State-Driven Dream Becomes a Fiscal Nightmare

The European project, born from the ashes of war, was built on a promise of shared prosperity and cradle-to-grave security. This vision of a state-driven economy, a supposedly more humane and stable alternative to the perceived ruthlessness of American capitalism, became a source of continental pride.

- That vision is now an illusion, shattering against the hard wall of economic and demographic reality.

- The state, intended as a safety net, has mutated into a cage, stifling the very prosperity needed to sustain it.

This post-war model has decayed into a fiscal doom loop, and for many nations, particularly France and the United Kingdom, the only question left is whether the inevitable correction will be managed or catastrophic.

The Demographic Time Bomb and the Pension Ponzi Scheme

The foundational promise of the European social contract was a dignified retirement for all. This goal was undermined by its mechanism: a pay-as-you-go pension system. For post-war politicians, this model was a masterstroke of political expediency. It allowed them to deliver immediate benefits to an aging and influential voting bloc without the difficult necessity of raising capital or making long-term investments. For decades, with a booming population of young workers easily supporting a small cohort of retirees, the system appeared flawless and sustainable.

Today, collapsing birth rates and soaring life expectancies have completely inverted the demographic pyramid.

- The "dependency ratio"—the number of retirees per worker—is spiraling towards levels that are mathematically impossible to maintain.

- The system no longer functions as a sustainable insurance program but as a brutal, state-mandated wealth transfer from the young, productive, and increasingly small working generation to the old.

- This is not an investment in the future; it is the mortgaging of it.

- While a funded system would have invested contributions into the best and brightest projects to fuel a virtuous cycle of economic growth, Europe's model simply disburses the cash, creating no future value.

To keep the checks from bouncing, governments are trapped, forced to choose between imposing crippling, growth-killing taxes on the next generation or issuing mountains of debt that devalue the future. It is, in its cold, hard mechanics, a state-sanctioned Ponzi scheme, and it is guaranteed to fail.

Immigration To The Rescue?

Faced with this demographic collapse and the mathematical certainty of the pension system's failure, European leaders reached for the only available lever to keep the Ponzi scheme from imploding: mass immigration. This was not a policy of choice, but of sheer demographic necessity.

- However, this desperate measure has ignited a political firestorm across the continent, creating a new and dangerous paradox.

- The policy designed to save the welfare state has directly fueled the rise of extreme political parties that campaign on fiercely anti-globalization and anti-immigration platforms.

Crucially, these nationalist movements are also deeply Eurosceptic, threatening to pull their countries out of the Euro and the European Union itself. The very "solution" to the economic problem has thus created a powerful political insurgency that seeks to dismantle the entire post-war European project, adding a volatile new dimension of instability to the impending economic reckoning.

The Leviathan State: An Economy on Life Support

The pension crisis is merely the most acute symptom of a deeper malaise: the overwhelming, suffocating dominance of the state in the economy. In France, government spending now accounts for a staggering 57% of GDP. This is not a mixed economy; it is a state-run economy with a private-sector appendage kept alive on government life support.

- This dominance manifests in every corner of society: in bloated public-sector payrolls of "fonctionnaires" who enjoy jobs for life; in byzantine regulations and permitting processes that crush entrepreneurship before it can begin; and in so-called "national champion" corporations kept afloat by a constant drip of subsidies and protectionism, insulating them from the pressures of innovation and efficiency.

- This has created a deeply perverse cycle of dependency. When the government is the largest customer, contractor, and employer, the private sector loses its dynamism.

- Ambition shifts away from creating world-beating products and services. Instead, businesses learn that the surest path to profit is to compete for the next government grant or contract.

- This fosters an artificial, fragile economy, acutely sensitive to the whims of fiscal policy. A new state-funded social center, for instance, produces no sustainable economic value, yet private construction firms come to depend on its existence merely to survive.

As a result, the very idea of fiscal discipline becomes politically toxic. Any attempt to cut spending means a direct and immediate hit to GDP, triggering a painful economic contraction and ensuring the political demise of anyone who dares to propose it.

