A Story Of Debt, State Control And Excess

China's most indebted property developer could fail to pay interests on its debt. The company might then default on its $ 305B in liabilities, sending shock waves through the Chinese real estate market. However, this should come as no surprise as Evergrande was a crash in the making:

- In August 2017, the company vowed to cut its debt by slashing net gearing ratio to 70% by June 2020, from 240% in June 2017

- In November 2018, the central bank named Evergrande as one of the few holding conglomerates that could cause systemic risk

- In August 2020, regulators met with 12 major property developers to introduce caps on debt ratios

- In September 2020, the company offered a 30% discount on properties for a month to push sales

- In 2021, the company IPOed its electric vehicle unit, sold a 10% stake in its online real estate and automobile marketplace. All while state media reported that construction works in Kunming were halted

China's Great Wall Of Debt

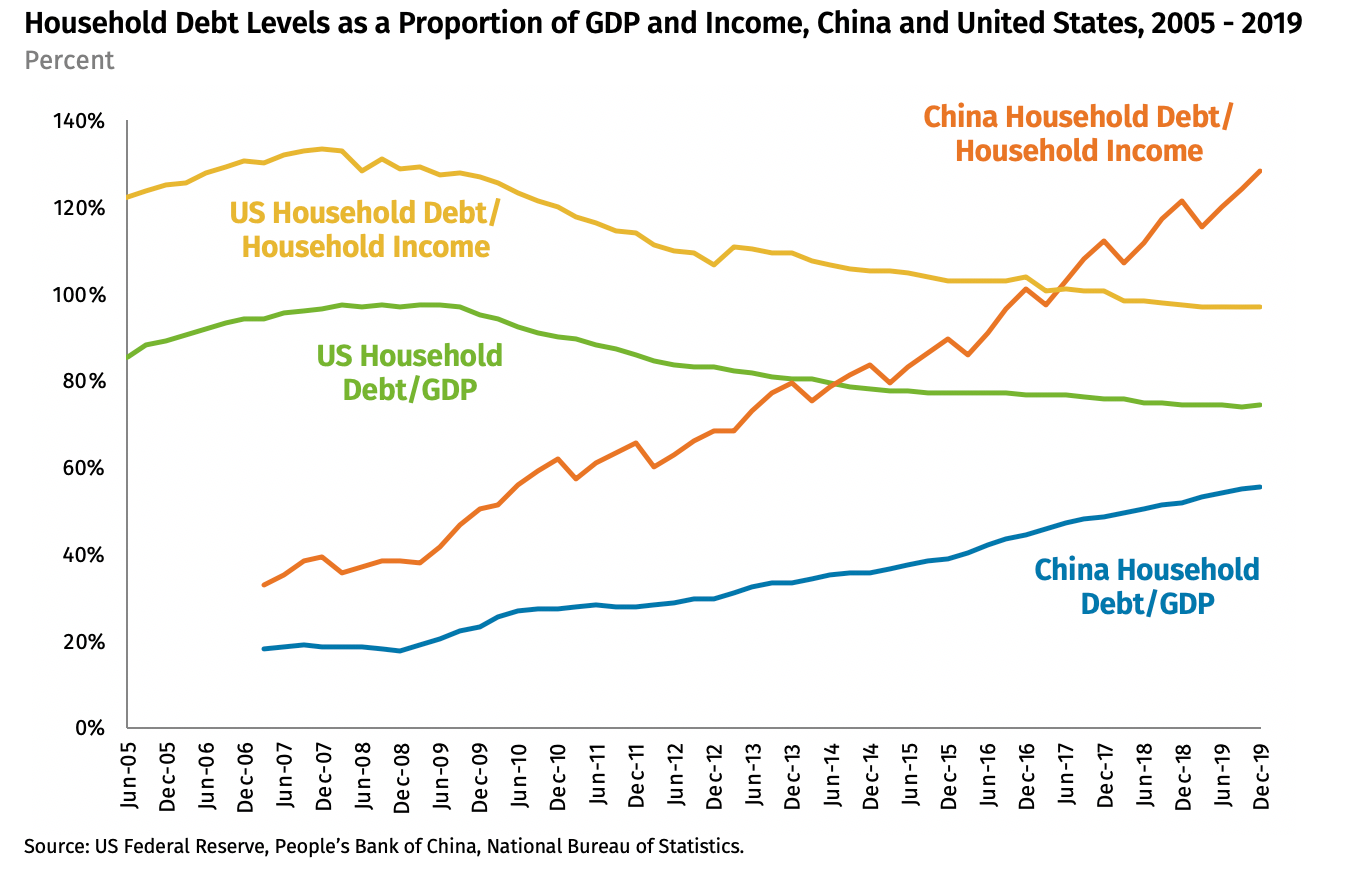

Until recently, China's households were among the top savers in the world. However, household debt has risen to 128% of household income and 56% of Chinese GDP in only five years. While the majority of this expansion is attributed to China's property market in the form of mortgage debt, consumer credit has also grown rapidly: China's credit card debt now exceeds that of the United States in absolute terms.

