Minorities Are Not Coming Back, Helping Prices Higher

Economists and investors around the world are trying to determine whether inflation is spilling over to the labour market. A rise in wages could demonstrate that inflation is lasting rather than transitory. Eventually forcing the FED to intervene by raising rates.

Why does it matter?

- It is one thing to raise prices, it is another to pass these price-increases to productive work forces. Creating a self-reinforcing inflationary cycle that is resolved once rates increase

- An increase in rates drives up the cost of capital and lowers the demand for labour as it becomes more expensive the fund businesses and projects

How are these price-increases passed along to productive work forces?

- As the economy re-opens, many businesses have to fill vacant positions and start hiring again

- When there are significantly more job openings than available workforce, employers have to start increasing the wages they offer in order to attract talent

- Since the 2007 - 2008 financial crisis, wages have hardly increased for U.S. workers

“Wage stagnation has been a subject of much economic analysis and commentary, though perhaps predictably there’s little agreement about what’s causing it […]”

“Other factors that have been suggested include the continuing decline of labor unions; lagging educational attainment relative to other countries; noncompete clauses and other restrictions on job-switching; a large pool of potential workers who are outside the formally defined labor force” by Drew Desilver for the Pew Research Center

Why could it be different this time?

- In order to kickstart the economy and help families deal with the impact of the pandemic, the Biden Administration signed into law a $ 1.9T stimulus package

“nearly one-third of American households who are currently unemployed or will lose their job this summer will receive federal unemployment benefit payments of $300 per week – on top of standard benefit levels – through September 6, 2021.” by Marc A. Wojno for Kiplinger

- This package hands over money directly to consumers with the hope that they spend it and look for a job. However, a lacklustre job report in April showed that consumers were not in a hurry to get a job

“If you look at April, it appears that there were about 1.1 unemployed workers for every job opening. So there are a lot of jobs out there, there is just still not a lot of labor supply.” Jason Furman by Jeff Cox for CNBC

So, could we see wage inflation soon?

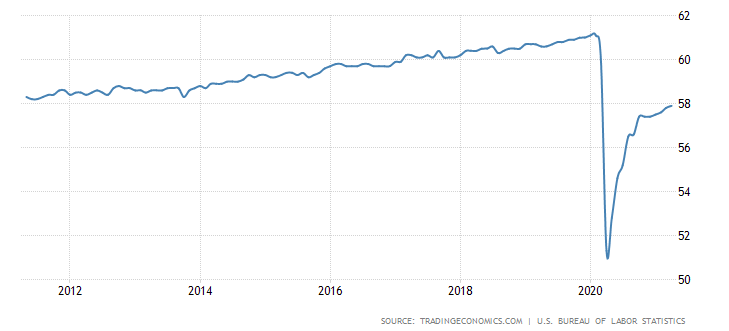

- Cautious investors might want to review the evolution of the employment rate in the United States. The graph hereunder shows that it might take years for the employment rate to recover its pre-pandemic levels

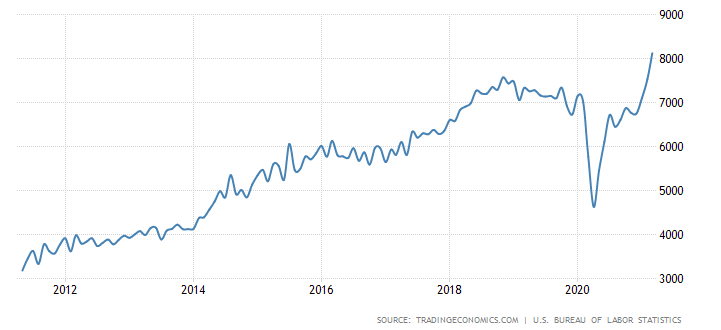

- While job openings are shooting past the 8.1m mark

BENCHMARK’S TAKE

- The extensive stimulus package, pent up demand and constrained labour supply may require employers to increase wages

- Supply may remain constrained for longer than expected as families prefer to stay at home as schools are closed, wait for better job opportunities, avoid contact jobs out of fear of contamination

- These may then require the FED to act earlier than initially thought in order to tame inflation expectations

- This may push the economy in an unwelcome place: high inflation due to tight labour supply and high consumer spending (due to the stimulus) - combined with fears of rising rates which would further compress valuations

- Such a situation may create an extremely weak environment for stocks with stretched multiples and no earnings

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Daniel Lloyd Blunk-Fernández on Unsplash.