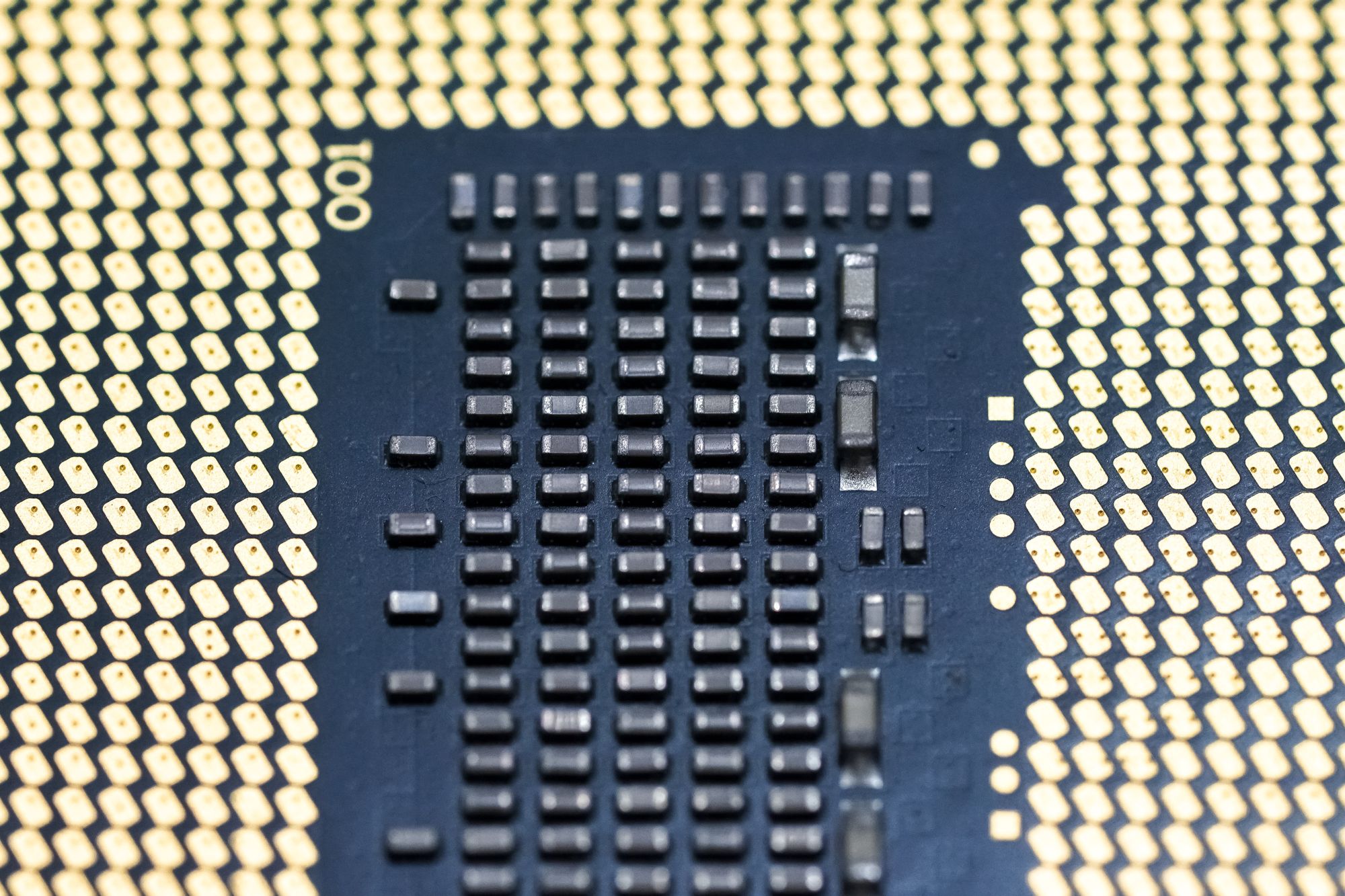

Founded back in 1986, Synopsis has grown to become a leader in innovation and technology. It is at the forefront of powering digital innovation by developing advanced silicon chips paired with software. The company regards this as Smart Everything, where devices are getting smarter, everything is connected and must be secure. Through its advanced tech for chip design, IP integration, verification, quality testing and software security, the company is helping customers innovate, thereby allowing them to deliver Smart Everything.

