Bandwidth is a Communications Platform as a Service (CPaaS) founded by David Morken, the current CEO, in 1999. By this time, fibre optic networks were just being introduced. These provided higher bandwidth and transmitted data over longer distances than wired cables.

Quickly, Morken realised that these new fibre optic cables would radically change the landscape. In order to capitalize on this, he bought the domain name bandwidth.com and set up shop.

At first, the business was straightforward. Companies looking for a better internet connection would type the word “bandwidth” into the search engine. The bandwidth domain would then be one of the first results. From its website, Morken then redirected users to larger telecom companies and he would take a commission on the deal.

Growing The Business

Bandwidth.com was just an intermediary connecting customers to telecom operators. However, in 2003, it started buying bandwidth from these larger operators and sold it to coporate clients.

This increased Bandwidth.com margins from 12% to around 20%. But David Morken knew that retailing bandwidth to corporate clients wouldn’t be the best long term business.

By this time, many of Bandwidth competitors were starting to sell voice transfer services rather than just packets of data. Companies were spending enormous amounts on network infrastructure but failed to turn these investments into cash flows quickly enough. Leading to bankruptcies.

But who was the late entrant in this game? We’ll you’ve guessed it. Bandwidth.com was thus able to snap up left over fibre networks and telecom data centres in order to build it its own network.

Here is what David Morken told Business North Carolina:

“We realized we could build a network, a voice network, and this was the important moment in 2007, 2008 … kind of in the middle of the financial crisis. Out of those ashes we built the last really CLEC ever built. Out of the ashes of the largest value-destruction ever. The CLEC wipeout. The dot-com wipeout […] We had the last-mover advantage”

Running Its Own TIER-1 Network

So here we have it. David Morken started by redirecting prospective buyers to telecom operators. Simple enough.

He then retained this client base for his own by selling bandwidth he bought in bulk. Already a bit more complex.

Then, in the middle of the fibre network infrastructure boom and bust, Bandwidth.com snapped up the infrastructure required to create its own national internet-based network. Bandwidth.com now effectively had its own Tier-1 Network enabled by a Session Initiation Protocol.

What is a Tier-1 Network?

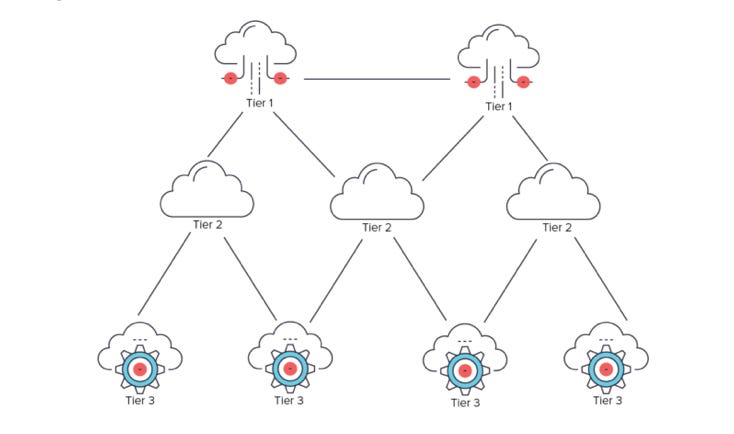

- Tier-1 Networks are basically the back bone of the internet. These are the networks that are large enough to support the flow of internet traffic on a global level.

- What is best with these networks is that Tier-1 networks don’t have to pay fees to each other, they exchange traffic based on strict peering agreements that don’t require the intervention of a third party - hereby reducing costs.

A visual illustration of Tier 1, Tier 2 and Tier 3 networks from Elite.

What is a Session Initiation Protocol?

- A Session Initiation Protocol is a communications protocol used to start, manage and close calls and exchanges in an IP based network.

- Basically, it is just the instruction set that tells an application how to process a phone call.

Serving Silicon Valley

Equipped with its new network, Bandwidth.com was strategically placed - at the crossroads of telecom and internet - to serve the next generation of communication players. These were the Goolge and Microsoft of this world.

When Google set up its Google Voice Phone service in 2009, it became Bandwidth.com’s networks first customer. Since then, Bandwidth.com has supplied over 60 million phone numbers to businesses in North America. Accounting for 10% of the numbers in the region.

Going Public And Serving Larger Clients

In the last 10 years, Bandwidth has expanded it capabilities in voice and messaging communications while growing its revenue from $ 2.5m in 2003 to $ 204m by 2018. It went public in 2017 at $ 20 a share and raised around $ 74m. It further raised $ 147m in a follow-on offering in 2019.

What Has Bandwidth Become?

It now enables customers to create, scale and operate voice or messaging communications services across any mobile application or connected device.

These customers include top notch communication enablers such as Google, RingCentral, Zoom, GoDaddy and Microsoft.

Why Bandwidth And Not Twilio?

1. Twilio Is Best For Apps

Let’s say you are building your own Uber-like service where users can list their services and buyers can purchase these.

