Shorting Bubbles

Greenlight Capital saw a return 36.6% for 2022 thanks to its strategy of shorting overpriced technology stocks. The Nasdaq Composite index, which is heavily weighted toward technology, fell 33% in 2022 as a result of aggressive interest rate hikes that prolonged last year's downturn and made it worse.

Hedge fund manager David Einhorn's bets against cutting-edge technology businesses like those praised by growth investor Cathie Wood were a major factor in Greenlight's outstanding performance.

Here is from the investor letter:

"[...] during the 1998-2000 bubble, we recognized that shorting bubbles can be quite profitable when they burst. Though we didn’t expect to ever see another bubble like that one again, we were wrong. When we saw a second mega-bubble forming, we wanted to participate in the subsequent decline.

[...] 2013 was a year of enormous gains for a number of speculative stocks. In early 2014, the bubble appeared to be breaking and we created our first bubble basket. This proved to be very premature.

In our bubble baskets, individual positions are small and names come and go. There were sixtyeight stocks in the original 2014 bubble basket, which we built up to 13.8% of capital at cost.

During our holding period, forty-two were profitable shorts while twenty-six were unprofitable. Though eleven of the stocks fell more than 50%, thirteen rose more than 50% and eight of them doubled or more. To our surprise, several of these names did in fact grow eventually into their 2014 valuations.

Through the end of 2016, the basket was profitable. But 2017-2019 was a different story. We had covered a number of the winning bubble stocks and concentrated our risk on the names that had not yet worked. This was a mistake.

Ultimately, we covered the remaining stocks from this basket during the COVID crash in March 2020. This basket lost money, with cumulative negative impact to our returns of 11.3% of capital spread over several years.

We believed that during COVID the re-inflated bubble began to pop in September 2020. We instituted a second bubble basket with fifty-eight names totaling 20.7% of capital.

Unfortunately, the bubble had one more leg up. Convinced that we were again early, we covered our 2020 bubble basket in early January 2021. The losses on this basket were 2.1% of capital.

Looking back on these names, six were subsequently acquired at an average price that was 45% over our entry. However, of the other fifty-two names, the average stock at the end of 2022 was down 42% from our entry price, with only nine up from our entry price, while nine fell more than 80%.

We are nothing if not persistent. In March of 2021, we again believed that the bubble had popped… this time correctly. We created our third bubble basket with thirty-one names totaling 6.5% of capital. This bubble basket remains in the portfolio, though we have covered some names.

All but one of these stocks are down through year-end from our entry, with an astounding twenty-four of them down more than 70%. The cumulative positive impact on our returns has been 3.0% of capital.

In early 2021, we also identified an actively-managed ETF of so called “innovation” stocks that appeared to us to have significantly similar characteristics to our bubble names. We shorted a basket comprised of the components of that ETF in February 2021 that we ramped up to 9.0% of capital. It has declined by 76% from our first entry. The cumulative positive impact on our returns has been 6.4% of capital."

Hedge Funds Did Well Globally

According to statistics from Hedge Fund Research (HFR), many macro managers avoided the sagging equities markets that were rattled by swift interest rate increases and geopolitical unrest, notably the war in Ukraine.