- Synopsis is the brainchild of Aart de Geus, a former employee at General Electric Microelectronics Center

- The company started as Optimal Solutions, Inc. focusing on the development of Synthesis software before later renaming itself to Synopsis (SYNthesis OPtimization SYStems)

- Today, the company has over 15,0000 employees, over $3 billion in annual revenue and is the current leader in Gartner Magic Quadrant for appsec testing in Forrester Wave for software composition analysis

- Synopsis also has the broadest portfolio of silicon intellectual property in the market today

WIDE PRODUCT RANGE

Synopsis has over 100 different products and services in its offering. These range from data converters to PrimeSim XA and IC Compilers and fall into five main product categories:

- Coverity: this focuses on identifying critical defects and security vulnerabilities during software development. It allows businesses and developers to debug their systems before they get to customers. This saves them time, helps to manage risk and make better decisions

- Seeker: an interactive application testing solution that allows developers to quickly and conveniently view their web app security posture, enabling them to identify vulnerability trends against compliance standards

- Black Duck: this scans newly-introduced open-source projects and containers, allowing for easy identification of vulnerabilities and risks associated with licensing

- eLearning: a training solution that is outcome-driven and learner-centric. It makes learning about security easy, accessible and relevant

- Defensics: an automated black-box solution that allows users to discover and address security weaknesses in software, thereby improving time to market and managing operational costs

COMPETITIVE MARKET

Synopsis is lauded for its quality of service, along with the breadth of its IT solutions. With its years of experience and robust infrastructure, the company has made a name for itself for its dependability, reliability and overall efficiency. Synopsis’ systems also accommodate and easily integrate into various application areas, from retail to POC, making it easy to integrate, use and manage. The company is not alone in its sector and has to compete with:

- Parasoft: founded in 1987, the company posts an estimated annual revenue of $40.9 million. The company offers automated software testing solutions and is headquartered in Monrovia, California

- Cadence: founded in 1988, this is company posted yearly sales of $2.7 billion and $0.73 billion for the quarter ending June 30, 2021. The company offers electronic design automation solutions, delivering IP, hardware and software for electronic design

- Rambus: posted total revenue of $246 million in the 2020 financial year. Founded in 1987 and headquartered in Sunnyvale, California, the company offers automated software testing solutions

From an employee point of view, Synopsis has been praised for how much it helps the community, its excellent management, open-door policy, along with various training opportunities. Employees also note just how much the company is dedicated to bringing the best services to its customers.

THE MARKET

Market growth is supported by the growing demand for integrated circuits in devices such as military weapons, gaming devices, smartphones and computers. This growth will also be facilitated by the overall development of wireless networking technologies, the emergence of advanced data analytics, along with the connectedness that comes with the proliferation of smart devices.

In 2020, the global cyber security market was valued at $156.24 billion.

- It is projected that by 2026, it will be valued at $352.25 billion, representing a CAGR of 14.5% during the forecast period (2021-2026)

- The growth will be attributed to the increasing cases of cyber security incidents, the growing demand for strengthened cyber security solutions, along with the high reliance on traditional authentication

- It is projected that the aerospace and defense segment will experience significant growth, while Asia-Pacific will post the fastest growth during the forecast period

In 2019, the silicon wafer market was valued at $11.15 billion.

- It is projected to grow to $14.4 billion by 2026, representing a

CAGR of 4.2% during the forecast period (2021-2026) - This growth will be attributed to the increasing use of integrated circuits in devices such as military weapons, gaming devices, smartphones and computers

- It will also be attributed to the technological advances that are designed to improve wafer capabilities

In 2020, the global Internet of Things (IoT) market was valued at $761.4 billion.

- It is estimated that by 2026, the industry will be valued at $1.39 trillion, representing a CAGR of 10.5% during the forecast period (2021-2026)

- This growth will be fueled by the collaboration currently being witnessed by vendors in the market which are offering emerging tech-enabled solutions in various areas, including healthcare

- This growth will also be facilitated by the overall development of wireless networking technologies, the emergence of advanced data analytics, along with the connectedness that comes with the proliferation of smart devices

- North America remains the best performing IoT market owing to the deployment of connected cars, home automation, smart energy projects and smart manufacturing

TIER-1 MANAGEMENT

Synopsis is led by Dr. Aart de Geus, the company's founder, chairman, and co-Chief Executive Officer (CEO). He is responsible for turning Synopsis from a start-up into a global high-tech leader. Geus previously led a team at General Electric Microelectronics Center.

