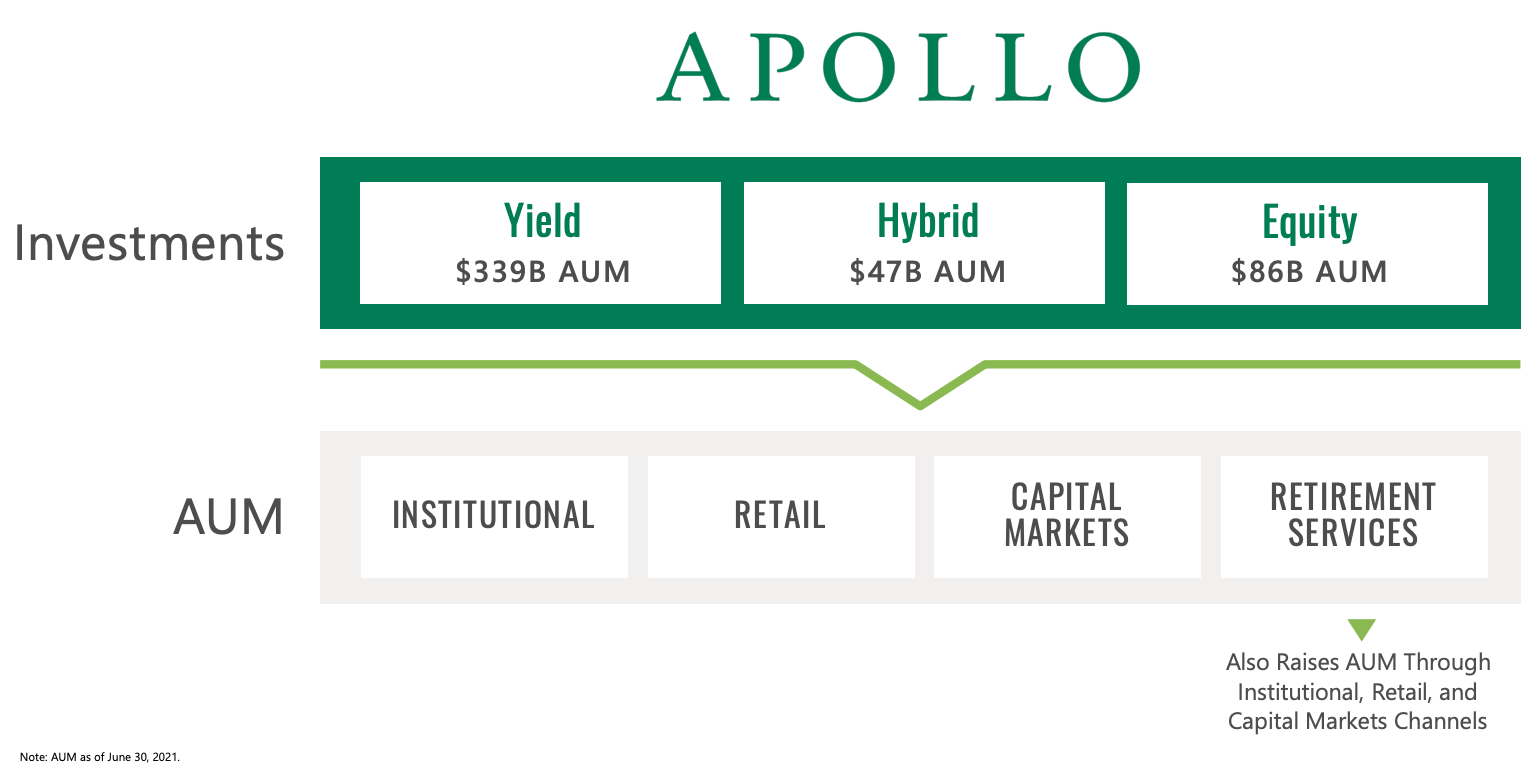

Founded in 1990, Apollo is a high-growth, global alternative asset manager with a focus on three investing strategies: yield, hybrid and equity. The company has a flexible mandate in many of the funds it manages which enables it to invest opportunistically across a company’s capital structure. The company raises, invests and manages funds on behalf of large pension, endowment and sovereign wealth funds, as well as other institutional and individual investors.