- The economic repercussions from the COVID-19 epidemic now threatens to exacerbate financial risks associated with growing household debt, with ramifications for financial stability, consumer growth and the broader economy

- China's recent household debt increase matches that of the United States pre-crisis

- Between 2015 and 2019, Chinese families accumulated $4.6 trillion to their debt, similar to a $5.1 trillion increase in US household debt from Q3 2003 to Q3 2008

Ageing Population Reshaping Political Priorities

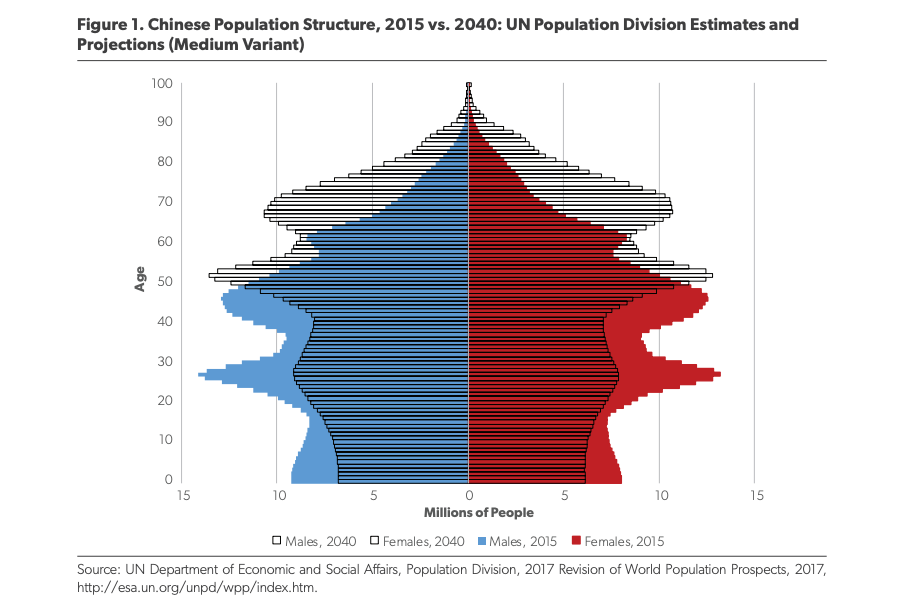

The clock is ticking for China as its ageing population might force it to rethink its priorities going forward. Instead of investing into relatively more productive infrastructure projects, it might have to redirect expenses towards (non-productive) care for an ageing population.

- According to projections, China would have endured over half a century of sub-replacement fertility by 2040 and the country's fertility level would have been considerably below replacement throughout the majority of the decades in question

- As a result, it should come as no surprise that the working-age population peaked shortly before 2015 and that it is expected to rapidly decline from 2015 to 2040

- Despite the probability of general population decline in the coming decades, China will experience a unique form of population explosion: a rapid growth in the number of senior persons aged 65 and up

- According to UNPD forecasts, China's 65+ population will increase by about 150 percent between 2015 and 2040, from 135 million to nearly 340 million

Hard Landing

A hard landing in China continues to be a looming threat to the global economy, particularly in Asia. So far, Chinese officials have avoided such a situation, but the financial system's expanding debt heightens the possibility of a policy blunder.

- Slowing Chinese GDP, changing demographics, tighter financial conditions in the shadow banking sector and dwindling rewards from government support could lead to a serious deterioration in credit conditions

- Defaults on business and personal loans cascade across the banking system as asset and property values decrease, forcing systemically important financial institutions to fail

BENCHMARK'S TAKE

- Evergrande's failure might trigger a broader market slowdown in China as consumers are left without a home and the collapse of one property developer triggers a chain of bankruptcies

- We doubt the Chinese government will step in as it seeks to curb asset prices and debt levels

- This might trigger a country-wide slowdown which might negatively affect commodity prices as real estate projects are put on hold

- Real estate prices might then be pressured, causing troubles for Chinese home-buyers and home-owners who might undergo a negative wealth effect, certainly as around 90% of the Chinese population is a home-owner

"The continued rise of real-estate investment left China with the largest increase in global household debt in the first half of the year" by Mike Bird for the Wall Street Journal

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits