Workers Are Not In A Hurry

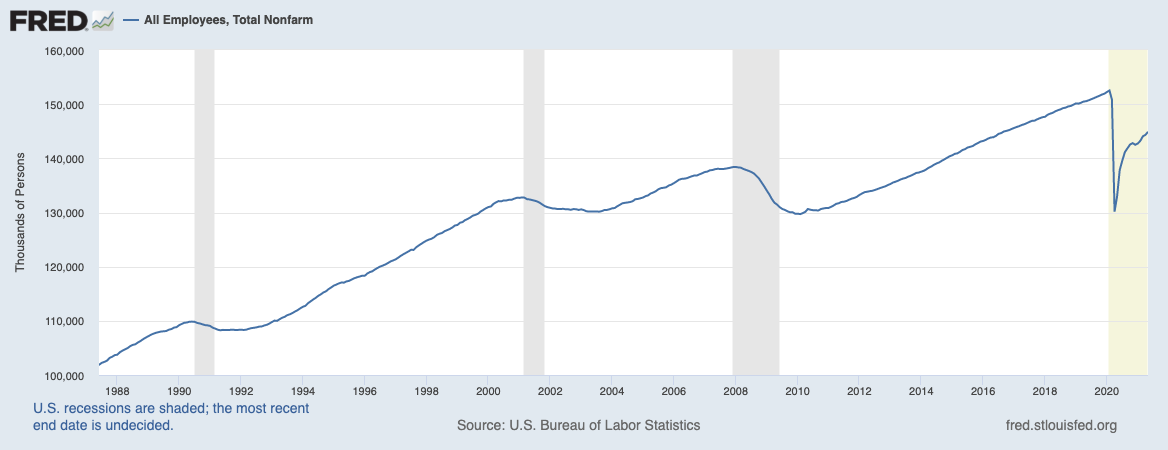

At least 26 states, mostly led by Republican governors, are terminating federal unemployment benefits before the expiration date of Sept. 6. However, no evidence has emerged so far that the earlier terminations, which started on 12 June and will run until 31 July, are pulling the unemployed into jobs.

A survey of the Indeed job search engine found that while the vast majority of unemployed indicated they would like to start looking for work in the next three months, many did not express a sense of urgency about finding a new job.

BENCHMARK’S TAKE

- This may slow down the U.S.’ recovery and may help drive prices higher past the summer as it could take years for the labour market to recover from the pandemic

- On the other hand, price increases induced from imports may normalise as supply-chain hurdles get cleared

Home Prices Continue To Rise

Compared to April, pending home sales jumped an unexpectedly high 8% in May. This is the highest sales activity since May 2005. However, the weekly mortgage demand is falling, down nearly 7% in the week, according to the Mortgage Bankers Association. This may be caused by rising home prices as the U.S. Census Bureau revealed that the median price of a newly built home sold in May was up 18%.

“While these hurdles have contributed to pricing out some would-be buyers, the record-high aggregate wealth in the country from the elevated stock market and rising home prices are evidently providing funds for home purchases” Lawrence Yun, NRA’s Chief Economist by Diana Olick for CNCB

The supply of existing homes is around 20% below the level of the previous year as builders have seen prices for land, labor and materials skyrocket in the past months.

BENCHMARK’S TAKE

- With the stock market close to its all-time highs, the wealth effect is starting to form and retail investors are moving some of their gains from the stock market to the housing market

- The current price increases may not last past the current year as supply-chain hurdles get cleared and homebuilders are able to increase the home supply while keeping costs down

- This could avoid a housing-based wealth effect as price increases cool down. However, if prices continue to rise and rates are then increased, consumers might become more cautious as the value of their house falls

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Blake Wheeler on Unsplash.