The Last Time This Happened...

“Wall Street edges higher on tech gains, 'meme' stocks rally” by Shashank Nayar and Ambar Warrick for Reuters

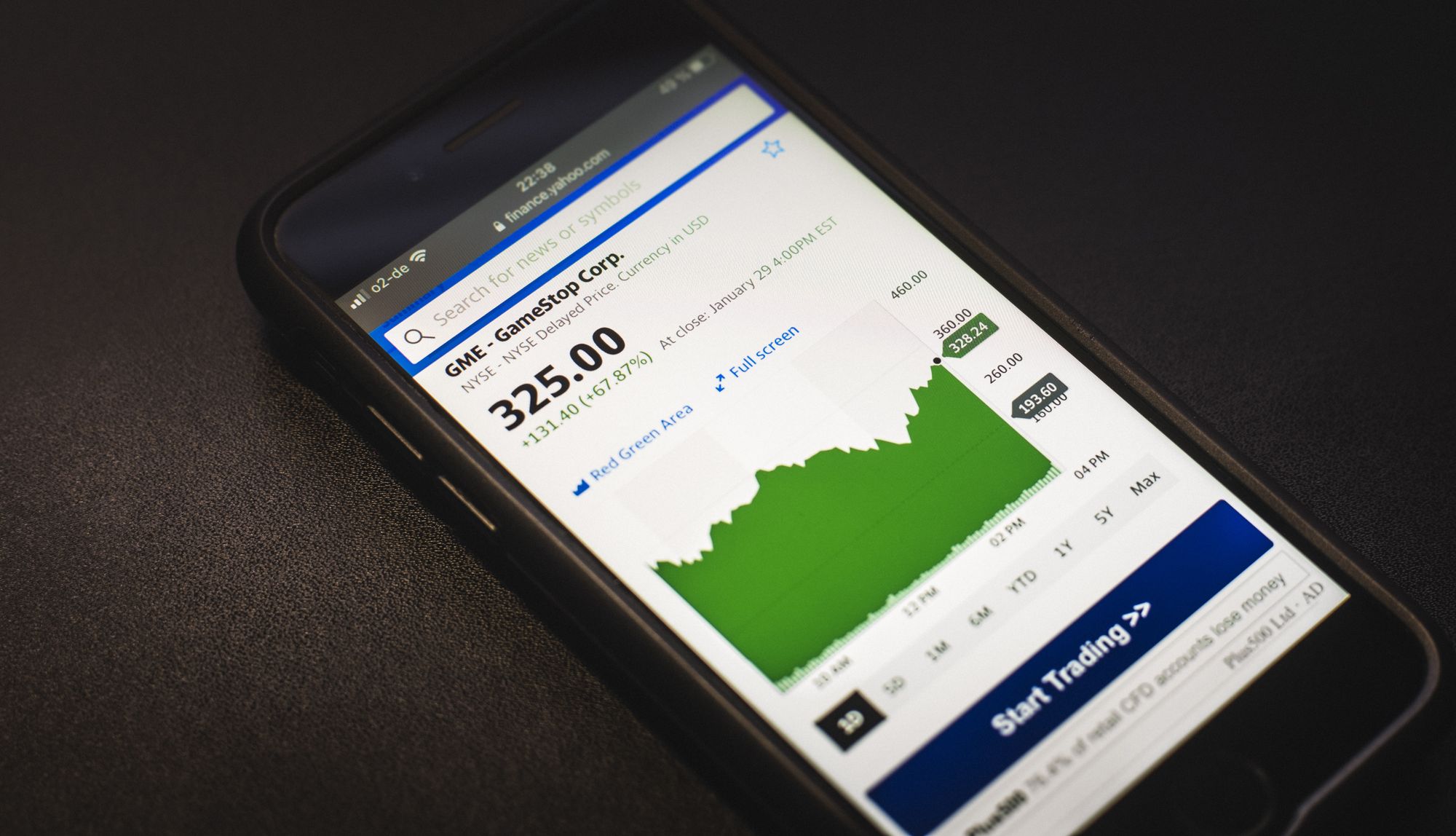

Recent months have been interesting, even by Wall Street standards. Back in February, this took the form of extreme speculation in heavily shorted stocks and unlimited optimism regarding the fate of many high-growth stocks.

While the latter had a haircut, the former is still going strong:

- GameStop is still significantly higher than its late-2020 levels and AMC is sitting on triple digits gains

- Other heavily shorted stocks also joined the ranks as Clover Health surged more than 105% on Tuesday and ContextLogic rose over 40%

“Some 43.5 percent of Clover’s float shares have been sold short, CNBC said Tuesday, citing data from S3 Partners. The push kicked off in February after respected research firm Hindenburg Research issued a scathing report suggesting the company was facing a probe from the Department of Justice over possible corruption charges.” By Lydia Moynihan for New York Post

- This is fuelled by a fresh inflow of retail money. Individual investors have put as much cash into so-called meme stocks in June as they did during the GameStop rally in January

“Meme stocks have received $1.27 billion of retail inflows in the past fortnight, matching the peak in January, when retail traders piled into video game retailer GameStop Corp in an attempt to drive up the share price and punish short sellers by forcing them to cover their positions at big losses.” by Reuters Staff

BENCHMARK’S TAKE

- Buying a stock to engineer a short squeeze isn’t an uncommon event. However, the size and duration of recent attempts are staggering

- While there may be little value to meme stocks, prudent investors could still listen to the signals these are sending

- These are the same as in February 2021: current price action suggests that the casino is open and retail investors are flocking in

- We therefore believe that prudent investors should be careful when buying stocks with high retail ownership

- When the casino cool downs, these stocks may be the hardest hit

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Michael Förtsch on Unsplash.