Teradyne, Inc. is a North Reading, Massachusetts-based designer and manufacturer of automatic test equipment (ATE). It was founded in 1960 by Alex d'Arbeloff and Nick DeWolf, both students at the Massachusetts Institute of Technology (MIT). Today, the company counts Samsung, Qualcomm, Intel, Analog Devices, Texas Instruments, and IBM as customers.

- The company is known for bringing high-quality inventions to market quickly, such as smart devices, life-saving medical equipment, and data storage systems

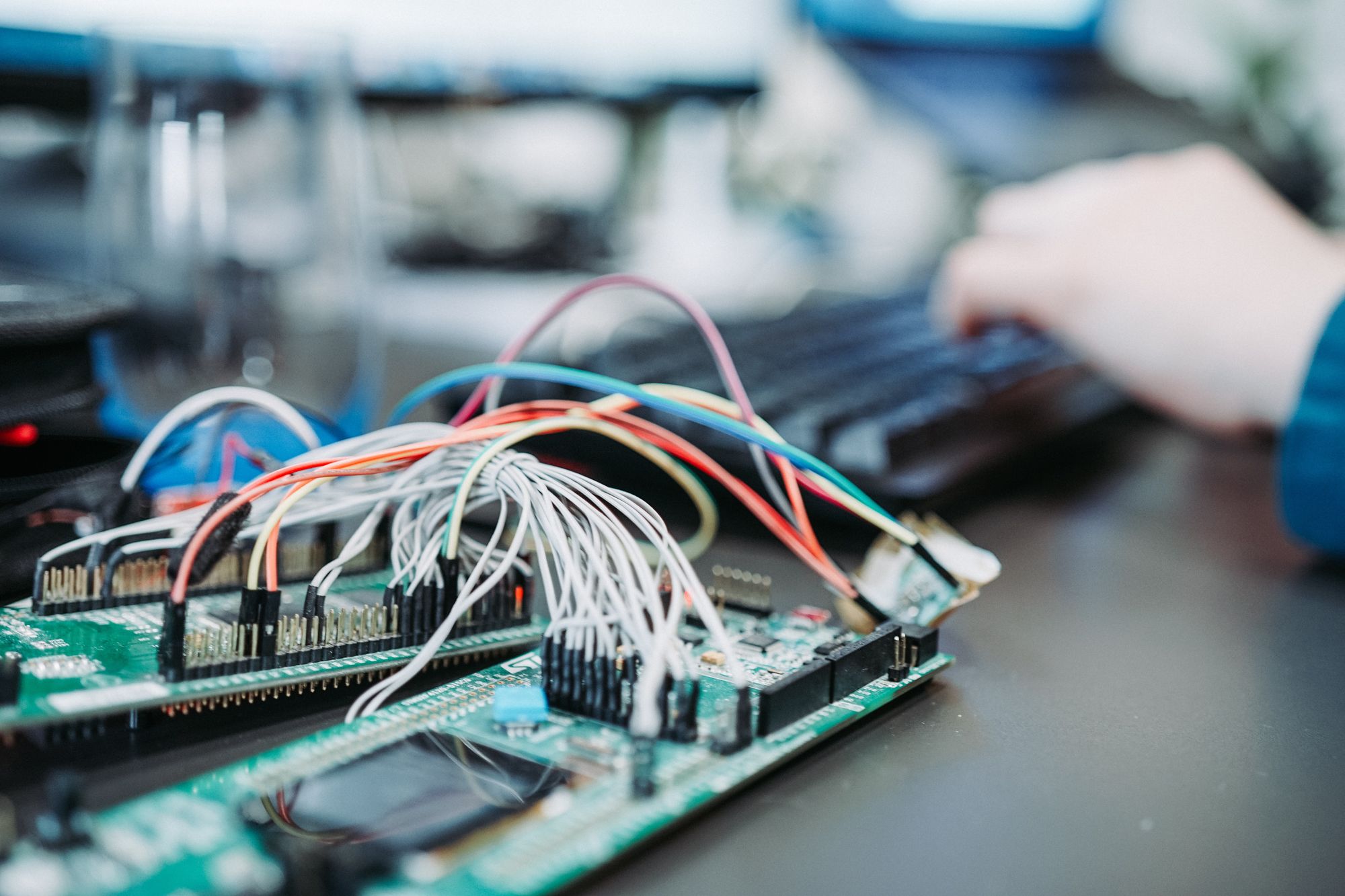

- Its test solutions for semiconductors, electronic systems, wireless devices, and other items ensure that products function as intended

