David Vélez, Cristina Junqueira and Edward Wible launched Nubank in 2013 after becoming dissatisfied with Brazil's banking services. The company secured a $2 million seed investment from Sequoia Capital and Kaszek Ventures. On April 1st, 2014, the first purchase was made using a Nubank card and in 2016, the company was already valued at around $ 500m. In 2017, it became a so-called "unicorn".

- The company went public in December 2021 and fetched a valuation of a little under $ 50B on its first trading day, making it one of the most valuable digital banks

- Today, it is Latin America's biggest fintech bank counting more than 54m users

- Its corporate headquarters are located in Sao Paulo with additional engineering offices located in Berlin, Buenos Aires and Mexico City

NUBANK'S OPPORTUNITY

Within Latin America, Nubank currently serves Brazil, Mexico and Colombia, which together accounted for over 60% of the population and 61% of the GDP in the region in 2020, and provide a fertile opportunity driven by the following factors.

- Expensive incumbents. Financial services consumers in Latin America suffer from real pain points as incumbent banks in Brazil, Mexico and Colombia, on average hold between 70% and 85% of all loans and deposits. These incumbents charge very high fees and generate outsized profits, based on data from local Central Banks

- Favorable secular trends. There is a strong technology adoption trend in the region as illustrated by the 80% smartphone adoption rate projected in 2025 according to GSMA. This trend is fueled by the size of the population under 30 years old in Brazil, Mexico and Colombia (44%, 51% and 58% of the total population, respectively), but also a growing middle class, driving some of the highest mobile app usage rates in the world, based on time spent on mobile apps

- Significant penetration opportunities. Financial services in Latin America still offer a significant penetration opportunity ahead as the electronic payments and consumer credit segments continue to deepen across the region. For example, in Brazil, Mexico and Colombia there is a large unbanked population consisting of 134 million adults in aggregate, low credit card adoption rates of 27.0%, 9.5% and 13.9%, respectively, compared to 65.6% in the United States and 65.4% in the United Kingdom and limited household debt as a percentage of GDP, at 30.5%, 16.2% and 27.6% in Brazil, Mexico and Colombia, respectively, compared to 55% to 85% in developed markets (consisting of the United Kingdom, the United States, Spain, Japan and France). Finally, there is also a low credit and debit purchase volume as a percentage of household consumption: 40%, 24% and 15% in Brazil, Mexico and Colombia, respectively, compared to 51% in the United States and 62% in the United Kingdom

TARGETING YOUNGER CONSUMERS ONLINE

Based on Nubank's analysis of publicly available data, the company believes it serves a larger proportion of younger consumers than incumbent banks. This position creates opportunities to grow with its customers as they accumulate wealth and reach life milestones that expand their financial needs.

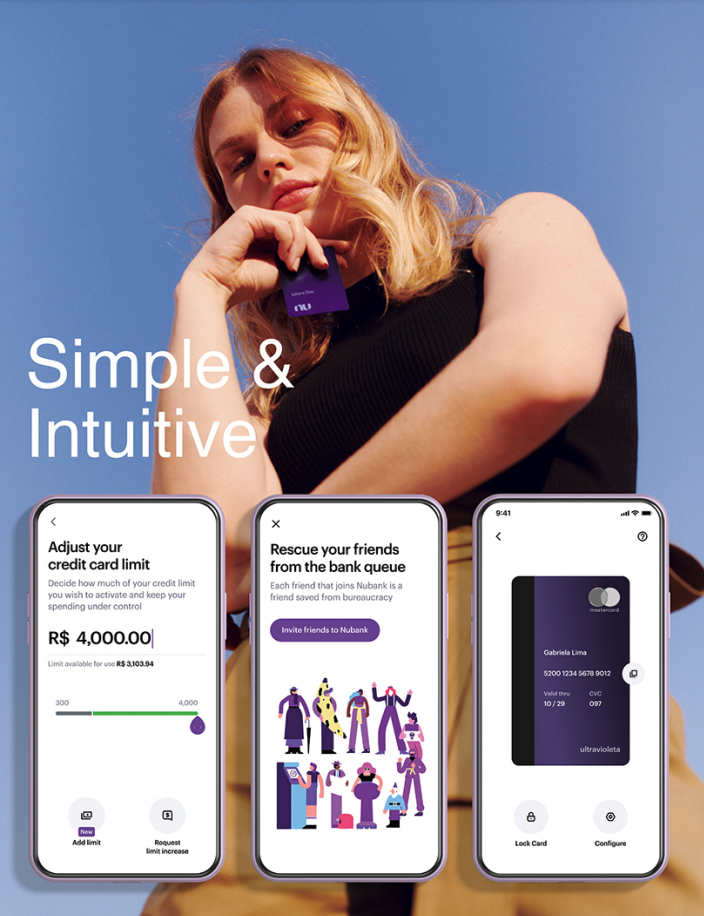

- The company goes to market, serves and supports its customers through an all-digital, cloud-based model that is low-cost and highly efficient without the need for expensive real estate and bank branches

