Inflation Pressures

As it confronts growing inflation pressures, Federal Reserve Chairman Jerome Powell suggested on Tuesday that the central bank may remove its support faster than initially planned.

- In a testimony before a Senate committee, the Fed chairman said he believes the rate of monthly bond purchases may be slowed down faster than the $15 billion-per-month plan outlined earlier this month

- Powell suggested that the topic will be discussed in the December meeting

- This takes place in a context of increased fears related to new and potentially more harmful COVID variants

"Transitory" Inflation

Throughout the economic recovery that was kicked-off by the re-opening of the economy, Federal Reserve Chair Jerome Powell stood firmly by his claims that inflation was transitory. He even offered a one-sided case for why pricing pressures were no cause for concern in his much-anticipated Jackson Hole speech in August.

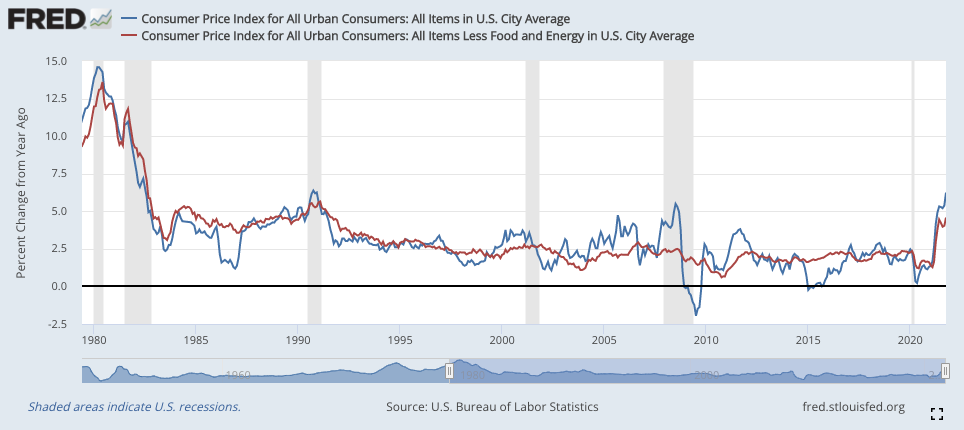

- In October, consumer prices rose at their quickest rate in more than three decades as gasoline costs rose, supply chains remained strained, and rents increased, causing concern among Federal Reserve policymakers and the Biden White House

- Inflation began to accelerate again on a monthly basis after rising 6.2 percent in the previous 12 months, the fastest rate since 1990

A Powell Pivot

With fears of the new variant running high, markets expected the Fed to provide re-assurance and potentially continue its support as the threat of new lockdowns and reduced mobility threatens economic activity.

- Yet, Powell's speech to the Senate Banking Committee was peppered with signals that fighting inflation was a primary priority: "factors pushing inflation upward will linger well into next year"

- He also went out of his way to stress that pricing pressures were spreading beyond just a few things

"Most forecasters, including at the Fed, continue to expect that inflation will move down significantly over the next year as supply and demand imbalances abate. It is difficult to predict the persistence and effects of supply constraints, but it now appears that factors pushing inflation upward will linger well into next year. In addition, with the rapid improvement in the labor market, slack is diminishing, and wages are rising at a brisk pace." Jerome Powell, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, Washington, D.C.

Inflation Isn't Transitory At All Anymore

On Tuesday, the Fed Chair re-iterated his claims and stated that the appearance of a new and more harmful variant could further increase prices by placing pressure on supply chains and the labour market.

"The recent rise in COVID-19 cases and the emergence of the Omicron variant pose downside risks to employment and economic activity and increased uncertainty for inflation."

"Greater concerns about the virus could reduce people's willingness to work in person, which would slow progress in the labor market and intensify supply-chain disruptions." Jerome Powell, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, Washington, D.C.

BENCHMARK'S TAKE

- After massive rounds of stimulus and the sustained inflation it created, the Fed is starting to acknowledge that when more money chases the same (or even less) goods, prices can only rise

- High inflation is eating into the spending power of less well-off individuals while wealthier individuals see the prices of their assets rise in line with inflation

- We expect the Fed to get back to its policy of engineering a socially-fair economic environment

- In order to make this work, the Fed now realises that it needs to tighten its policies rather than loosen them so as to increase workforce participation and cool down prices

- We thus expect a more hawkish environment going forward, pressuring valuations of unprofitable companies and rewarding long term cash generators

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Robert Bye on Unsplash.