Adyen was founded in 2006 by Arnout Schuijff and Pieter van der Does who both worked at Bibit Global Payment Services (Bibit). Before starting Adyen, Pieter was the Chief Commerce Officer at Bibit and Arnout was a Systems Architect.

Bibit was one of the world’s leading Payment Service Providers specializing in processing payments from various channels over an internet infrastructure. It provided an End-to-End Payment Service for over 70 payment methods in Europe, Asia and the U.S.

The company was founded in 1997 - right when the internet became mainstream with the launch of Windows 95, Internet Explorer, Amazon, eBay and the creation of Java.

In 2003, Bibit was acquired by the Royal Bank of Scotland (RBS). By the time of this acquisition, Bibit was one of the 5 most rapidly growing European technology startups and the combined value of payments processed over the platform was approaching € 3B.

However, the corporate environment at RBS slowed down the development of Bibit and employees started to leave, according to Roelant Prins (now Chief Commerce Office at Adyen).

In the next three years, the Bibit platform did not really developed because the corporate environment of RBS used up all the energy. There were discussions who should control the servers, instead of discussions about customers. Bibit was cutting-edge when it was acquired by RBS, but after three years of stagnation, I and others decided that we wanted to work on a next generation platform. - Taken on the 28th of September from StartupJuncture

Frustrated by the developments at RBS, employees came up with a vision to create a modern infrastructure directly connected to card networks and local payment accross the world. Not surpisingly, the employees (Arnout Schuijff and Pieter van der Does a.o.) left and started their own little project.

Soooo… This is all well and good. What we have here are basically industry veterans working in the online payment industry since it beginnings and are frustrated with the recent developments at their “new” employer. A short summary:

- Bibit was a fast growing and leading Payment Service Providers

- It was acquired by a bank, Royal Bank of Scotland, that was founded in 1727 and counted 111,200 employee by 2003

- Tired of the slow and corporate culture at RBS, employees left with a vision to create a modern payment infrastructure

The Birth Of The Phoenix

This vision would translate into Adyen (Est. 2006) and would allow for unified commerce (across all selling channels) and provide critical shopper insights to merchants. Fun fact, “Adyen” means “Start over again” in Surinamese.

By now, you should be convinced that Adyen was started by people with a deep level of expertise in online payment. But? How do these payment solutions work?

Let’s dive into a simple explanation in 3 steps:

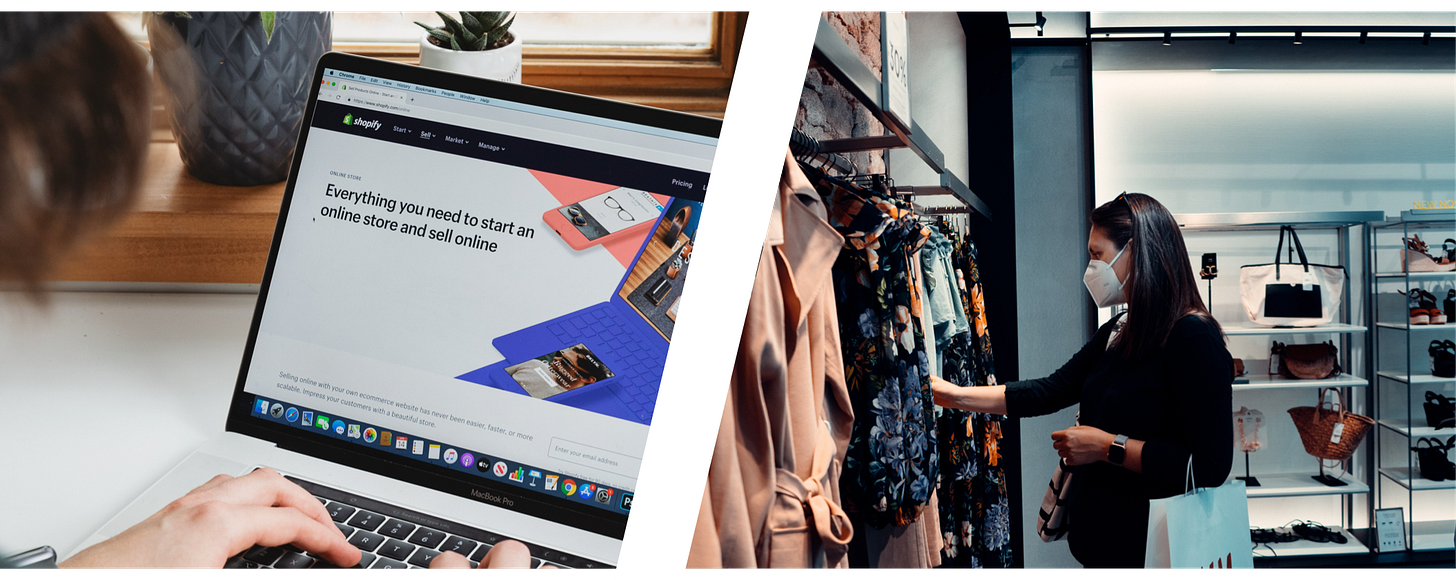

1. Starting Your Side Hustle

Let’s say you want to start selling the beautiful clothes you design as a side project. First things first, you set up a Shopify store and start accepting payments with Shopify Payments.

Things are going well and you decide to open a retail location and start selling abroad. Now, you need to accept in-person payments and foreign cards. This is still possible with Shopify Point-of-Sale and Shopify Payments which is available in more than 16 countries.

For now, everything is running just fine but you don’t want to be limited by Shopify reach of 16 countries. In order to boost your sales and get more flexibility when it comes to customizing and further growing your website, you decide to build your own website from scratch.

As a side-note, building a website is not very hard anymore. You can do it yourself if you have technical knowledge, work with an agency or hire a freelancer through Fiverr, Upwork, Toptal…

2. Growing Your Business

Of course, when building your own website, your developer will not write all the code on its own. Need to integrate mailings? You can integrate Sendgrid from Twilio to your website. Want to provide video meetings through your website. Well you don’t have to build your own Zoom. Just integrate it.

The same holds for your payment solutions. You need to integrate payments? Just integrate a Payment Service Provider (PSP) on your website. One of the best known PSP is Stripe. Stripe serves as a third party payment processor and a payment gateway.

A short intermezzo on Stripe and PSPs

In very simple terms, Stripe has its own merchant account and when one of your customers makes a purchase, Stripe will send the transaction details through the card processor to the customer’s card issuer.

Once the card issuer confirms that there are enough funds for the transaction, the issuer sends a message back to the card processor who then reaches out to the merchant account with an approval. The funds then end up in the merchant account. From these funds, you’ll have to deduct the Interchange fees and the fees charged by your merchant account provider, in this case, Stripe.