- It markets and sells its solutions and services online by prioritizing high-quality customer experiences to drive organic word-of-mouth advertising and customer referrals, fostering its social media presence and developing digital content to drive awareness, education and engagement

- It also makes selected investments in marketing and promotional campaigns when returns are attractive to further accelerate customer adoption

FEES AND INTEREST PAYMENTS

The company earns revenue from two main sources: fees and interest payments. Fees include fees imposed on credit and debit card transactions, payments, loyalty programs, prepaid mobile phone top-ups and distribution of certain financial products and services, such as investments, insurance and remittance products. Interest payments are related to interest charged on revolving and refinanced credit card balances and personal loans, as well as interest earned on deposits, government bonds and other interest-earning instruments.

- For the nine months ended September 30, 2021, 43% of its revenue was earned through fee and commission income, which comes mostly from interchange fees and is not directly charged to the customer

- For the nine months ended September 30, 2021, it had $1,062.1 million in revenue, which represents an increase of 394% and a CAGR of 70% from $214.9 million in the nine months ended September 30, 2018, or an increase of approximately 634% and a CAGR of 94% from $146.0 million in the nine months ended September 30, 2018 when computed on an FX Neutral basis

LEADING IN TECHNOLOGY

Nubank uses advanced technologies and modern tools to deliver a superior experience for its customers in a hyper-scalable and secure environment. The company prioritises building its own architecture and investing in engineering talent. The key components of its technology include:

- NuCore technology platform. All of Nubank's products, services and operations are powered by NuCore, its proprietary, cloud-based core banking platform that was designed and built from the ground up. NuCore enables it to centrally manage several key functions, including transaction authorisation and processing, core banking, regulatory reporting, business operations, customer services, credit underwriting and fraud prevention. This provides the company with greater speed and control to optimise its products and address the needs of the markets in which it operates. It also allows it to innovate on core product features that won’t be immediately accessible to competitors that leverage platforms that are standard in the market today

- Microservices approach. Nubank uses a versatile, decentralised technology architecture to manage and deploy over 500 modular microservices it has developed. This advanced technology strategy enables it to scale, launch new products, enter new markets, and maintain and evolve its codebase incrementally with decentralised ownership

- Immutable architecture. Nubank has created an advanced, immutable ledger utilising the Datomic database technology it developed. This provides it with a highly reliable audit trail and transaction history that it believes provides better accuracy, control, reliability and transparency versus traditional database architectures. As a result, it is are able to develop new code more aggressively with 120+ deployments per day on average

DATA-DRIVEN OPERATIONS

Nubank acquires and analyses over 11,000 data points on each active users each month in order to inform its decision making, reduce risks and improve customer experience. Its data science strategy consists of:

- Proprietary Data. On average Nubank collects over 11,000 data points on each monthly active customer and uses these insights to better understand customers’ behaviour, risks and financial needs to better serve them

- Powerful NuX Credit Engine. Its in-house, proprietary credit underwriting engine learns from customer behaviour, enabling it to develop curated credit strategies to offer customers the best product for their specific financial situation

- Self-Driving Ecosystem. Nubank integrates all data in its Nu Ecosystem to develop a holistic profile of its customers, enabling it to algorithmically recommend products in real time that may meet specific customer needs throughout their financial journey

FOUNDER-LED

Nubank is led by David Velez, he was previously a partner at Sequoia Capital and worked at Goldman Sachs, Morgan Stanley and General Atlantic. Cristina Junqueira spent some years at BCG before joining Nubank.