- As of December 31, 2021, AUM amount to $ 497.6B with a team of 2,153 employees, including 652 investment professionals

- Apollo operates in a highly integrated manner and by leveraging market insights, management, banking and consultant contacts it is able to deliver strong long-term investment performance for its funds throughout a range of economic cycles

LONG TERM FOCUSSED STRATEGY

Apollo's objective is to achieve superior long-term risk-adjusted returns for its fund investors. The majority of the investment funds it manages are designed to invest capital over periods of seven or more years from inception. Its investment approach is value-oriented, focusing on nine core industries in which it has considerable knowledge and experience, and emphasizing downside protection and the preservation of capital.

Its core industry sectors include chemicals, manufacturing and industrial, natural resources, consumer and retail, consumer services, business services, financial services, leisure, and media and telecom and technology. According to the company, its contrarian investment management approach is reflected in a number of ways, including:

- The willingness to pursue investments in industries that its competitors typically avoid

- The often complex structures employed in some of the investments of its funds, including its willingness to pursue difficult corporate carve-out transactions

- Its experience investing during periods of uncertainty or distress in the economy or financial markets when many competitors simply reduce their investment activity

- Its orientation towards sole sponsored transactions when other firms have opted to partner with others

- Its willingness to undertake transactions that have substantial business, regulatory or legal complexity