- Founder, Chairman and co-Chief Executive Officer of Synopsis, a position he has held since founding the company in 1986

- Also serves on the boards of the Silicon Valley Leadership Group, the Global Semiconductor Alliance, Applied Materials and the Electronic System Design Alliance

- Previously led a team at General Electric Microelectronics Center

- Has won various awards such as “CEO of the Year,” the GSA Morris Chang Exemplary Leadership Award, and the IEEE Robert N. Noyce Medal, among others

- Holds a Ph.D. in Electronic Design Automation (EDA) from the Southern Methodist University and a Master’s Degree in Electrical Engineering from EPFL (École Polytechnique Fédérale de Lausanne)

- President and co-CEO of Synopsis, a position he has held since 2012

- Previously served as the president and COO of the company for 14 years, before he was appointed President and co-CEO

- Before Synopsis, Chan held various positions in companies such as NEC Corporation and Intel Corporation

- Holds a Ph.D. as well as a Master’s Degree in Computer Engineering from Case Western Reserve University. Also has a Bachelor of Science Degree in Electrical Engineering from Rutgers University

- The Chief Operating Officer (COO) of Synopsis, a position he has held since 2020

- Has held various other positions within Synopsis such as General Manager of Design Group, Vice President, Sales and Corporate Marketing Group and Staff Application Engineer, among others

- Previously served as a Design Engineer at Intel Corporation

- Holds a Bachelor’s Degree in Business Administration from the Lebanese American University, a B.S.E.E. from the Georgia Institute of Technology, as well as an M.S.E.E. from the University of Tennessee

RED FLAGS

In January 2017, Synopsis won a $30.4 million jury verdict in a copyright infringement claim against ATopTech Inc. the latter had copied Synopsis’ proprietary command set into competing EDA software back in 2013. The court awarded Synopsis $22 million in lost profits and $8.4 million in infringer’s profits.

In August 2019, Synopsis filed a motion for a temporary restraining order, expedited discovery and order to show cause against AzurEngine upon discovery that the defendant had impermissibly accessed Synopsis’ EDA software. AzureEngine was directed to preserve all evidence and cease transferring, copying, or accessing Synopsis data without the company’s authorization. This would mark yet another one of Synopsis’ cases with IP infringement from other companies within the United States.

TAKE A BREATH

So… This is a lot of information. Let’s summarise:

- Founded back in 1986, Synopsis has grown to become a leader in innovation and technology. It is at the forefront of powering digital innovation by developing advanced silicon chips paired with software

- Synopsis has over 100 different products and services in its offering. These range from data converters to PrimeSim XA and IC Compilers

- Synopsis is lauded for its quality of service, along with the breadth of its IT solutions. With its years of experience and robust infrastructure, the company has made a name for itself for its dependability, reliability and overall efficiency

- Market growth is supported by the growing demand for integrated circuits in devices such as military weapons, gaming devices, smartphones and computers

- Synopsis is led by Dr. Aart de Geus, the company's founder, chairman, and co-Chief Executive Officer (CEO). He is responsible for turning Synopsis from a start-up into a global high-tech leader. Geus previously led a team at General Electric Microelectronics Center

FINANCIAL CHECK

- Synopsis posted total revenue of $1.02 billion for the second quarter of the 2021 fiscal year, up from $861.3 million over the same period in 2020

- Net income for this second quarter was $195.1 million, up from $109.9 million during the same period in the 2020 financial year

- Non-GAAP net income totaled $267.1 million, up from $188.3 million during the second quarter of the 2020 fiscal year

- Total assets for this second quarter stood at $8.33 billion, up from $8.03 billion during the same period in 2020

- Total liabilities, on the other hand, were $3.2 billion, up from $3.1 billion during the same period in the 2020 fiscal year

- For the entire 2020 fiscal year, total assets amounted to $8.03 billion, up from $6.41 billion in the 2019 financial year

- Total liabilities amounted to $3.1 billion, up from $2.32 billion in the 2019 financial year

- Total annual revenue in 2020 was $3.7 billion, up from $3.4 billion in 2019

- Net income was $663.4 million, up from $532.4 million in 2019

- The Semiconductor & System Design segment was the best performing in the 2020 financial year, posting an adjusted operating income of $990.8 billion, up from $806.6 billion in 2019

- It was closely followed by the Software Integrity segment with an adjusted operating income of $40.8 billion, up from $32.2 billion in 2019

THE BOTTOM LINE

The Good

- Synopsis is an electronic design automation company that focusses on silicon design, intellectual property and software security. Its technology is used in self-driving cars , AI and IoT solutions

- Market growth is supported by the growing demand for integrated circuits and the advent of IoT solutions

- Through a series of merger and acquisitions, the company manages to grow its sales by around 10% every year while maintaining a net profit margin above 15%

The Bad

- The company is currently trading in the upper echelon of its historical range

THE STAKE

We have a position in Synopsys. Synopsys is a leading electronic design automation company growing at around 10% a year while delivering a steady profit year over year.

- We will increase if it manages to sustain its sales growth over the next year while expanding its operating margins

- We will cut if growth falls and margins get compressed over the next year

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Jeremy Zero on Unsplash.