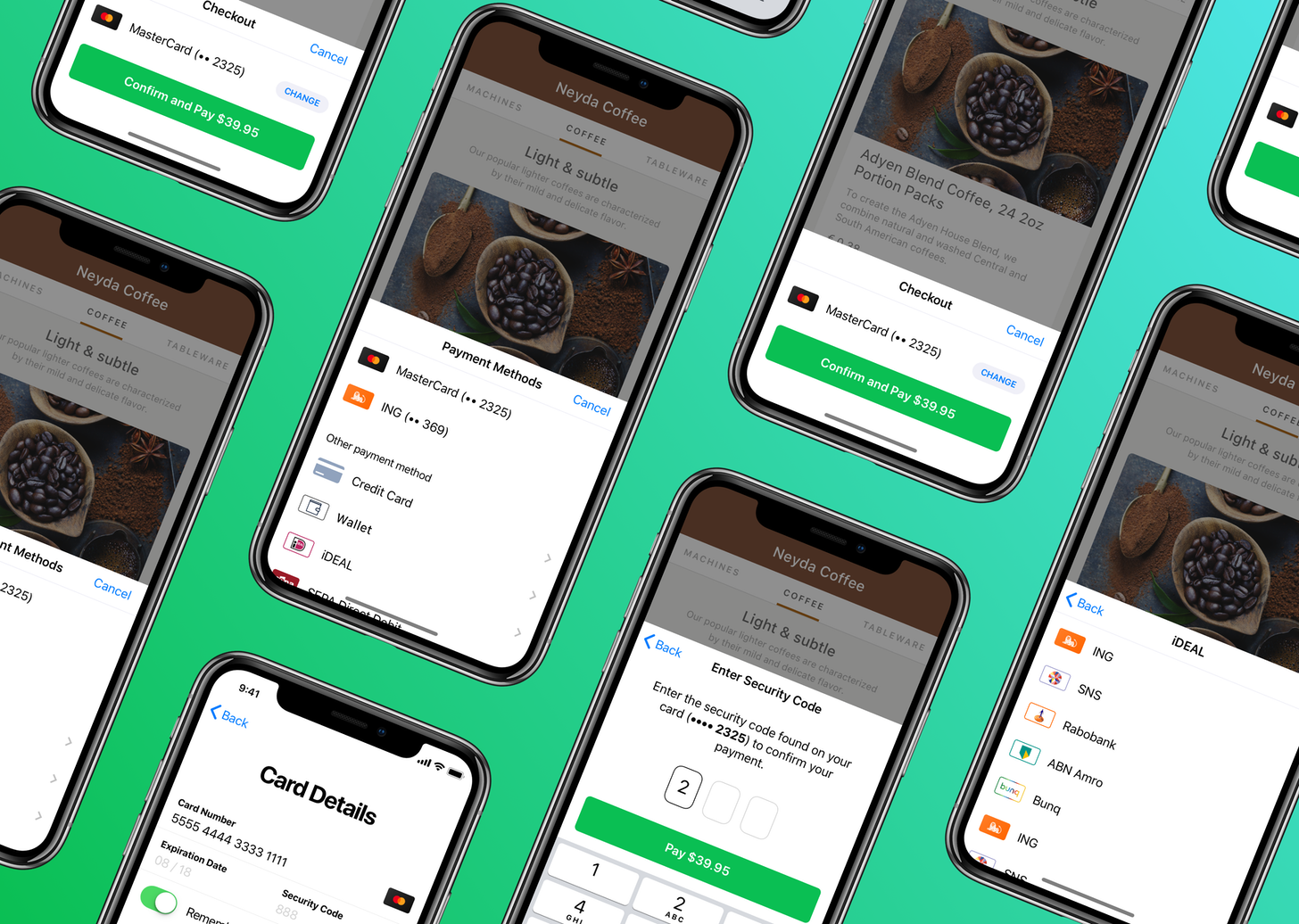

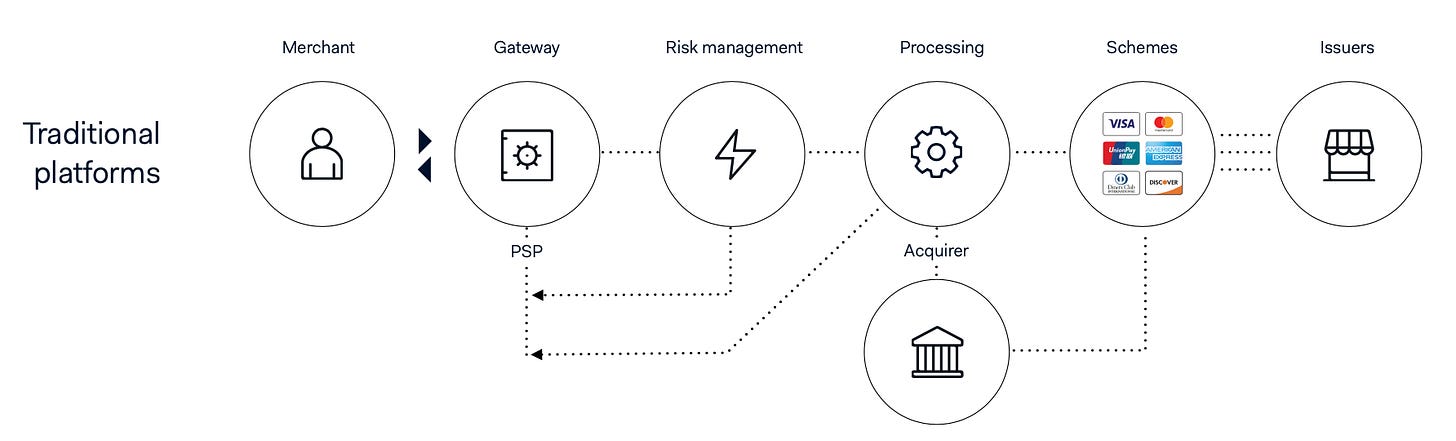

Ok, that may look like a big deal, so here is a graph from Adyen Capital Market Day (April 2019). You can see where the PSP fits in the broader story.