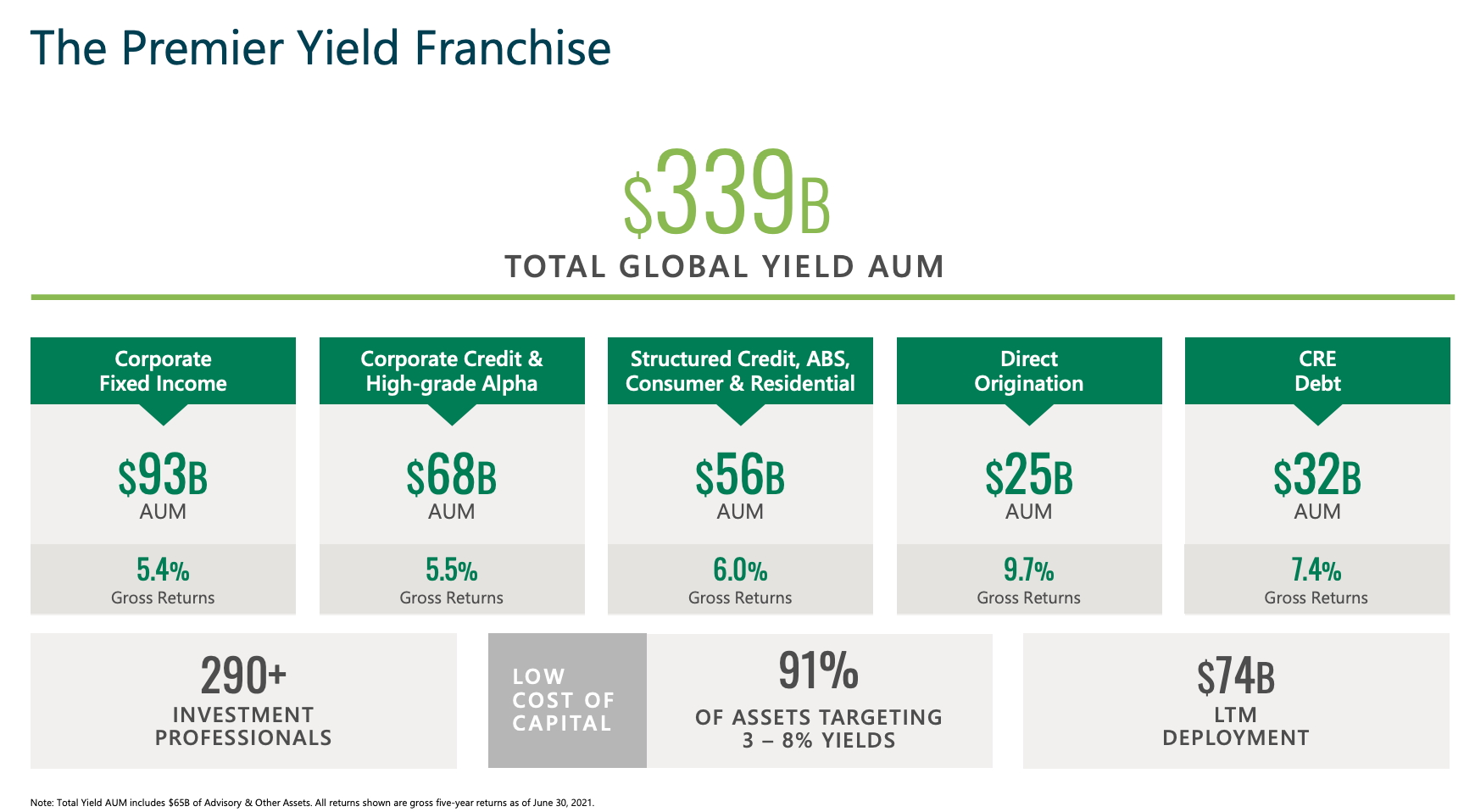

CREDIT MAKER

Apollo’s credit-oriented approach to investing commenced in 1990 with the management of a high-yield bond and leveraged loan portfolio. Since that time, its credit activities have grown significantly, through both organic growth and strategic acquisitions. As of December 31, 2021, Apollo’s credit segment had total AUM and Fee-Generating AUM of $ 350.1B and $ 285.5B, respectively, across a diverse range of credit-oriented investments. Apollo’s credit platform is categorized as follows: corporate credit, structured credit, direct origination, and advisory and other.

- Corporate credit investments includes performing credit, opportunistic credit and other strategic investment accounts. Performing credit strategies focus on income-oriented, senior loan and bond investment strategies that target issuers primarily domiciled in the U.S. and in Europe. Liquid opportunistic strategies primarily focus on credit investments that are generally liquid in nature and utilize a value-oriented investment philosophy. Apollo's AUM and Fee-Generating AUM within corporate credit totaled $ 170.1B and $ 130.3B, respectively, as of December 31, 2021

- Structured credit includes corporate structured and asset-backed securities, consumer and residential and financial credit investments. Corporate structured and asset-backed securities is focused on structured credit investment strategies that seek to obtain favorable and protective lending terms, predictable payment schedules, well diversified portfolios and low historical defaults. Consumer and residential is focused on consumer and residential real estate credit investment strategies, which include investments in residential mortgage-backed securities, whole residential real estate loans, consumer loans and other asset-backed securities. Financial credit investments is focused on life insurance policies issued by insurance companies that insure the lives of natural persons, as well as other insurance linked securities. Apollo's AUM and Fee-Generating AUM within structured credit totaled $ 87.5B and $ 72.3B, respectively, as of December 31, 2021

- Direct origination advises clients investing in loans, including, but not limited to, first-lien senior secured and unsecured loans, second lien term loans, mezzanine loans, private high-yield debt, private investment grade debt, asset-backed loans, leveraged loans, real estate loans, rediscount loans, venture loans and bridge loans, particularly in the context of transactions that require certainty of financing. This strategy focuses on originating private debt both directly with sponsors and through banks in the United States, but also targets Europe and other markets. Apollo's AUM and Fee-Generating AUM within Direct Origination totaled $ 30.6B and $ 27.6B, respectively, as of December 31, 2021

PRIVATE EQUITY LEADER

Apollo seeks to focus on investment opportunities where competition is limited or non-existent and generally prefers sole sponsored transactions and since inception, approximately 67% of the investments made by its private equity funds have been proprietary in nature. Apollo's management believe that by emphasizing its proprietary sources of deal flow, its private equity funds will be able to acquire businesses at more compelling valuations which will ultimately create a more attractive risk/reward proposition. As of December 31, 2021, its private equity segment had total and Fee-Generating AUM of approximately $ 86.6B and $ 40.0B, respectively.

- Apollo acts as an “hands-on” investor where it believes it has significant knowledge and expertise, and remains actively engaged with the management teams of the portfolio companies of its private equity funds

- To achieve this, Apollo takes a holistic approach to value-creation, concentrating on both the asset side and liability side of the balance sheet of a company

- On the asset side of the balance sheet, Apollo works with management of the portfolio companies to enhance the operations of such companies. Its investment professionals assist portfolio companies in rationalizing non-core and underperforming assets, generating cost and working capital savings, and maximizing liquidity

- On the liability side of the balance sheet, Apollo relies on its deep credit structuring experience and works with management of the portfolio companies to help optimize the capital structure of such companies through proactive restructuring of the balance sheet to address near-term debt maturities

The companies in which its private equity funds invest also seek to capture discounts on publicly traded debt securities through exchange offers and potential debt buybacks. In addition, it has established a group purchasing program to help its portfolio companies leverage the combined corporate spending in order to reduce costs, optimize payment terms and improve service levels for all participants.

