KKR Closes $19 Billion North America Private Equity Fund

On Monday, KKR announced the full closure of the KKR North America Fund XIII, an oversubscribed $19 billion fund focused on pursuing opportunistic private equity investments in North America.

The KKR North America Fund XIII will invest largely in the U.S. and Canada in companies that operate in financial services, healthcare, retail, industrials, technology, media, and telecommunications.

- Through the firm's balance sheet, affiliates, and employee commitments, KKR will invest $2.0 billion in the fund alongside investors

- The fund has raised more money than the KKR 2006 Fund, KKR's previous largest fund with $17.6 billion raised

- KKR North America Fund XIII predecessor funds, KKR North America Fund XI and KKR Americas XII Fund, have delivered respectively average gross IRR of 30.1% and 50.1%

KKR's $12 Billion Bid for Telecom Italia Stuck Over Due Diligence Issues

In November 2021, KKR presented a non-binding purchase proposal for Telecom Italia worth €10.8 billion.

- Early April, KKR sent a letter to Telecom Italia's board warning it could not confirm its bid unless the operator grants access to its data as part of a due diligence procedure

- Before receival of KKR's letter, TIM signed a non-disclosure agreement with CDP, an Italian state lender, to begin official negotiations about merging its network with that of smaller broadband rival Open Fiber

- Meanwhile, CVC has expressed a strong interest in buying a stake in Telecom Italia's business services sector

- According to a note by analysts at Banca Akros: "The odds of the deal seem now very low"

Private Equity Continues To Drive Growth In Private Markets

According to the McKinsey Global Private Markets Review 2022, PE was the best-performing asset class in private markets for the fifth year in a row. PE's in-year returns for 2020 and 2021 have outperformed all previous years since the global financial crisis.

- In 2021, PE fundraising amounted to $680 billion, following a long-term upward trend and just shy of the 2019 prepandemic peak of $688 billion

- The most successful PE companies raise more capital more frequently while expanding into new product families

- Since 2016, the average flagsip fund size of the top 20 fundraising share gainers has more than doubled to $10.7 billion

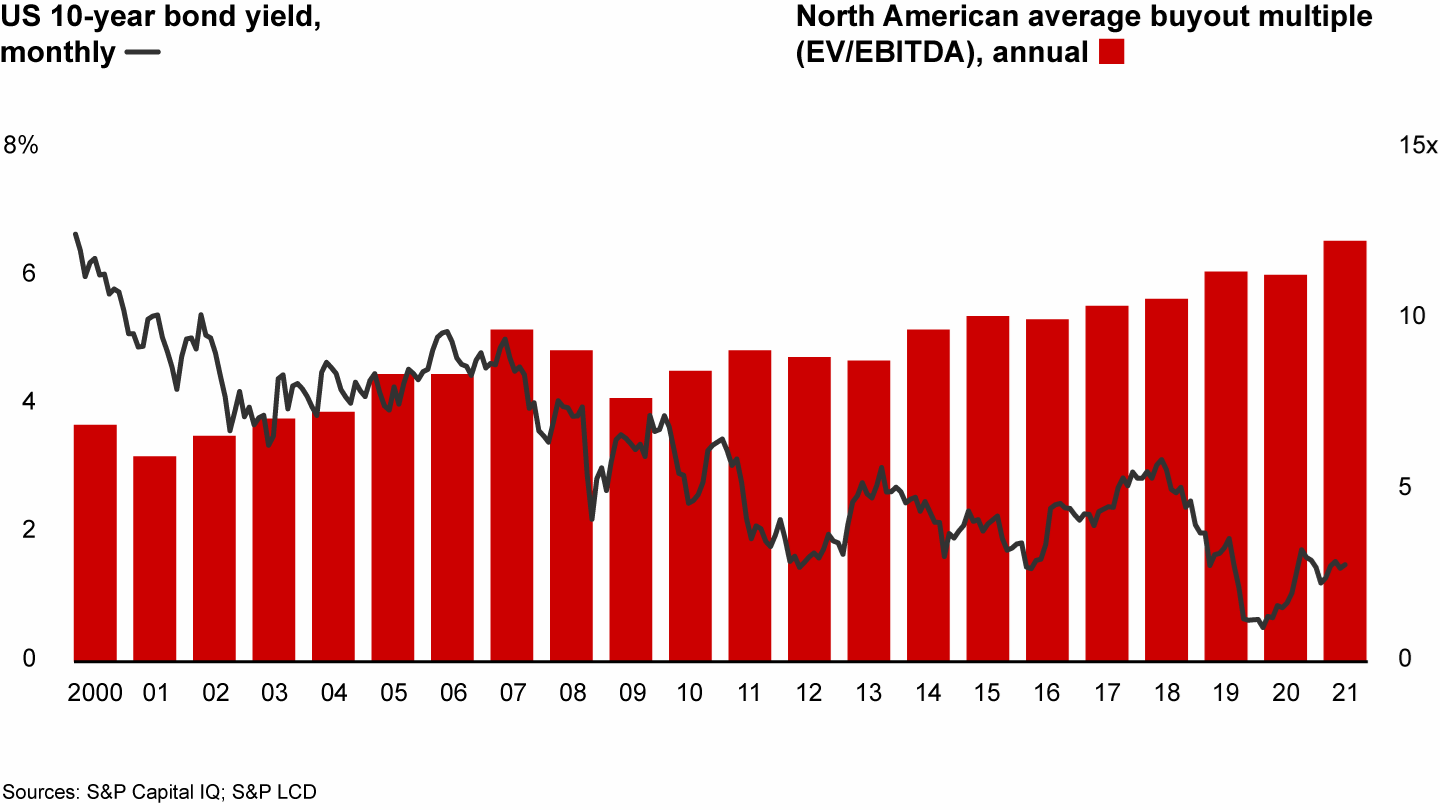

Volatility And Inflation May Undermine PE Returns

Volatility is growing following the Russian invasion of Ukraine, greater inflation and interest rates, and supply chain and labor issues.

According to the Bain & Company Global Private Equity Report, inflation poses a twofold challenge to portfolio companies: growing expenses and limited multiple expansion during ownership.

- While the 10-year Treasury yield has fallen from 6.0% in 2000 to about 1.5% in 2021, the average leveraged buyout multiple has almost doubled to 12.3 times EBITDA from 6.8 times in 2000

Aside from inflation, other global issues provide difficulties for companies seeking to increase profitability.

- The Covid effect, along with geopolitical uncertainties, has forced companies to consider if they may need to reverse years of cost-cutting to protect their global supply networks

- Political conflicts, demographic trends, and a retreat from globalization have started to impede the flow of cheap capital, even as labor shortages and the push for automation drive up demand

Quoting Bain & Company Global Private Equity Report: "PE firms and portfolio companies will have to learn how to manage effectively amid rising prices and rates".

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Patrick Weissenberger on Unsplash