Nvidia Sales Are Cooling Down

Due to a 33% decline in gaming revenue to $2.04 billion, Nvidia's sales came in at $6.7 billion for the quarter ending July 31, which is 17% less than the $8.1 billion it had anticipated previously.

- Even though sales would climb at their slowest rate in three years, they would still be up from the year before to hit their fourth-highest total ever

- According to Chief Executive Jensen Huang, the company is altering prices and inventory levels as a result of a large reduction in gaming revenue over the course of the quarter

- Retailers, electronics distributors, and chip manufacturers have reported a decline in demand from PC gamers who raced to purchase processors during the pandemic

The warning came after Advanced Micro Devices CEO Lisa Su last week said graphics processors favored by PC gamers decreased in the second quarter, reflecting pressure on consumer spending from the current economic downturn. Nvidia graphics cards are also utilized in bitcoin mining. A decline in digital currency has caused a dramatic slowdown in those operations.

Micron Warns Of Weaker Demand

As the market for computer memory chips continues to deteriorate, Micron warned that revenue may be lower than previously anticipated in the current quarter. In a regulatory statement, the business stated that since it last gave guidance, demand growth for memory chips had slowed. For the upcoming two quarters, difficult conditions are anticipated.

- It anticipates a sequential reduction in bit shipments in the upcoming quarter, which would result in a sizable revenue deficit, damage margins, and negatively impact free cash flow

- To meet the present situation, the firm is curtailing some of its spending commitments and announcing that overall capital expenditures would now be significantly lower in fiscal 2023 compared to the previous year

Chip Shortage Is Easing

The semi-conductor chip shortage is easing, according to Hyundai, ABB, and Swedish refrigerator giant Electrolux. This is encouraging for manufacturers following a protracted search for parts. An increase in chip supply will ease one of the challenges facing an industry that is also dealing with rising raw material prices, a competitive energy market, and rising interest rates that are reducing consumer demand.

- As it released its second quarter earnings, ABB, a significant supplier to the automotive sector, stated that semiconductor chip bottlenecks were now improving

- With its control systems and motors used in the transportation sector and manufacturing, the Swiss business, which competes with Siemens and Schneider, is seen as a gauge of the state of the world economy

Demand Is Slowing Down

This slowdown seems to be caused by a steep reduction in demand. During the pandemic, consumers spent more on electronic items that enabled streaming, video conferencing and remote work. This seems to have changed now.

- Data on international trade from South Korea, shows indications of a global decline. Chip export growth fell for the fourth consecutive month in July, falling to 2.1% from 10.7% in June

- Taiwan, another significant participant in electronics supply chains, has a similar tale to tell. Manufacturing shrank in June and July as demand declined

The dwindling semiconductor production also implies that manufacturing has been ramped up sufficiently—or more than sufficiently—to satisfy demand. In the long run, that should be good news for inflation as it shows that supply chains can adapt to changes in demand, allaying concerns about ongoing shortages.

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

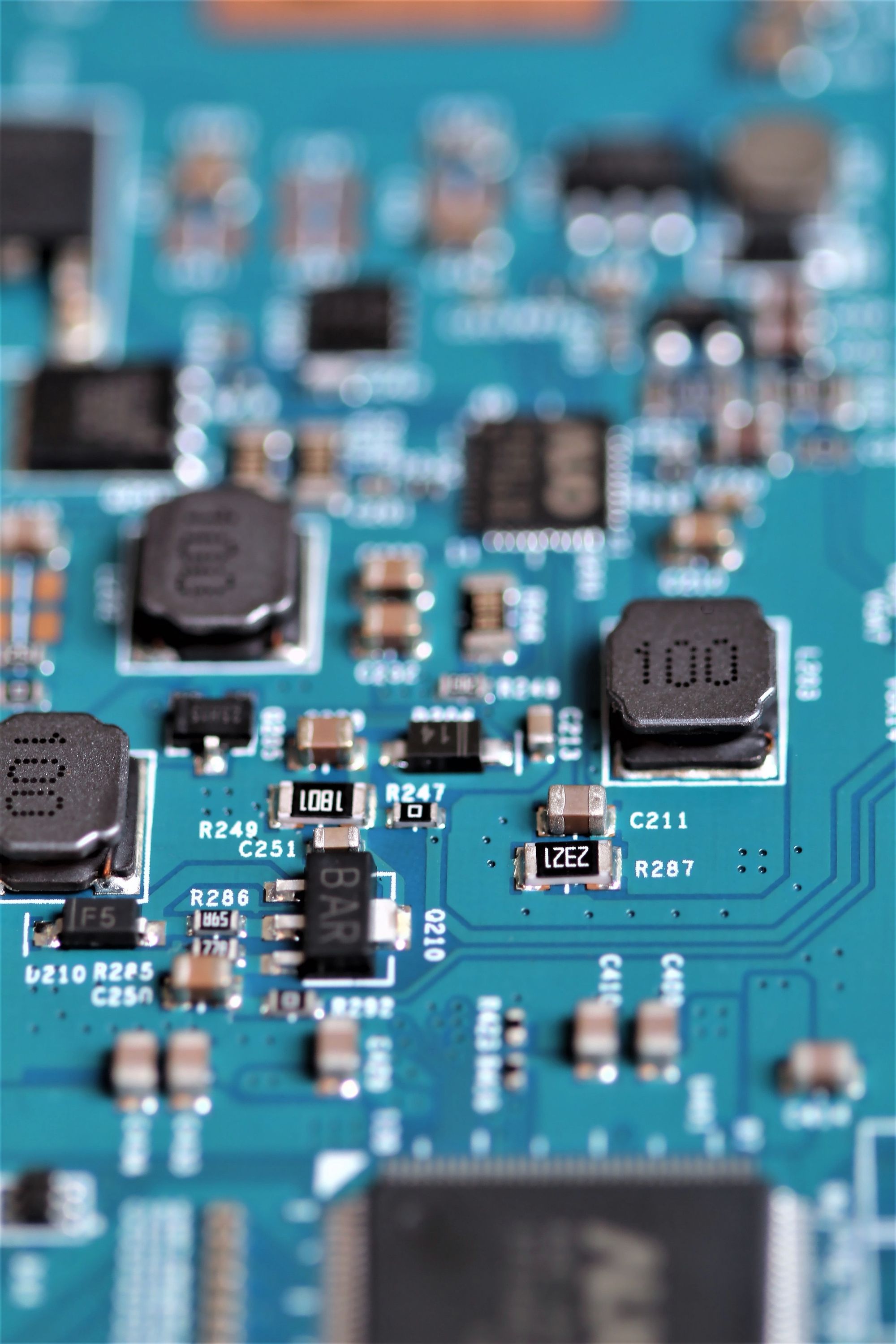

Photo by Anne Nygård on Unsplash.