Monster Beverage Corporation is a beverage company headquartered in Corona, California, which develops, markets, sells, and distributes energy drinks and concentrates in the U.S. and overseas. Monster Beverage's brands include Monster Energy, Reign, Burn and Relentless.

- Previously known as Hansen, the company was formed in 1935 in Southern California selling fresh juices

- In 2012, the firm changed its name to Monster Beverage

- In 2015, The Coca-Cola Company paid $2.15 billion for a 16.7% stake in Monster Beverage

- Under the agreement, Monster Beverage sold its Hansen's juices and other non-energy drink brands to The Coca-Cola Company in return for its energy drink brands

- In February 2022, Monster Beverage entered the alcoholic beverages industry with the $330 million acquisition of CANarchy Craft Brewery Collective LLC, a maker of craft beer and hard seltzer

- In November 2021, the company was reported being in talks with international beverage alcohol company Constellation Brands. In February 2022, merger talks were reported to be progressing

A DIVERSIFIED BEVERAGES HOLDING COMPANY

Monster Beverage operates through 3 reportable segments: (i) Monster Energy Drinks, which primarily consists of the Monster and Reign Total Body Fuel high performance energy drinks, (ii) Strategic Brands, which primarily consists of various energy drink brands acquired from Coca-Cola in 2015, as well as the affordable energy brands, and (iii) Other, which consists of products sold to independent third-party customers by American Fruits and Flavors LLC, a wholly-owned subsidiary.

- Monster Energy Drinks: Monster Beverage generates revenues primarily via the sale of ready-to-drink packaged energy drinks to bottlers and full-service beverage distributors. The company sells among others directly to supermarkets, convenience and specialty stores, wholesalers, and the military in some situations

- Strategic Brands: The Strategic Brands segment earns revenues largely from the sale of concentrates and/or beverage bases to licensed bottling and canning companies. Bottlers make ready-to-drink packaged energy drinks by combining concentrates and/or beverage bases with sugars, water, and other components. Among others, bottlers, full-service distributors, or retailers, such as retail grocery and specialty chains, wholesalers, and the military, sell the ready-to-drink packaged energy drinks. The segment also generates revenues by supplying bottlers and full-service beverage distributors select ready-to-drink packaged energy drinks

- Other: Monster Beverage acquired American Fruits and Flavors LLC in 2016, the company operates in both juice and flavor manufacturing plants. The segment generates revenues through the sale of juices and flavors to independent third-party customers

SUPPLY CHAIN BOTTLENECKS

In 2021, Monster Beverage faced a number of issues following unexpected high demand, which had a negative impact on sales, operational expenses, and the availability of items in stores.

- Monster was particularly hit by a shortage of raw materials such as aluminium cans and energy drinks ingredients, insufficient canning capacity in the U.S. and in EMEA as well as of shortage in trucking capacity in EMEA

Vice Chairman and Co-Chief Executive Officer Hilton Schlosberg stated in February 2022: “We continued to experience challenges meeting demand in the United States and EMEA in the fourth quarter, largely as a result of a shortage in aluminum cans, the availability of co-packing capacity and procurement difficulties in other inputs. [...] Due to the actions we have taken [...], we currently have sufficient supplies of aluminum cans to meet demand. However, we continue to experience shortages in the availability of co-packing capacity for certain of our products."

“We continue to implement measures to mitigate the impact of increased costs experienced in our supply chain through reductions in promotions and other pricing actions in the United States and in EMEA,” Schlosberg added.

PUSH INTO ALCOHOLIC BEVERAGES

In February 2022, Monster Beverage entered the alcoholic beverages sector after it closed the $330 million acquisition of CANarchy Craft Brewery Collective, a maker of craft beer and hard seltzer.

- CANarchy was founded in 2015 and is a top ten U.S. craft brewery

- The company distributes craft drinks throughout the U.S. as well as 21 other countries

- Its brands include Oskar Blues Brewery, Cigar City Brewing, Squatters Craft Beers, Wasatch Brewery, Deep Ellum Brewing Company and Perrin Brewing Company

The acquisition continues the trend of soft-drink giants pushing out into the alcohol industry as the lines between the two categories become increasingly blurred.

