Growth Stocks Have Stopped Their Descent As Fears Of Rates Rise Decreased

Inflation fears faded at the start of the week as Fed officials repeatedly downplayed the effects of higher price pressures and have confirmed their belief that the Central Bank could engineer a soft landing.

Most Fed officials are trying to stick to their guns while others are sending some cautious messages. Randal Quarles, the vice chairman of the Federal Reserve Board of Governors signaled on Wednesday that he was open to talks on decreasing some of the Fed’s emergency support if the economy continues its upward trajectory.

“The risk comes if the Fed is wrong, and Quarles laid out why he feels coming inflation may prove more persistent. He worried that wages might accelerate faster than anticipated and get passed through to prices;”

“federal spending might fuel stronger demand from households as people return to jobs while also flush with record savings; and that supply-chain bottlenecks might not ease before rising prices become entrenched.” by Howard Schneider, Ann Saphir for Reuters

Technology Stocks Stop Their Descent

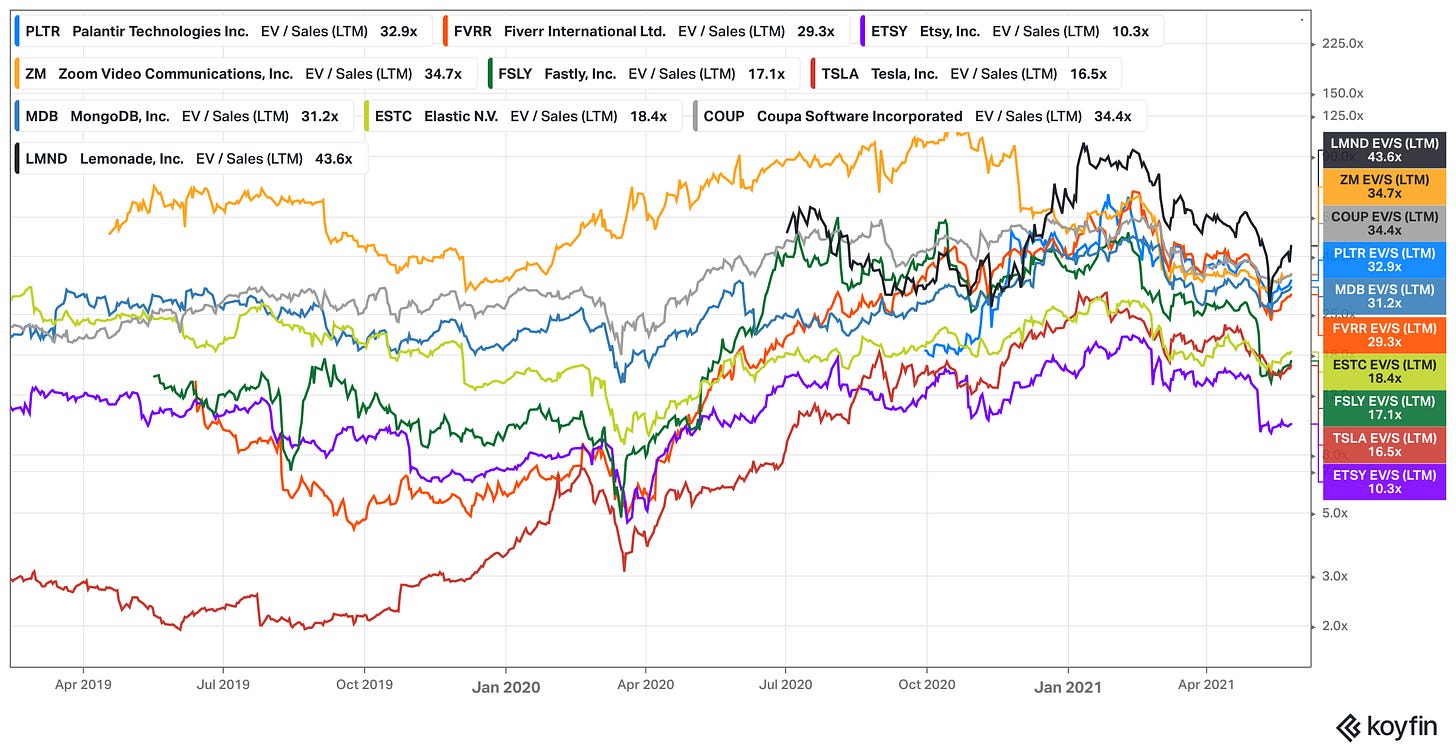

Investors have increased their exposure to technology stocks as yields took a step back and as the valuation of most high-growth names have compressed to late-2020 levels.

“Tech has amassed multiple compressions on fears that rates would have to be raised but now that inflation has been recognized as overblown, fund managers are piling back into certain sections” Thomas Hayes by Shashank Nayar for Reuter

Despite the contraction in valuations, growth stocks remain above their pre-pandemic levels and may thus experience a weak environment should inflation fears mount.

BENCHMARK’S TAKE

- The fear of a rate-rise could continue to pressure high growth names

- Short duration stocks (the ones with earnings “today” rather than “tomorrow”) such as the companies forming the Dow Jones index should continue to fare well given the massive consumer demand and government spending plans

- Banking stocks could continue to benefit from rising yields. On top of this, banks benefiting from volatility through their trading activities should be able to outperform the market in this setting (e.g. Goldman Sachs)

- More reasonably priced technology names should be able to fare higher, boosted by strong earnings. Especially high-growth European and Asian equities which are already profitable and still growing at a fast rate

- We are monitoring most high-growth and high-flying stocks for a potential re-entry as valuations have compressed and offer a better risk / reward in the long term

- Despite this, we still expect high-growth equities to go through volatile times in the coming weeks because of upcoming announcements in government spending, as well as rising inflation and an unsettled labor market

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits