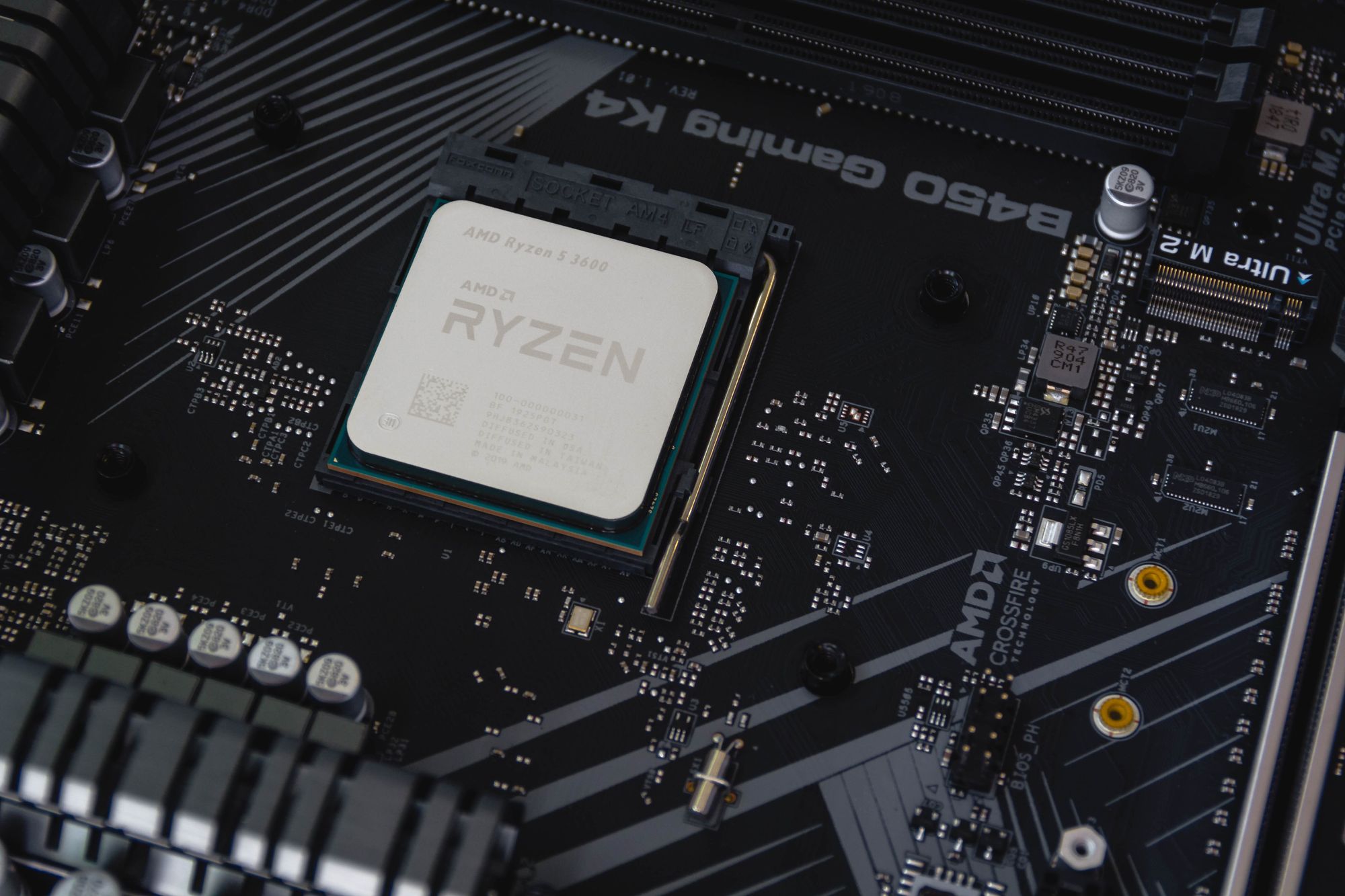

A Slump In Demand Follows The "Chip Shortage"

The semiconductor industry is used to cycles of booms and bust. As such, after a chip shortage that affected manufacturers at a global scale, the chip industry is now anticipating sluggish sales going forward.

- The industry is experiencing a severe decline in sales of personal computers and smartphones, and concerns are growing over the demand for chips

- In addition, the U.S. government is enforcing new restrictions that go beyond earlier export prohibitions to crack down even harder on semiconductor technology sold to Chinese corporations

Even after a month of depressing news from chip manufacturers like Nvidia and Micron, analysts expect more bad news to come. The PHLX Semiconductor Index (SOX) is now down 35% for the year. This is almost twice as much of a drop as the S&P 500 has seen during that time. Since the SOX's current multiple of about 18 times profits is relatively close to the low level reached during the past 3 years, the sector may have reached its bottom. But there's a good chance that the tsunami of bad news isn't done.

PC Sales Fall Sharply

The end of 2022 saw a staggering global fall in PC sales of 19.5%, the most since Gartner started keeping track of sales in the mid-1990s. According to IDC's Worldwide Tracker, the research firm estimated the decline to be 15% year over year and matched Gartner's assessment of the factors affecting sales.

- The pandemic-induced boom in PC sales and the enormous increase in hybrid and remote work have now slowed down and are no longer contributing to computer sales

- Mikako Kitagawa, a director analyst at Gartner, stated that back-to-school PC purchases also had "disappointing results, despite massive promotions and price drops, due to a lack of need as many consumers had purchased new PCs in the last two years"

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Christian Wiediger on Unsplash.