- In 2021, PepsiCo has teamed up with Boston Beer to bring a Mountain Dew-branded alcoholic beverage to market

- In 2022, Coca-Cola has teamed up with brewer Constellation Brands to bring Fresca-branded ready-to-drink cocktails to market

Monster's Vice Chairman and Co-Chief Executive Officer Hilton Schlosberg about the deal:"This transaction provides us with a springboard from which to enter the alcoholic beverage sector,"

"The acquisition will provide us with a fully in-place infrastructure, including people, distribution and licenses, along with alcoholic beverage development expertise and manufacturing capabilities in this industry,"

CONSTELLATION MERGER TALKS

On top of Monster's acquisition of CANarchy, the company has been reported to be holding merger talks with Constellation. If the deal goes through, the combined companies would have a market capitalisation of about $90 billion and create an energy drinks and alcoholic beverages giant.

According to Kenneth Shea, a Bloomberg Intelligence analyst: a merger “could give the new entity a jump on the growing scramble to serve the surging U.S. market for low-alcohol drinks,”

Following the CANarchy acquisition, Kenneth Shea stated: “we expect the strategic move into the crowded and competitive domestic alcoholic-beverage market as risky, since it will have to boost spending to scale up operations nationally and compete with larger companies with more resources.”

THE MARKET

According to Report Ocean, the global energy drinks market was worth $62 billion in 2021, and is predicted to increase to $106 billion by 2030, with a CAGR of 9.6% from 2022 to 2030.

Mordor Intelligence projects a CAGR of 9.1% during the period from 2022 to 2030. The market research firm highlights the following growth drivers for the forecast period:

- As a consequence of growing health concerns and greater efforts to prevent the onset of lifestyle diseases, consumers are opting for low-calorie, low-sugar, or sugar-free dietary patterns in foods and beverages

- Companies like as PepsiCo and Coca-Cola have vowed to remove artificial ingredients from their goods and reduce the amount of sugar in them

In its 2021 Annual Report, Monster Beverage highlighted as key risk: "There is increasing awareness of and concern for health, wellness and nutrition considerations, including concerns regarding caloric intake associated with sugar-sweetened beverages and the perceived undesirability of artificial ingredients. Some consumer advocacy groups and others have expressed concerns regarding certain ingredients in diet sodas, which are contained in certain of our energy drinks. [...] This may reduce demand for our beverages, which could reduce our revenues and adversely affect our results of operations."

- North America dominates the energy drinks market along with the country's vast coffee culture. In the U.S., energy drinks are a staple of social events, parties, and celebrations