The Inescapable Sovereign Doom Loop

This dependency has trapped many European nations in a vicious, self-reinforcing "sovereign doom loop." The process is as predictable as it is destructive. First, facing a structural deficit, a government attempts minor, politically palatable spending cuts.

- This timid move immediately spooks the state-dependent economy, causing a slowdown. This slowdown, in turn, reduces tax revenues and increases welfare costs, ironically worsening the very deficit the cuts were meant to address.

- Financial markets, seeing both the fiscal deterioration and the clear lack of political will for genuine reform, begin to demand higher interest rates on the nation's debt.

- This rising cost of borrowing acts as a vise, forcing the government into more painful cuts, which in turn cause a deeper recession. It is a death spiral from which there is no easy escape.

The inevitable end is a catastrophic market event: a bond market revolt that makes borrowing impossible (as the UK briefly experienced during the Liz Truss crisis), a bailout with externally imposed conditions (as Greece endured for a decade), or a turn to the printing press, unleashing inflation to vaporize the debt.

Belgium, A Case Study

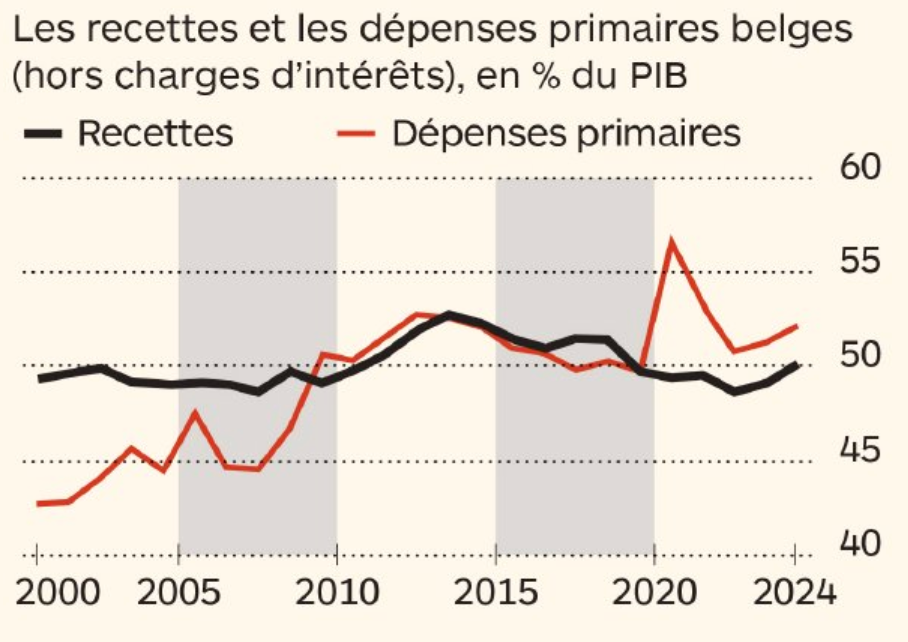

Since peaking in 2014, total federal tax revenues (black line on graph) in Belgium have been on a decline as a percentage of the economy. Simultaneously, primary government spending has surged (red line on graph), creating a dramatic and widening gap between what the state takes in and what it spends.

- This is the very definition of a structural deficit and represents the first, paralyzing stage of the sovereign doom loop.

- The Belgian state is now trapped: any attempt to implement meaningful spending cuts would immediately trigger a painful economic contraction, further depressing tax revenues and ironically worsening the deficit.

This inability to act, born from the state's oversized role in the economy, creates the exact conditions of fiscal deterioration that eventually lead financial markets to demand higher borrowing costs, tightening the vise and accelerating the spiral towards a full-blown crisis.

The American Exception: A Dangerous and False Comparison

Cornered, European leaders often deflect criticism by pointing to the large nominal debt of the U.S. government. This comparison is dangerously misleading and ignores the fundamental structural differences between the economies. With government spending at a much more modest 37% of GDP, the American economy operates in a different universe. Its growth is not driven by state directives but by the dynamism of private consumption, corporate investment, and innovation.