- Teradyne earned $3.1 billion in revenue in 2020 and currently employs 5,500 people throughout the world

AUTOMATIC TEST EQUIPMENT

Teradyne develops, manufactures and sells automatic test systems used to test semiconductors, wireless products, data storage and complex electronics systems in many industries including consumer electronics, wireless, automotive, industrial, computing, communications, aerospace and defence.

- Its industrial automation products include collaborative robotic arms, autonomous mobile robots (AMR) and advanced robotic control software used by global manufacturing, logistics and light industrial customers to improve quality, increase manufacturing and material handling efficiency and decrease manufacturing and logistics costs

- Teradyne's automatic test equipment and industrial automation products and services include: semiconductor test systems, storage and system level test systems, defence/aerospace test instrumentation and systems, and circuit-board test and inspection systems, wireless test systems and industrial automation products

SEMICONDUCTOR TESTING

The test systems provided by Teradyne are used both for wafer level and device package testing. These chips are used in automotive, industrial, communications, consumer, smartphones, cloud, computer and electronic game applications, among others. Semiconductor test products and services are sold to:

- Integrated device manufacturers (IDM) that integrate the fabrication of silicon wafers into their business

- Fabless companies that outsource the manufacturing of silicon wafers

- Foundries that cater to the processing and manufacturing of silicon wafers, and semiconductor assembly

- Test providers that provide test and assembly services for the final packaged devices to both Fabless companies and IDMs

These customers obtain the overall benefit of testing devices and reducing the total costs associated with testing by using Teradyne's semiconductor test systems to improve and control product quality, measure and improve product performance, reduce time to market and increase production yields.

THE MARKET

Market growth is supported by the growing demand for integrated circuits in devices such as military weapons, gaming devices, smartphones and computers. This growth will also be facilitated by the overall development of wireless networking technologies, the emergence of advanced data analytics, along with the connectedness that comes with the proliferation of smart devices.

In 2019, the silicon wafer market was valued at $11.2 billion.

- It is projected to grow to $14.4 billion by 2026, representing a

CAGR of 4.2% during the forecast period (2021-2026) - This growth will be attributed to the increasing use of integrated circuits in devices such as military weapons, gaming devices, smartphones and computers

- It will also be attributed to the technological advances that are designed to improve wafer capabilities

In 2020, the global cyber security market was valued at $156.2 billion.

- It is projected that by 2026, it will be valued at $352.3 billion, representing a CAGR of 14.5% during the forecast period (2021-2026)

- The growth will be attributed to the increasing cases of cyber security incidents, the growing demand for strengthened cyber security solutions, along with the high reliance on traditional authentication

- It is projected that the aerospace and defence segment will experience significant growth, while Asia-Pacific will post the fastest growth during the forecast period

In 2020, the global Internet of Things (IoT) market was valued at $761.4 billion.

- It is estimated that by 2026, the industry will be valued at $1.4 trillion, representing a CAGR of 10.5% during the forecast period (2021-2026)

- This growth will be fueled by the collaboration currently being witnessed by vendors in the market which are offering emerging tech-enabled solutions in various areas, including healthcare

- This growth will also be facilitated by the overall development of wireless networking technologies, the emergence of advanced data analytics, along with the connectedness that comes with the proliferation of smart devices

- North America remains the best performing IoT market owing to the deployment of connected cars, home automation, smart energy projects and smart manufacturing

EXPERIENCED MANAGEMENT

Teradyne is led by Mark Jagiela who has been with the company since 1982 as a design engineer. He later became general manager of Teradyne's Japanese operations and serves as a director since 2014.