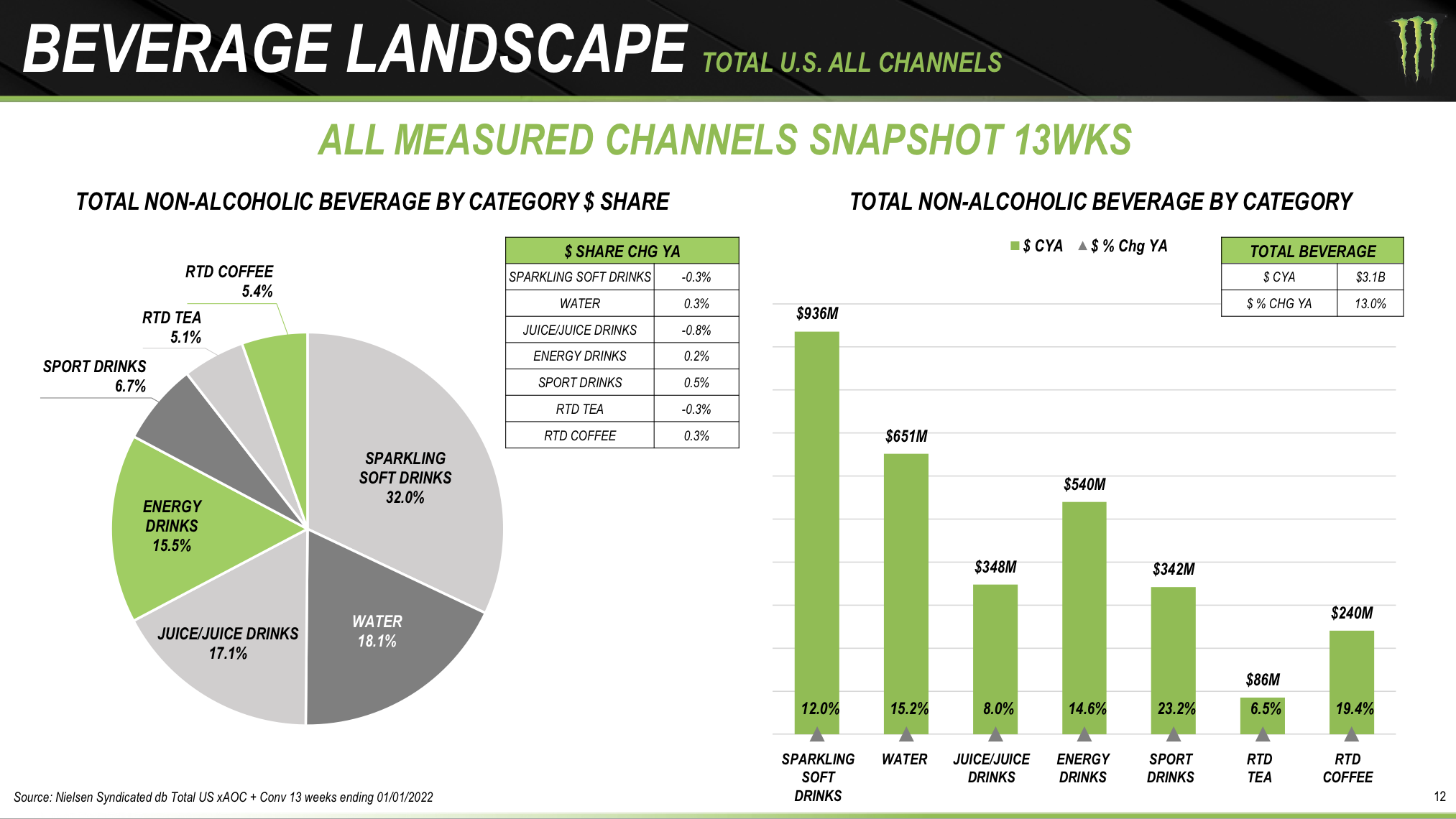

Based on data collected by Nielsen and reported in Monster's investor presentation of January 2022, energy drinks in the U.S. accounted for 15.5% of total non-alcoholic beverage sales in the 13 weeks ending 2021.

EXPERIENCED MANAGEMENT

Since January 2021, Monster Beverage is led by Co-Chief Executive Officers Hilton Schlosberg and Rodney Sacks, who has served as the Chief Executive Officer of the Company since 1990.

In 1990, the duo bought Hansen's Natural Corporation, then soda manufacturer. They introduced Monster Energy twelve years later.

Rodney Sacks

- Rodney Sacks serves as Chairman and Co-Chief Executive Officer since 1990

- Sacks and his fellow South African, Hilton Schlosberg, headed a syndicate that bought Hansen Natural Corporation in 1990, which then bought Hansen's Natural Soda and Apple Juice for $14.5 million in 1992. In 2012, the company was renamed Monster Beverage Corporation

- In South Africa, Sacks worked as a lawyer and was the youngest partner at Werksmans, the country's largest corporate law firm. Sacks came to California with his family in August 1989, after nearly two decades with Werksmans and advancing to the position of senior partner

- He earned a law degree as well as a postgraduate higher certificate in tax law from the University of the Witwatersrand in Johannesburg