- Founding shareholder, chairman of the board of directors and chief executive officer

- Before founding Nu in 2013, David was a partner at Sequoia Capital between January 2011 and March 2013, in charge of the firm’s Latin American investments group. Before Sequoia, David worked in investment banking and growth equity at Goldman Sachs, Morgan Stanley and General Atlantic

- He holds a Bachelor’s of Science in Management Science and Engineering and a Master’s in Business Administration, both from Stanford University

- Co-Founder & Brazil CEO, a position she has held since February 2021

- Cristina began her career in strategic consulting, working at BCG (Boston Consulting Group) and before founding Nu in 2013, worked for several years at Itaú Unibanco S.A. with products and marketing teams in consumer credit and cards

- She holds an Engineering Bachelor’s degree and a Master’s degree from Universidade de São Paulo (USP), and also an MBA from Northwestern University’s Kellogg School of Management

- Chief Financial Officer, a position he has held since February 2021, and served as vice president of finance from March 2019 to February 2021

- From April 2006 to March 2019, he served in various positions at the Credit Suisse Group AG, including as managing director in its investment banking group. He also previously worked at McKinsey & Company from 2005 to 2006

- He holds a Bachelor’s of Science in Industrial Engineering from Escola Politécnica da Universidade de São Paulo and a Master’s in Business Administration from the Harvard Business School

TAKE A BREATH

So… This is a lot of information. Let’s summarise:

- David Vélez, Cristina Junqueira and Edward Wible launched Nubank in 2013 after becoming dissatisfied with Brazil's banking services. The company secured a $2 million seed investment from Sequoia Capital and Kaszek Ventures

- On April 1st, 2014, the first purchase was made using a Nubank card and in 2016, the company was already valued at around $ 500m. In 2017, it became a unicorn startup

- Within Latin America, Nubank currently serves Brazil, Mexico and Colombia, which together accounted for over 60% of the population and 61% of the GDP in the region in 2020, and provide a fertile opportunity

- Based on Nubank's analysis of publicly available data, the company believes it serves a larger proportion of younger consumers than incumbent banks. This position creates opportunities to grow with its customers as they accumulate wealth and reach life milestones that expand their financial needs

- The company earns revenue from two main sources: fees and interest payments. Fees include fees imposed on credit and debit card transactions, payments, loyalty programs, prepaid mobile phone top-ups and distribution of certain financial products and services, such as investments, insurance and remittance products. Interest payments are related to interest charged on revolving and refinanced credit card balances and personal loans, as well as interest earned on deposits, government bonds and other interest-earning instruments

- Nubank uses advanced technologies and modern tools to deliver a superior experience for its customers in a hyper-scalable and secure environment

- Nubank acquires and analyses over 11,000 data points on each active users each month in order to inform its decision making, reduce risks and improve customer experience

- Nubank is led by David Velez, he was previously a partner at Sequoia Capital and worked at Goldman Sachs, Morgan Stanley and General Atlantic. Cristina Junqueira spent some years at BCG before joining Nubank

FINANCIAL CHECK

Nu ended Q2'22 with a record 65.3 million customers, reaching its all-time high for both retail customers and SMEs. Brazilian customers increased 51% YoY to 62.3 million, with an activity rate setting a record high of 80%. Nu customers now represent 36% of the country’s adult population. Moreover, Nu has become the primary bank for over 55% of the monthly active customers who have been with the Company for over a year.

- In Mexico, Nu's customer base increased over 6x YoY to 2.7 million, consolidating the Company’s position as the largest issuer of new credit cards in the country since H2’212

- In Colombia, the Company believes that it has become the largest issuer of new credit cards in H1’222, having reached around 314,000 customers in the quarter

- Together these two countries added nearly 700,000 unique customers in the second quarter

- Revenues reached $1.2 billion (+230% YoY on FX neutral basis), and Monthly Average Revenue per Active Customer (ARPAC) of $7.8, +105% YoY FXN

- Deposits stood at $13.3 billion (+87% YoY FXN), and booked an Interest Earning Portfolio of $3.2 billion, +220% YoY FXN. Loan-to -deposit ratio remained at 24%

- Leading indicators have remained stable and asset quality continued normalising post pandemic: Nu's NPL 15-90 remained at 3.7%1 while 90+ reached 4.1%

THE BOTTOM LINE

The Good

- Nubank is a fast growing digital bank active in Latin America and capitalising on the region's younger demographics and rapidly increasing internet penetration

- The bank is slowly reaching profitability in its main Brazilian market and uses its cash to finance its operations in Mexico and Colombia

The Bad

- Rising yields and recession fears might hamper demand for credit and might pressure Nubank's activities in emerging markets

- Ownership and control is concentrated into David Velez's hands, posing some issues to the governance of the group

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Nu Pagamentos S.A.