- Mark Jagiela became CEO of Teradyne in February 2014

- He has been President of Teradyne since 2013 and has served as a director since 2014. Prior to these roles, Mark was the President of the Semiconductor Test Division and was worldwide marketing manager of Teradyne's semiconductor test products from 2001 to 2003. He joined Teradyne in 1982 as a design engineer, developing image sensor test systems. From 1989 to 1999, Mark served as general manager of Teradyne's Japan Division

- He holds a BSEE from the University of Michigan

- Sanjay Mehta was appointed Teradyne’s Chief Financial Officer in April 2019 and oversees Teradyne’s finance, information technology, global infrastructure and supply line management functions, including new product introduction and manufacturing operations

- Prior to joining Teradyne, Sanjay served in a variety of senior financial management and leadership roles in Qualcomm’s semiconductor group (QCT), including segment Chief Financial Officer from 2010 to 2015 and President of QCT China from 2016 to 2018. He began his career at Price Waterhouse Canada and qualified as a Chartered Accountant in 1995

- Holds a Bachelor of Commerce degree from the University of Toronto

- Rick Burns joined Teradyne in 2007 and has served in a variety of roles, including Vice President of Semiconductor Test Engineering

- He has over 30 years of engineering, engineering management and business leadership experience

- Holds a BS in Physics from the University of California, Los Angeles and an MSEE from the California State University, Northridge

TAKE A BREATH

So… This is a lot of information. Let’s summarise:

- Teradyne, Inc. is a North Reading, Massachusetts-based designer and manufacturer of automatic test equipment (ATE)

- It was founded in 1960 by Alex d'Arbeloff and Nick DeWolf, both students at the Massachusetts Institute of Technology (MIT)

- Today, the company counts Samsung, Qualcomm, Intel, Analog Devices, Texas Instruments, and IBM as customers

- Teradyne develops, manufactures and sells automatic test systems used to test semiconductors, wireless products, data storage and complex electronics systems in many industries including consumer electronics, wireless, automotive, industrial, computing, communications, and aerospace and defence industries

- The test systems provided by Teradyne are used both for wafer level and device package testing. These chips are used in automotive, industrial, communications, consumer, smartphones, cloud, computer and electronic game applications, among others

- Teradyne is led by Mark Jagiela who has been with the company since 1982 as a design engineer. He later became general manager of Teradyne's Japanese operations and serves as a director since 2014

- Market growth is supported by the growing demand for integrated circuits in devices such as military weapons, gaming devices, smartphones and computers

- This growth will also be facilitated by the overall development of wireless networking technologies, the emergence of advanced data analytics, along with the connectedness that comes with the proliferation of smart devices

FINANCIAL CHECK

Teradyne reported revenue of $885 million for the fourth quarter of 2021 of which $592 million was in Semiconductor Test, $127 million in System Test, $52 million in Wireless Test and $113 million in Industrial Automation (IA). GAAP net income for the fourth quarter was $230.3 million or $1.29 per diluted share.

- Revenue of $885 million in Q4 2021, growth of 17% from Q4 2020

- Full year 2021 revenue grew 19%, GAAP EPS grew 30%, Non-GAAP EPS grew 29% from 2020

- Test Revenue grew 16% in Q4 2021 from Q4 2020, 17% in FY’21

- Universal Robots Revenue grew 22% in Q4’21 from Q4’20, 41% in FY’21

- MiR Revenue grew 46% in Q4 2021 from Q4’20, 42% in FY’21

- Quarterly dividend increased 10% to $0.11

- Expect to repurchase a minimum of $750 million in shares in 2022

Guidance for the first quarter of 2022 is revenue of $700 million to $770 million, with GAAP net income of $0.71 to $0.93 per diluted share and non-GAAP net income of $0.76 to $0.98 per diluted share.

THE BOTTOM LINE

The Good

- Demand for advanced testing equipment is sustained as foundries and major tech companies require more advanced chips

- The company manages to grow throughout the ups and downs of semiconductors super-cycles while exposing itself to new markets (cloud, automation, connectivity)

The Bad

- The company may be negatively affected by the semi-conductors super-cycles and the potential reduction in demand that will follow the current period of extremely high demand

- Customer concentration is relatively high as five of its largest customers account for around 33% of sales

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits