Improving Job Conditions May Signal A Rate Hike

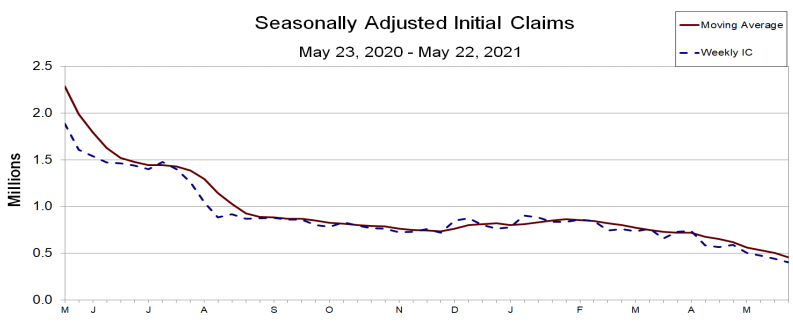

The U.S. jobs market saw an improvement in terms of initial jobless claims which fell to 406,000 for the week ended May 22. This represents a steep decline from the previous week’s 444,000 claims.

“Many of the factors that sidelined workers earlier in the recovery are changing to contribute to fast job gains in the rest of 2021. The pandemic is coming under control in the U.S., assuaging health fears” Bill Adams by Jeff Cox for CNBC

This sent yields on the benchmark 10-year Treasury note sharply higher, climbing to 1.616% from 1.55% the previous day. An improvement in employment conditions pushes the economy closer to a fuller recovery, which could lead the Fed to increase rates.

“Investors are watching jobs data closely, as the Federal Reserve has said it will wait for a fuller recovery in the labor market before it looks at tapering its asset purchases and raising interest rates.” by Vicky McKeever for CNBC

Biden Goes Big

The New York Times reported that the Biden Administration seeks to raise U.S. federal spending to $ 6T for the 2022 fiscal year and raising it to $ 8.2T by 2031. The administration seeks to pay for its plans through increased taxes on corporations and high earners.

“The proposal would contain major investments in infrastructure, education and health care, according to the Times, and bring federal spending levels to their highest sustained level since World War II.” by Dominick Mastrangelo, Morgan Chalfant and Niv Elis for The Hill

Yields on Treasury notes jumped in reaction to the report as these spending plans could over-heat the economy and drive prices higher.

BENCHMARK’S TAKE

- The fear of a rate-rise could continue to pressure high growth names

- Short duration stocks (the ones with earnings “today” rather than “tomorrow”) such as the companies forming the Dow Jones index should continue to fare well given the massive consumer demand and government spending plans

- Banking stocks could continue to benefit from rising yields. On top of this, banks benefiting from volatility through their trading activities should be able to outperform the market in this setting (e.g. Goldman Sachs)

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Clem Onojeghuo on Unsplash.