THE MARKET

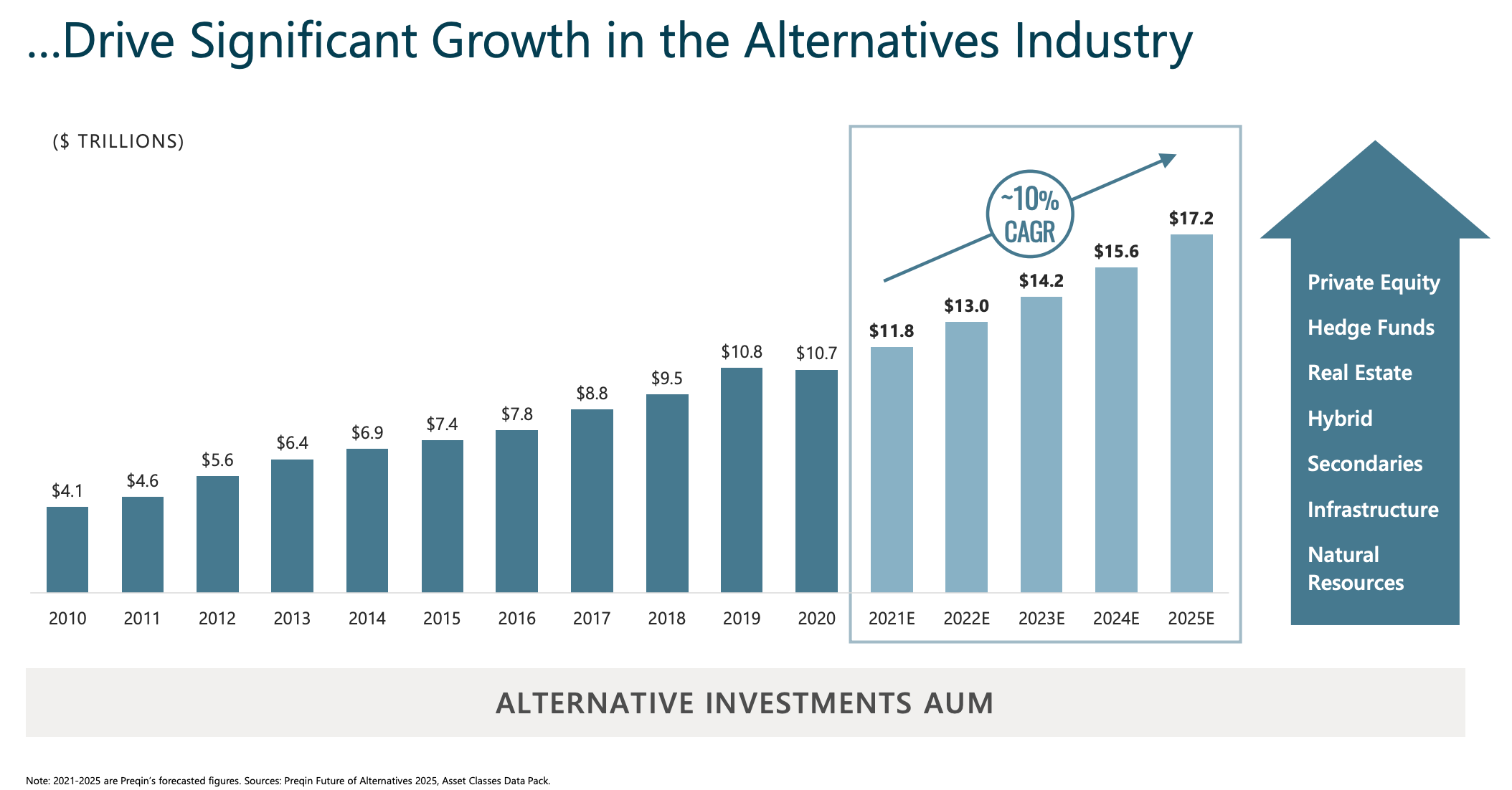

Growth in the alternative credit market is expected to be pushed by a global hunt for yields as more conventional solutions fail to generate significant returns. In this light, Apollo expect the market to grow by a CAGR of 10% over the 2021 to 2025 period.

"With Higher Yields Hard to Find Elsewhere, 2/3 of Investors Intend to Increase Investment in Private Credit" by JPM Asset Management, January 2021

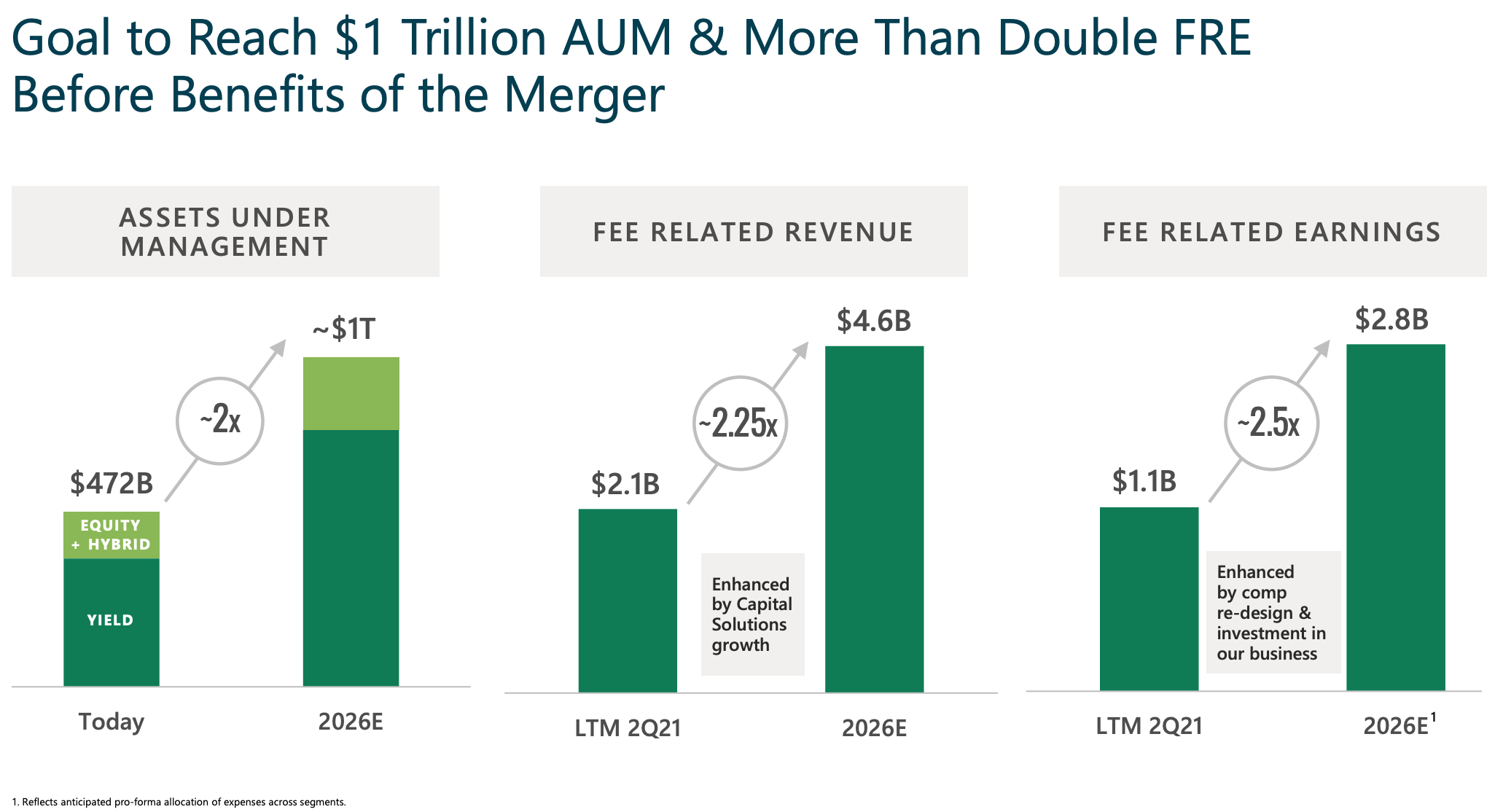

Apollo therefore aims to reach $ 1T in AUM by 2026 and more than double its fee related revenue from $ 2.1B in 2021 to $ 4.6B in 2026 all while improving its margins.