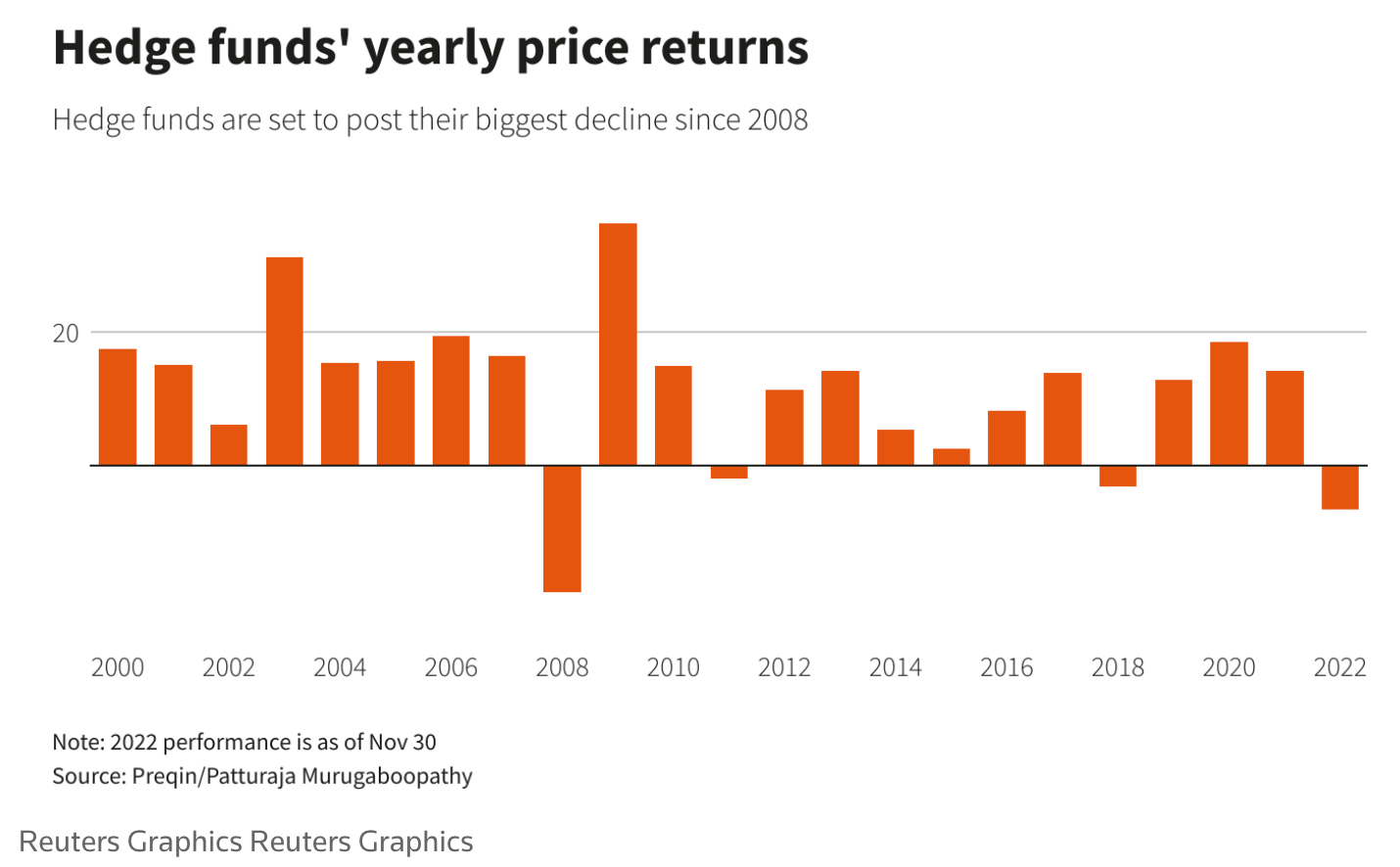

- While the global hedge fund index fell 4.25%, the HFR's macro index rose 14.2%, marking the index's first decline since 2018

- According to HFR data, equity hedge funds, which hold the majority of the industry's approximately $3.7 trillion in assets, fared worse with a 10.4% loss

- Still, the hedge funds vastly beat the S&P 500 index's 19.4% decline

Some macro-focused hedge fund strategies that invested in commodities and currencies and took advantage of price discrepancies between related securities did well in 2022, giving investors respectable returns.

- According to HFR data, equity-hedged and event-driven strategies lost 9.7% and 4.7%, respectively, while macro funds gained 8.2% through November of this year

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products. Please note that the writer of this article is not registered as a financial advisor.

Credits

Photo by Patrick Weissenberger on Unsplash.