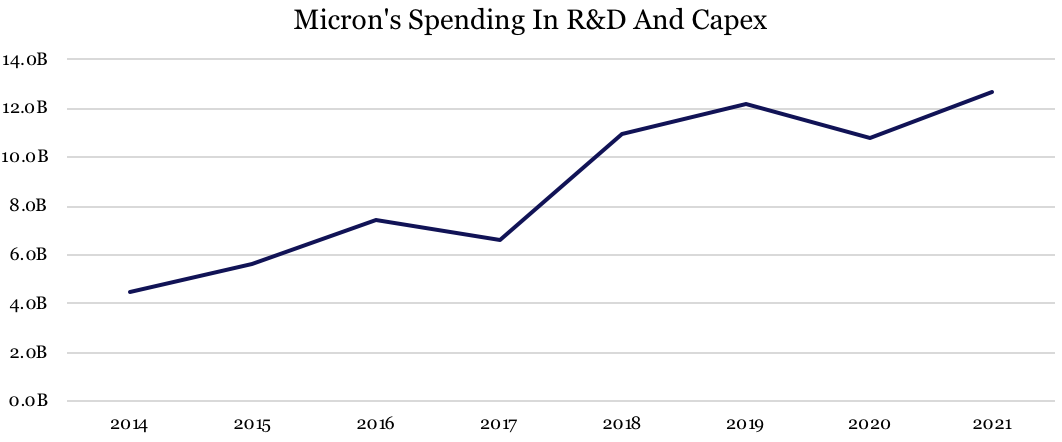

- In 2021, R&D expenses amounted to $2.7 billion, up from $2.6 billion in 2022 and $2.4 billion in 2019

- In 2021, the sum of R&D expenses and Capex amounted to $12.7 billion

In June 2022, Micron announced it would expand its workforce by 2,000 people and establish an R&D corridor in Taiwan.

- Micron already employs over 10,000 people in Taiwan, with two factories producing dynamic random access memory chips

However, when evaluated against Micron's rivals, the sum of Micron's spending is still a small portion of Samsung's expenditures. The Korean company typically invests as much in capex as Micron does in annual revenue.

- However, Micron's spending in R&D and capex doubled over the past ten years

To address 2030-era demand for memory, Micron plans to invest more than $150 billion globally in manufacturing and R&D over the next decade.

- Micron's investments include a potential fab expansion in the U.S. in conjunction with ongoing government support

- The investment is part of Micron's bullish outlook for datacenters development and its position as a leading component manufacturer

- The move is also part of the U.S.' efforts to bring chip manufacturing back from overseas as most of Micron’s production is done in Japan, Singapore and Taiwan

GROWTH PROSPECTS

The market for semiconductor memory was valued at $140 billion in 2021. Market research firms expect the market to grow at a 14.5% CAGR from 2022 to 2028, reaching a valuation of $360 billion by 2028.

- The market is primarily driven by rising semiconductor component utilization as well as IoT (Internet of Things) integration across a range of sectors, including consumer electronics, automotive, and IT & telecom

The DRAM market is projected to reach a size of $220 billion by 2030, representing a CAGR of 9.2% for the period between 2020 and 2030.

- The global expansion of datacenters and growth of the semiconductor industry are driving the DRAM market growth

- The quick adoption of 5G devices is also a major contributor

The market for 3D NAND flash memory was estimated to be worth $12.4 billion in 2020, and it is anticipated to grow to $78.4 billion by 2030, representing a CAGR of 20.3% between 2021 and 2030.

- 3D NAND memory improves the performance of flash memory by decreasing the cost per bit and increasing maximum chip capacity

- IoT technologies in businesses and homes represent a major growth driver for the 3D NAND flash memory market

A GRIM OUTLOOK

The outlook for memory chip manufacturers has deteriorated recently as consumer spending on cellphones and personal computers, a key market for the sector, has been negatively impacted by rising inflation, China's slowing economy, and the Russia-Ukraine war.

“Near the end of [the quarter] we saw a significant reduction in industry bit demand, primarily attributable to end demand weakness in consumer markets, including PC and smartphone, [...] These consumer markets have been impacted by the weakness in consumer spending in China, the Russia-Ukraine war, and rising inflation around the world.” Sanjay Mehrota, Micron Technology President & CEO

- As a result, chip prices have fallen and stockpiles have increased; according to research firm TrendForce, the price of DRAM chips would fall by 3 to 8% in the third quarter of 2022

Given the recent demand slowdown, Micron announced it was taking immediate action to reduce its supply growth.

- The company will now use its inventory to supply part of its market demand for next year

- As a result, wafer fab equipment capex will be reduced for FY23 versus its prior plans, FY23 wafer fab equipment capex are expected to decline year-on-year

In its June 30 earnings call, Micron shared a much weaker-than-expected business outlook, after almost two years of robust demand. The news sparked worries that the sector was entering a down cycle after the pandemic induced boom.

