Kaspi.kz was founded in 1997 by Vyacheslav Kim. With its headquarters in Kazakhstan, it has grown to become the country’s leading payments and e-commerce player.

- In 2019, Kaspi.kz postponed its London listing, citing “uncertain and unfavorable market conditions”

“This is obviously a disagreement on price. There were intensive discussions over the weekend between the global coordinators and the vendor, and the vendor decided they were not happy with the price.” Source familiar with Kaspi.kz’s matters by Simon Jessop and Abhinav Ramnarayan for Reuters - Kaspi.kz would, however, go ahead to have a successful IPO in October of 2020 valuing it at $6.5 billion

“The IPO was the largest London listing by a company from Kazakhstan since 2007 and is the largest international technology-focused IPO in London this year to date.”Ayuna Nechaeva, head of Europe at the London Stock Exchange

FROM BANK TO TECH PLAYER

In the early 2000s, Kaspi served as a traditional bank, with clients mainly made up of corporates, small and medium enterprises. It was not until the mortgage crisis of 2008 that it began to shift its operations turning itself into a tech platform while maintaining a brick-and-mortar presence.

“You can achieve this only by being data-driven and technologically advanced. We felt that would be our biggest source of competitive advantage in the years to come.” Mikhail Lomtadze, Kaspi.kz CEO and Co-founder

Taking inspiration from Amazon, Kaspi shifted its focus towards customer experience. It seeks to become the leading financial technology and e-commerce player in Central Asia by offering great value for money and enhancing customer experience through technology.

“We are not a bank. Banks think in terms of the back office. We are at the front end of the relationship between the customer and our products and services. Are we a financial services company? Yes. Are we a payments company? Yes. Are we a marketplace and e-commerce company? Yes. But above all, we are a technology and a customer experience design company.” Mikhail Lomtadze, Kaspi.kz CEO and Co-founder.

Today, Kaspi is the leading technology company in Kazakhstan with a 41% market share in the e-commerce sector, 35% in payments and 31% in consumer finance.

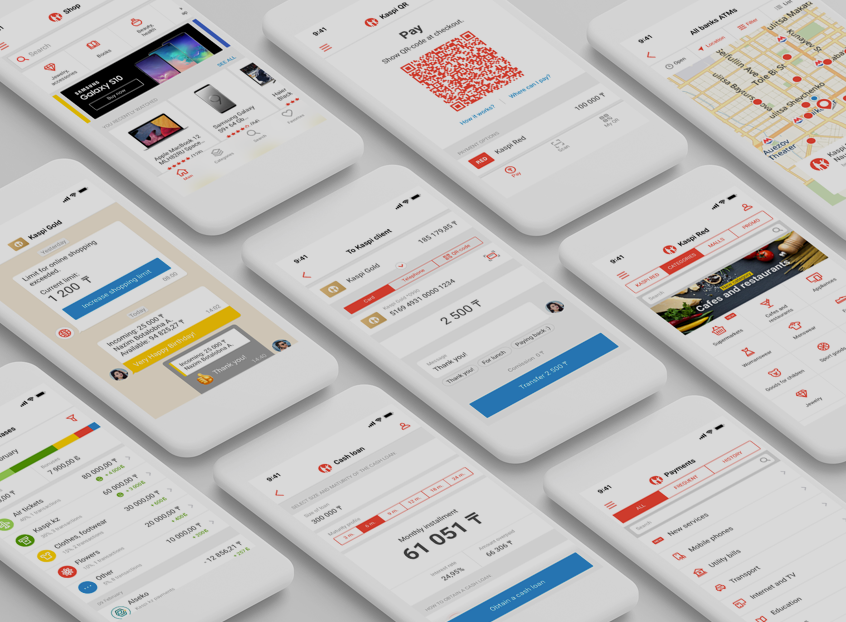

ALL-ROUND SUPER APP

Kaspi’s offering is aimed at addressing daily consumer needs, both online and offline. This means assisting consumers in shopping for everyday goods and offering financing options and financial management services.

1. Marketplace

Kaspi.kz offers an e-commerce platform with over 350,000 items ranging from jewellery to books, furniture and electronics. It also has a mobile shopping service counting over 27,500 shops, including but not limited to restaurants, supermarkets, fitness centres and petrol stations.

2. Fintech

Fintech focuses on digital finance, covering aspects such as car insurance, consumer finance, SMB finance, deposits and a buy-now-pay-later provision.

3. Payments

Payments covers taxes, insurance, taxi, public transport, utility bills, tickets, charity and education-related payments. It also covers P2P and mobile payments, such as payments by phone number, card payments and global P2P payments. Kaspi.kz also has its Kaspi QR and Kaspi Gold payments.

STAY CAUTIOUS

Mikhail Lomtadze (CEO) and Vyacheslav Kim (chairman) own 23% and 24% of the company’s shares respectively with a combined value of $4 billion. However, questions arise on how the two men acquired their large stakes in the venture.