The big trick with Stripe (and other PSP) is that they have one large merchant account on which all funds are deposited. The PSP then transfers these funds (minus fees) to the retailers’ bank accounts.

Why are you using Stripe and not Adyen? Well, Stripe is amazingly easy to implement, offers simple pricing plans, provides access to 42 countries and accepts all major credit cards and most local cards.

The key here is that Stripe is extremely easy to implement. This is so because you do not need to set up your own merchant account. Stripe actually has its own large merchant account through which your payments will be reviewed and then transferred to your own bank account.

Is there still a case for Adyen then?

3. Running your large corporation

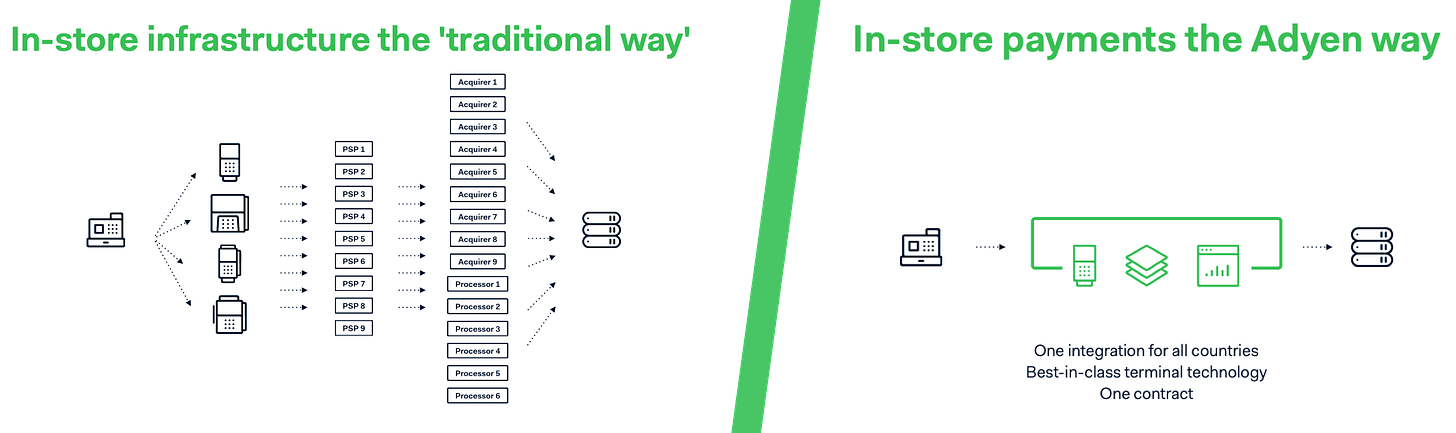

Ok, let’s now say that the small clothing brand you started turned out the become Nike. You now have hundreds, even thousands of shops and you accept payments in lots of different countries. Your Point-of-Sale system is fragmented, you rely on different payment gateways, service providers, acquirers and processors.

To keep it short, you now run OMNI-CHANNEL operations (online, physical stores) on a GLOBAL scale. You have 3 problems:

- Your global POS system is fragmented among lots of intermediaries (payment gateways, service providers, acquirers, processors)

- Since payment preferences differ across the world, you have to work with different intermediaries by location

- You have a hard time collecting a unified view of your customers in order to derive insights from you customers’ data