EXPERIENCED MANAGEMENT

Micron is led by Sanjay Mehrotra since 2020. Before joining the company, he served as founder and CEO of SanDisk. He held design engineering positions at Integrated Device Technology, SEEQ Technology and Intel Corporation.

- Sanjay Mehrotra is president and chief executive officer at Micron Technology

- Mehrotra joined Micron in May 2017, after a career at SanDisk Corporation where he led the company from start-up in 1988 until its eventual sale in 2016. In addition to being a SanDisk co-founder, Mr. Mehrotra served as its president and CEO from 2011 to 2016, overseeing its growth to an industry-leading Fortune 500 company. He also served as a member of its board of directors from July 2010 to May 2016

- Mr. Mehrotra earned both bachelor’s and master’s degrees in electrical engineering and computer science from the University of California, Berkeley and is a graduate of the Stanford Graduate School of Business Executive Program (SEP)

- Scott DeBoer is executive vice president of Micron’s Technology and Products organization since 2019, Dr. DeBoer is in charge of Micron’s global technology development and engineering efforts

- Dr. DeBoer joined Micron in 1995 as a process technology engineer and has served in a variety of technical and managerial positions leading up to his appointment as vice president of Process R&D in 2007, executive vice president of Technology Development in 2017, and executive vice president of Technology and Products in 2019

- Dr. DeBoer completed his undergraduate degree at Hastings College in Hastings, Nebraska. He earned a master’s degree in physics and a doctorate in electrical engineering from Iowa State University

- Mark Murphy is executive vice president and Chief Financial Officer at Micron Technology since April 2022

- Murphy was previously executive vice president and CFO of Qorvo, a leader in wireless technologies serving smartphone, defense, Wi-Fi, automotive and broad IoT markets. He has over two decades of financial and operational leadership at global companies of scale including Delphi Automotive, Praxair, and MEMC Electronic Materials and has deep experience in semiconductor materials and device manufacturing, semi capital equipment, and automotive electronics.

- Mark is a veteran of the U.S. Marine Corps and holds an MBA from Harvard University and Bachelor of Science in Business from Marquette University

TAKE A BREATH

So… This is a lot of information. Let’s summarise:

- Micron Technology is the fourth largest semiconductor company in the world. It designs, produces, and distributes memory and storage products such as USB flash drives, flash memory, and dynamic random-access memory

- Micron operates through 4 segments: (i) Compute and Networking Business Unit, (ii) Mobile Business Unit, (iii) Storage Business Unit, and (iv) Embedded Business Unit generating total revenues of $27.7 billion in 2021

- Micron's spending in R&D and capex doubled over the past ten years and today amount to around $12 billion per year

- The market for semiconductor memory was valued at $140 billion in 2021 and could reach a valuation of $360 billion by 2028, representing a 14.5% CAGR

- The outlook for memory chip manufacturers has deteriorated recently due to weakening demand from rising inflation, China's slowing economy, and the Russia-Ukraine war

- In its June 30 earnings call, Micron shared a much weaker-than-expected business outlook, after almost two years of robust demand

- Micron is led by Sanjay Mehrotra since 2020. Before joining the company, he served as founder and CEO of SanDisk

FINANCIAL CHECK

Total fiscal Q3 revenue was $8.6 billion, up 11% quarter-on-quarter and up 16% year-over-year. DRAM revenue was $6.3 billion (73% of total revenue). NAND revenue was $2.3 billion (26% of Micron's total revenue). Gross margin stood at 47.4%, down approximately 40 basis points quarter-on-quarter due to an increase of the lower-margin NAND products in the sales mix.

- Operating income was $3.1 billion (operating margin of 36.4%, up approximately 110 basis points quarter-on-quarter and up 450 basis points year-on-year)

- Adjusted EBITDA was close to $5 billion (EBITDA margin of 57.4%, down approximately 40 basis points quarter-on-quarter and up over 400 basis points year-on-year)

- Net Income amounted to $2.9 billion

- Non-GAAP earnings per share EPS in fiscal Q3 were $2.59, up from $2.14 in fiscal Q2 and up from $1.88 in Q3 2021

- $3.8 billion in cash was generated from operations in fiscal Q3, representing 44% of revenue

- Free cash flow for fiscal Q3 was $1.3 billion

Following its Q3 earnings release, Mircon decreased its sales outlook for the upcoming quarter to $7.2 billion, in contrast to consensus estimates of $9 billion.

THE BOTTOM LINE

The Good

- Demand for memory and storage devices is growing at a global level on the back of rising semiconductor component utilization in datacenters and Internet of Things

- Micron is well positioned to perform into 2023 once supply-demand comes in balance as the company is reducing capex for 2022 and increasing its inventory utilization

The Bad

- The strong growth figures which resulted from the pandemic have proven not be sustainable and Micron is now facing a grim short term outlook

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Vishnu Mohanan on Unsplash