EXPERIENCED MANAGEMENT

Apollo is lead by Marc Rowan, who co-founded the group in 1990 along with former Drexel Burnham Lambert colleagues. Scott Kleinman acts as Co-President of Apollo and joined the firm in 1996.

- Marc Rowan is Chief Executive Officer of Apollo Global Management and co-founded the company 1990 with former Drexel Burnham Lambert colleagues

- Rowan started working in New York City and Los Angeles for Drexel Burnham Lambert's Mergers & Acquisitions Group. In 1990, Rowan formed Apollo Global Management along with former Drexel Burnham coworkers Leon Black and Joshua Harris

- Graduated summa cum laude from the University of Pennsylvania’s Wharton School of Business with a BS and an MBA in Finance

- Scott Kleinman is Co-President of Apollo, sharing responsibility for all of Apollo’s revenue-generating and investing business across its integrated alternative investment platform, focusing on its equity businesses

- Scott joined Apollo in 1996, and in 2009 he was named Lead Partner for Private Equity. Prior to joining Apollo, Scott was a member of the Investment Banking division at Smith Barney Inc. Scott currently serves on the board of directors of Apollo Global Management and Apollo Asset Management

- He received a BA and BS from the University of Pennsylvania and the Wharton School of Business, respectively

- James Zelter is Co-President of Apollo, co-leading its day-to-day operations including all of the Firm’s revenue-generating businesses and enterprise solutions across its integrated alternative investment platform

- Since joining Apollo in 2006, Jim has led the broad expansion of Apollo’s credit platform, which now oversees over $350 billion in assets under management. Prior to Apollo, Jim was with Citigroup Inc. and its predecessor companies in a variety of roles including Chief Investment Officer of Citigroup Alternative Investments. Before joining Citigroup, he was a high-yield trader at Goldman Sachs

- Jim earned his degree in Economics from Duke University

TAKE A BREATH

So… This is a lot of information. Let’s summarise:

- Founded in 1990, Apollo is a high-growth, global alternative asset manager with a focus on three investing strategies: yield, hybrid and equity

- The company has a flexible mandate in many of the funds it manages which enables it to invest opportunistically across a company’s capital structure

- The company raises, invests and manages funds on behalf of large pension, endowment and sovereign wealth funds, as well as other institutional and individual investors

- Apollo's investment approach is value-oriented, focusing on nine core industries in which it has considerable knowledge and experience, and emphasizing downside protection and the preservation of capital

- As of December 31, 2021, it had total AUM of $ 497.6B and has a team of 2,153 employees, including 652 investment professionals

- Growth in the alternative credit market is expected to be pushed by a global hunt for yields as more conventional solutions fail to generate significant returns. In this light, Apollo expect the market to grow by a CAGR of 10% over the 2021 to 2025 period

FINANCIAL CHECK

Apollo delivered Fee Related Earnings (FRE) of $310 million supported by year-over-year growth in management fees and transaction fees and Spread Related Earnings (SRE) of $670 million.

- Normalized SRE totaled $488 million in the first quarter

- Fee and Spread Related Earnings of $980 million represents the combined strength and durability of the Asset Management and Retirement Services businesses

- Gross capital deployment of $48 billion across Apollo's global integrated platform was driven by strong activity across Yield, Hybrid, and Equity strategies

- Debt origination volume totaled $22 billion in the first quarter and is run-rating at approximately ~$100 billion annually with activity driven by platforms such as MidCap, traditional sources such as commercial real estate and CLO debt, as well as numerous high grade alpha transactions

THE BOTTOM LINE

The Good

- The hunt for yields and trustworthy investment solutions is rising in the face of increased volatility and market uncertainty

- Through its wide network and proven methodology, Apollo manages to position itself advantageously in tier-1 deals and often sponsors these on its own

- This enables it to act in its best interest and ensure it gains ownership and control over its investments

The Bad

- In the short to medium term, rising yields might pressure its past investments and might put a damper on a M&A activity

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Ibrahim Boran on Unsplash.