What did Nike do? They worked with Adyen

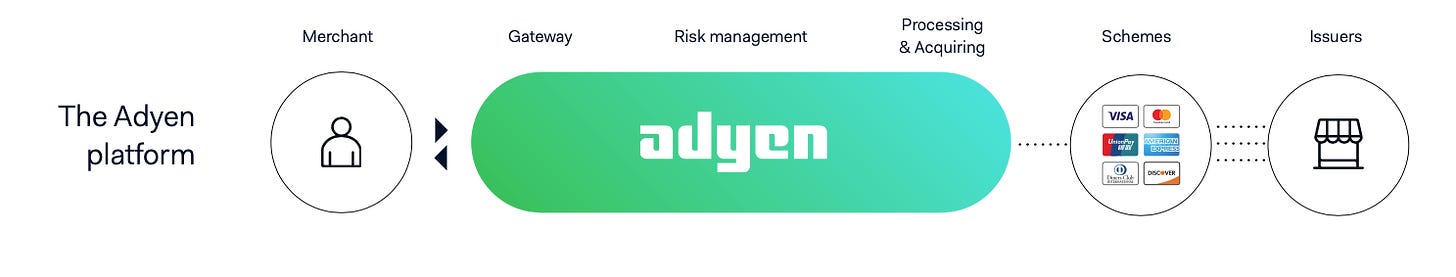

- Adyen is a payment gateway, service provider, acquirer and processor for online and physical shops - ALL IN ONE

- It just requires 1 system, 1 process integration and 1 contract for ANY company

- You can then service customers in over 150 countries and accept over 200 payment methods

In even more visual terms, when a large company relies on a PSP, it will very likely need a different PSPs by region and all these PSPs will have to communicate on their own with local infrastructure (banks, credit card networks).

Adyen on the other hand, provides a single solution for in-store and online purchases on a global scale. Saving on costs and delivering better data insights to their customers.

Of course, every single startup would sign up with Adyen if it was that simple. Here’s why Stripe is more popular with SMB and Adyen caters to medium and large businesses:

When using Stripe, your business’ funds are deposited into a single merchant account, along with the funds of other business.

- Stripe then transfers these funds minus their fees to your business bank account

- This make Stripe easy to set up but more expensive and more limited when it comes to the strict “payment capabilities” and delivering cross-channel and cross-geography data insights

When using Adyen, you need to set up your own merchant account. Your funds are then deposited into your merchant account directly.

- Adyen’s fees are often limited to the Interchange++ fees on top of which Adyen adds its own commission

- Adyen is more complex to set up but offers a more robust and more complete solution than Stripe

Hope this 3-steps story helped you understand what Adyen is doing! Let’s dive into another important part of Adyen: Data.

Data Insights Done Right

Until now, we have talked a lot about the different payment solutions and what Adyen does in this space.

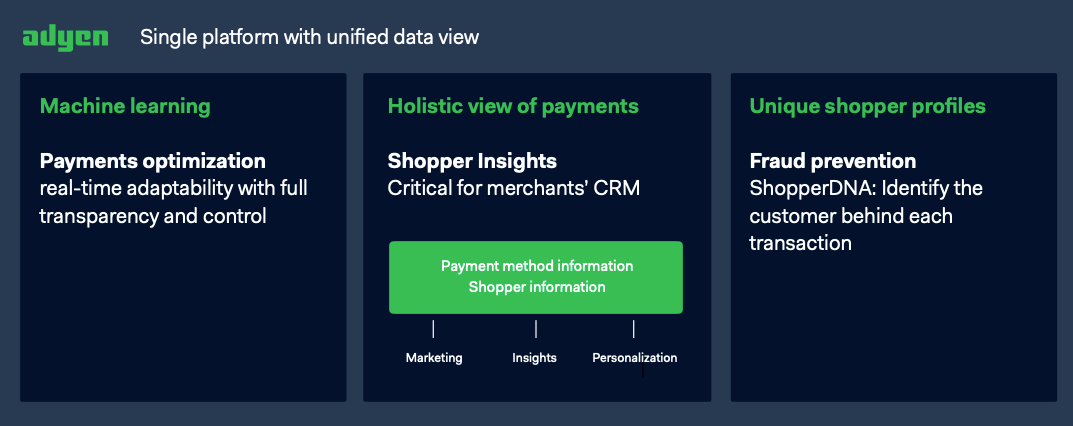

On top of building the most future-proof payment infrastructure available, Adyen is also building cutting-edge data analytics capabilities. Helping retailers know more about their customers and preventing fraud.