- Back in 2018, Kim spent at least $ 390m buying Kaspi stock. He would later transfer $ 500m worth of shares to Lomtadze in exchange for a certain “non-cash consideration”

- Mikhail Lomtadze joined the group in 2007 and was previously a partner at Baring Vostok Capital Partners

“The spokesman for Kaspi did not explain how Kim came up with hundreds of millions of dollars to buy Kaspi shares, nor on the exact terms of the 2007 deal that made Kim and Lomtadze equal partners.” By David Dawkins for Forbes - Kairat Satybaldy, a former investor and the nephew of Kazakhstan’s former president Nursultan Nazarbayev walked away from its stake in 2018. A stake similar to the one now owned by Lomtadez

“Kaspi confirms that it took around 13 years—from 2007 until this year–for Kim and Lomtadze to “formalize their shareholder agreement.” It also says that because the company didn’t seek external capital or pre-IPO funding, other than an investment from Baring Vostok in 2006, there was–until now–no need to make the “agreement” formal or public.”

“It’s not correct to say that Mikhail was just given his stake. It’s quite common for entrepreneurial founders to own large equity stakes in their businesses.” Kaspi spokesperson by David Dawkins for Forbes

THE MARKET

The e-commerce market is set to grow tenfold over the 2019 - 2025 period while the digital payments market is helped by growing mobile phone and internet penetration.

According to the Kazakh Ministry of Trade, e-commerce sales could reach $ 4.6B by 2025, up from $ 422m in 2019

- Driven by increasing e-commerce penetration as online sales (as percentage of total) are projected to jump from 2.9% in 2019 to 15% by 2025

- Further pushed by favourable government policies toward e-commerce platforms and brands

“The ministry plans to support all parties engaged in e-commerce to “create a full-fledged architecture” of it. The ministry, for example, will provide regulatory and technical support for Kazakh entrepreneurs.” by Aidana Yergaliyeva for The Asana Times

According to Euromonitor, Kaspi.kz was the largest online retailer in Kazakhstan by sales in 2018 and 2019, with market shares of 23% in 2017, 38% in 2018 and 46% in 2019 (according to company data)

- Market share gains are the result of superior growth (versus competition) in the number of users and a higher engagement of the Kaspi.kz Super App

- The second largest online retailer in Kazakhstan is AliExpress, which had three times smaller GMV growth in 2019 than Kaspi.kz and is mainly focused on cross border orders from China

“The pandemic has accelerated the process of changing customer behavior and the penetration of online shopping into new segments: the share of buyers over 50 years old increased significantly, people began to buy online: food, household goods and other things they used to buy in supermarkets, we also see an increase in purchases from the remote regions of the country.” Kaspi.kz by Natalia Lim for PwC (edited)

EXPERIENCED MANAGEMENT

Kaspi.kz is currently led by Mikheil Lomtadze. He previously served as a Partner at Baring Vostok Capital Partners and joined Kaspi in 2007. He holds a Master of Business Administration from Harvard Business School.

- Co-founder, CEO and chairman of the Management Board since November 2018

- Previously served as a Partner at Baring Vostok Capital Partners from 2007 to 2018. From 1995 to 2000, he founded and developed GCG Audit, a strategy consulting and auditing firm in Georgia, which later became part of the Ernst & Young global network

- Holds a Master of Business Administration from Harvard Business School

- Chief Operating Officer and Deputy Chairman of the Management Board since November 2007

- Previously served as the Project Manager at TIETO from 2003 to 2007

- Holds a General Management Program (GMP) certification from Harvard Business School, a Bachelor’s Degree in Computer Science from the Moscow Institute of Electronics and Mathematics of the Higher School of Economics

- Chief Financial Officer and Deputy Chairman of the Management Board since 2007

- Previously served as Finance Manager at Ernst & Young from 2003 to 2007 and as a financial analysis specialist at the World Bank

- Holds a General Management Program certification from Harvard Business School, a Bachelor’s and Master’s degree in Finance from the European School of Management (Georgia)

TAKE A BREATH

So… This is a lot of information. Let’s summarise:

- Kaspi.kz was founded in 1997 by Vyacheslav Kim. Headquartered in Kazakhstan, it has grown to become the country’s leading payments and fintech player

- In the early 2000s, it served as a traditional bank, with clients mainly made up of corporates, small and medium enterprises. It was not until the mortgage crisisof 2008, that Kaspi began to shift its operations turning itself into a tech platform

- Today, Kaspi is Kazakhstan’s leading technology player with a 41% market share in the e-commerce sector, 35% in payments and 31% in consumer finance

FINANCIAL CHECK

- For the first quarter of 2021, Kaspi generated sales of $ 427m, up 14% year-on-year

- The fintech segment posted the highest revenue at $ 278m, a 5% year-over-year decrease

- The payments segment generated sales of $ 93.4m, a 76% year-over-year growth

- The marketplace segment posted sales of $ 53.7m, a 105% year-over-year growth

- Net income was $ 184.4m, a 25% year-over-year growth

- Net income margin for the first quarter of 2021 stood at 43%

BENCHMARK'S TAKE

The Good

- The e-commerce and digital payments markets have been boosted by the pandemic and are growing at a rapid pace as internet and mobile phone penetration increase

- Kaspi successfully turned itself into a technology player and now boasts over 30% of Kazakh e-commerce and digital payments market

- The company is profitable and using its cash to expand in neighbouring countries (e.g. Azerbaijan) by acquiring established players

The Bad

- Kaspi’s growth opportunities may be constrained by the size of its local market and competition with major players from China (Alibaba, AliExpress) and Russia

- The company’s shareholder structure is not transparent and questions arise on what motivated the terms between major shareholders and their backers

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.