Hilton Schlosberg

- Hilton Schlosberg serves as Vice-Chairman and Co-Chief Executive Officer since 2021

- Previously, Schlosberg was Monster's President, CFO and COO

- He led the consortium with Sacks in 1990 to buy Hansen Natural Corporation

- Schlosberg attended the University of the Witwatersrand in Johannesburg

Thomas Kelly

- Thomas Kelly succeeded Scholsberg as CFO and Principal Accounting Officer in 2021

- Kelly has extensive experience at Monster as Executive Vice President of Finance before the transition to CFO

TAKE A BREATH

So… This is a lot of information. Let’s summarise:

- Previously known as Hansen, the company was formed in 1935 in Southern California selling fresh juices. In 1990, current Co-Chief Executive Officers Hilton Schlosberg and Rodney Sacks led the consortium that bought Hansen Natural Corporation. In 2012, the company was renamed Monster Beverage Corp

- In 2015, the Coca-Cola Company paid $2.15 billion for a 16.7% stake in Monster Beverage and transfered its energy drink brands in exchange for Hansen's juices and other non-energy drink brands

- In 2021, Monster Beverage faced a supply chain issues following unexpected high demand, which had a negative impact on sales, operational expenses, and the availability of items in stores

- In February 2022, Monster entered the alcoholic beverages industry with a $330 million acquisition of CANarchy Craft Brewery Collective LLC

- In November 2021, the company was reported being in talks with international beverage alcohol company Constellation Brands. In February 2022, merger talks were reported to be progressing

- The global energy drink market was worth $62 billion in 2021, and is predicted to increase to $106 billion by 2030, with a CAGR of 9.6% from 2022 to 2030

- Growing health concerns and greater efforts to prevent the onset of lifestyle diseases, consumers tastes are shifting to low-calorie, low-sugar, or sugar-free dietary patterns in foods and beverages which may reduce demand for Monster's beverages

FINANCIAL CHECK

Net sales rose 19% to a record $1.4 billion during the fourth quarter while annual net sales reached a record $5.6 billion. Gross profit was 54% of net sales, down from 58% in the fourth quarter in 2020. Operating expenses were $355 million from $288 million the previous year. Higher costs were partly driven by a shortage in aluminium cans, lack of packing capacity and a limited availability of raw materials.

- The Company's Monster Energy Drinks segment, which includes Monster Energy drinks, Reign Total Body Fuel high performance energy drinks, and True North Pure Energy Seltzers, saw a 21% increase in net sales to $1.4 billion in the fourth quarter of 2021, compared to $1.1 billion in the fourth quarter of 2020

- The Strategic Brands segment, which mainly comprises of energy drink brands acquired from Coca-Cola, as well as Monster's affordable energy brands, saw net sales fall 3.5% to $65.6 million in the fourth quarter of 2021, from $67.9 million in the fourth quarter of 2020, owing to flavor concentrate shortages for certain of the company's energy drinks

- Net income dropped 32% to $321 million from $472 million in the fourth quarter of 2020 while net income for the full year ending December 31, 2021 decreased 2.3% to $1.4 billion

- In February 2022, Monster Beverage completed the acquisition of CANarchy for a total cash consideration of $330 million

THE BOTTOM LINE

The Good

- The company is not standing idle and is deploying its cash by entering the alcoholic beverages industry with its $330 million CANarchy acquisition

- The move will enable the company to spur growth with hard seltzers, malt beverages and spirits as well as CANarchy distribution network

- Monster reported strong sales in its Monster Energy Drinks segment as it introduced new products and expanded disrtibution in international markets

The Bad

- Monster's 2021 supply chain issues could be prolonged into 2022 as the company is still facing shortages in co-packing capacity

- Rising operating costs are expected to be transitory but this could be challenged by the current inflationary environment

- Increasing awareness of and concern for health, wellness and nutrition considerations could negatively impact Monster Beverage if it fails to introduce products in line with shifting customers' tastes

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Christian Wiediger on Unsplash