These capabilities help customer fine-tune the check-out experience for their customers. Next to that, retailers are also able to send location-based discounts and coupons to their customers’ smartphone. All in all, these data capabilities can be summarized to:

- Frictionless and value adding checkout experiences

- Improved payment routing in order to increase conversion rates

- Increased payment authorization rates from issuing banks by sending the right message

- Failed transactions are instantly retried in order to increase conversion rates

Helping retailers keep the number of failed transactions low and driving sales! A key advantage when you know that on a global level, around 10% of transactions fail.

The Case For Adyen

So, by now this whole payment solutions thing should be clarified and the “why” of Adyen should also be clear

- Adyen acts as a single solution for all payments (online and physical) on a global scale

- It is more complex but more robust and more focussed on payments than alternatives

- It is able to deliver (in a very cost-effective manner) on the high volume demands of the largest retailers

- With its unified commerce offering, it is able to provide data insights to retailers

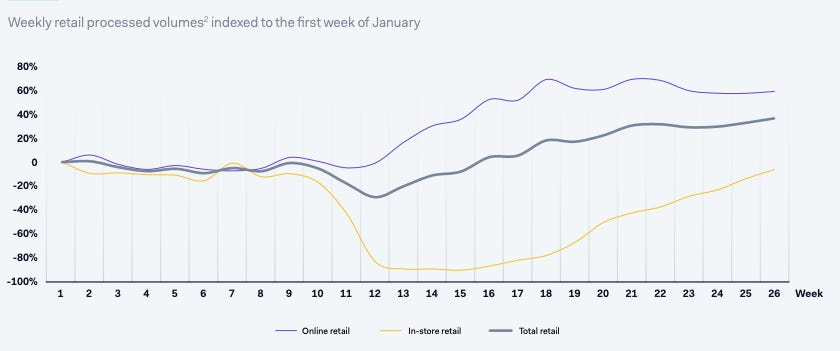

This strategy pays off and translates into the following numbers for the first half of 2020 (H1 ’20)

- Processed volume at € 129B - a 23% YoY increase

- Net revenue at € 280m - a 27% YoY increase

- EBITDA at € 141m - a 12% YoY increase

- EBITDA margin at 50% (57% a year earlier)

- Free Cash Flows of € 129m in H1 ’20

Of course, these growth numbers might look a bit low when compared to businesses such as Amazon, Shopify, Etsy… Which are online first businesses. One has to keep in mind that Adyen’s ambitions are larger than providing payment solutions for online shops only.

Rather, they want to become “THE” payment solution for medium and large business accross all geographies and sales channel (online and offline). Therefore, we have to remember that, despite the worst pandemic in ages, they still managed to grow by 27%.

Pricing Quality

Adyen is by no means cheap, trading at a PE of around 220 but delivers a Return on Equity (average 5Y) of 26%. This can be compared to $FIS that has a PE of 78 but a ROE of 4%. Of course, trying to price high growth companies is hard. However, we can assess the confidence we have in this company going forward. On that point, two elements reassure us.

1. International growth with blue chip customers

First, Adyen is winning key customers and is now being used by the largest companies in the world. Nike, Microsoft, Spotify, Esty, Uber, Booking, Fiverr, Farfetch all rely on Adyen to power their payments.

The company is just getting started in the U.S. (58% Growth YoY) and APAC (28% Growth YoY) and is focussed on growing these revenue streams going forward.

2. Adyen is laser focussed on creating the best product and platform

As our analysis has hopefully demonstrated, Adyen did not take any shortcut when building its product.

The founders are industry veterans and have changed the industry for the better. They provide a single solution that perfectly answers the needs of today’s large and medium companies that are selling online, in-store and in different geographies and currencies.

Adyen is also not standing still, the are innovating fast by providing data analysis tools, introducing MarketPay, have their own banking license and have introduced 3D Secure 2.0.

BENCHMARK'S TAKE

- Adyen is laser focussed on becoming the payment solution of medium to large accounts

- They have transformed the industry by offering a “All in one” solution that is cheaper, more robust and unified

- Their valuation is stretched for now but can be explained by 50% EBITDA margins and 27% growth YoY

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.