- A key difference lies in capital formation. America's world-leading capital markets are fueled by trillions of dollars in privately invested pension funds, such as 401(k)s.

- This immense pool of private capital is a source of incredible strength, funding the next generation of technology and enterprise, from Silicon Valley startups to nationwide infrastructure projects.

- This structure fosters a culture of risk-taking and adaptation that is largely absent in Europe's state-managed systems.

- Furthermore, the U.S. possesses critical structural advantages that Europe lacks: a single federal fiscal authority, a unified labor market, and the unrivaled power of the U.S. dollar as the world's primary reserve currency.

The U.S. has its challenges, but it possesses an economic resilience and fiscal space that Europe has long since squandered. In a true crisis, the U.S. government could make painful cuts to programs like Medicare; in France, as we have seen with protests against minor pension age adjustments, such a move would trigger a nation-stopping chaos.

History Repeats: The Enduring Hubris of the ECB

Don’t count on German rigidity to force swift change. The European response, as always, will be a long, bloody, and protracted affair. In the aftermath of the 2008 financial crisis, a narrative of moral superiority took hold in Brussels and Frankfurt. European leaders mocked the U.S. Federal Reserve's policy of Quantitative Easing (QE).

- The European Central Bank President at the time, Jean-Claude Trichet, repeatedly and forcefully insisted the ECB would not follow such a "reckless" path.

- This ideological hubris had devastating consequences. By refusing to act decisively, the ECB allowed a banking crisis to fester and morph into the 2011 sovereign debt crisis.

- This plunged southern Europe into a lost decade of brutal austerity, with youth unemployment soaring above 50% in nations like Greece and Spain.

After years of inflicting stagnant growth and immense human suffering, the ECB finally capitulated in 2015, launching its own massive QE program and effectively admitting its earlier policy was a catastrophic mistake. By then, it was too little, too late. The U.S. economy was already far ahead in its recovery.

The Market's Verdict and the End of an Illusion

Today, that same disconnect from reality persists. Leaders like Christine Lagarde speak of a "Euro moment" while living in a world of fabricated facts, focusing on regulatory crusades while their fiscal house burns to the ground. The market, however, is a ruthless arbiter of truth. Investors and even central banks are making their verdict clear through a massive flight to safety. We are witnessing record-high gold prices and a historically strong dollar.

- The verdict is already in. As The Wall Street Journal reported, this is not a minor trend. Central banks around the world have been "gobbling up gold for more than a decade, helping the precious metal surpass the euro as the world’s second-largest reserve asset this year."

- While European leaders celebrated themselves, gold quietly supplanted their currency as the world's number two store of value—a vote of no confidence of historic proportions.

- The path back to solvency is politically treacherous but economically essential: a deliberate, systematic shrinking of the state. This demands deep, painful structural reforms: slashing regulations, liberalizing labor laws, and drastically cutting the tax burden to finally unleash the private sector.

The choice is stark: endure the short-term, excruciating political pain of reform or accept long-term, irreversible national decline. The state, intended as a benevolent safety net, has become a cage. The illusion is over. The bill has come due, and the consequences of inaction will define the continent.

Nothing Is Too Big To Fail

The specter of 2008 is haunting Europe again, but with a twist. The last great crisis was defined by the concept of "too big to fail" banks and corporations, entities like Lehman Brothers, AIG, and Royal Bank of Scotland, whose collapse threatened the global financial system. Governments, using taxpayer money, were the ultimate backstop.

- Today, the roles have been reversed. The entities now teetering on the brink of insolvency are not the banks, but the sovereign states themselves. The new "too big to fail" are countries like France and Italy.

- When a corporation fails, the state can bail it out. But when the state is the one that fails, the ultimate question arises: who is left to perform the bailout?

The safety net that saved the system in 2008 is the very thing that is now tearing apart, heralding a crisis of a greater magnitude.

Disclaimer

Please note that Benchmark does not produce investment advice in any form. Our articles are not research reports and are not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by JOHN TOWNER / Unsplash.