The major share of your work will be in designing and building a data base, building a solid back end for your app and designing a good looking front end for users.

On top of that, you want to add emails, messaging and voice communications to your app so that users can interact with each.

In this case, you (or your developer) might prefer working with Twilio. Their product is easy to integrate and their “developer-first” approach has made sure that there is a vast array of documentation available for any developer to start working with Twilio.

This is why AirBNB, Netflix, Lyft, Twitter, Box, Uber and many more work with Twilio:

2. Bandwidth Is For Communications First Businesses

Now let’s say that you want to start your messaging, video or voice communications platform.

Of course you can use Twilio but that may be expensive. What could be a more scalable alternative?

Here comes Bandwidth. It is the only API platform that owns a Tier-1 Network and provides SIP trunking. As it has built and operates its own nationwide IP voice network rather than relying on third party carriers like Twilio.

Meaning the company controls rather than outsource its network:

- It offers a software platform on top of an IP network

- It results in better quality and control for its customers

- Better ability to set prices and undercut competitors ($ 0.35 per line per month for Bandwitdh vs. $ 1 for Twilio)

In simpler terms as explained by Bandwidth:

“If you equate choosing your API to buying a new car, not only do we own the car dealership, we also built the engine, control the quality of the gas and oil, and can even give you a GPS to find the best route. The other guys are just dealerships, crossing their fingers that the cars on the lot aren’t lemons.”

3. Well Of Course, There Is Room For Twilio And Bandwidth

You may have remarked it, Twilio caters to the businesses that do not have communications a the centre of their operations. Communications is rather a facilitator of business than an enabler.

Bandwidth on the other hand, is meant for the businesses that operate voice and messaging products. Bandwidth is thus an enabler of business for its clients.

Here are the key differences:

On customers:

- Twilio targets mobile application developers that just need to integrate voice and messages into their apps

- Bandwidth targets larger cloud native businesses that needs a cheaper infrastructure given their huge need for internet communications

On infrastructure:

- Twilio works with over 1,000 mobile carriers in over 150 countries for voice and text/SMS services

- Bandwidth owns and runs its own Tier-1 network and is able to undercut Twilio on pricing by up to 50% while delivering better reliability

CPaaS Market

By now, it should be clear that Bandwidth targets businesses that rely heavily on communications. Bandwidth is ideally placed to serve these customers as it is a mix of a telecom operator and software company.

- There is thus a case for Bandwidth differentiated product offering.

- But what about its market? What are the main trends and how are its customers doing?

Let’s look at its customers and see how the pandemic has affected its market.

Fast Growing Industry

In fact, the market for CPaaS is set to boom to $ 25B by 2025 according to Juniper Research - up from $ 7B in 2020. Growing by 260% over the next 5 years. This is mainly driven by:

- Rich Communication Services (RCC) that enables group conversations, send high-resolution images and videos and receive time-sensitive data. This is set to finally replace SMS

- Over-The-Top (OTT) Messaging that offers messaging capabilities directly over the internet such as WhatsApp, Facebook Messenger, Telegram

Payment going online as CPaaS vendors start integrating payment systems to their communication services. Enabling for faster and more effective funds transfers. The author of the research states:

“CPaaS vendors must demonstrate the additional value their platforms can provide to brands and enterprises, with payments services being the primary way by which CPaaS vendors can increase their market appeal”

Growing Customers

Now that corporates have been transformed by Zoom and Microsoft Teams there is a small chance that office workers ever go back to their costly landlines ($ 20 to $30 per month). Here is a quick look at the explosive growth experienced by these companies:

- Zoom revenue grew 355% YoY during Q2 2020 topping $ 663.5m

- Microsoft Teams DAU in April reached 75m from 44m in March

eCommerce, food delivery and a wide array of fintech companies have also had their moment in the sun and these sectors are prime users of internet communications

- Gross bookings on UberEATS grew 113% YoY

- Amazon revenue grew 40% to $88.9b

We can see it now, the effects of COVID on work, mobility and human interactions is set to last. This world will increasingly rely on communications services, giving a boost to Twilio and Bandwidth.

“Replace All Phone Lines” Is The Big Idea

Before the pandemic, businesses were quietly using their legacy phone installations and only slowly moving towards (Voice over Internet Protocol) VoIP technology.

Before the pandemic, only 7% of U.S. employees regularly worked from home.

Well that was before the pandemic. How has that evolved?

At some point during the pandemic, 64% of U.S. employees worked from home. On top of that, both employees and employers would like to continue this:

"According to a recent survey conducted by getAbstract, 43% of U.S. full-time workers in the U.S. would like to work remotely more often after COVID-19, citing the absence of a commute, added flexibility and productivity gains as the main motivations behind that wish." From TalentLyft

"By summer, big tech companies were officially in competition to be the last ones back in the office. First, the likes of Facebook and Google extended their remote leave until the end of the year; Twitter and Square then went above and beyond to say workers could stay home “forever.” […]." From CNBC

No need to draw a sketch, legacy phone systems could most probably die off in this new environment. These will be replaced by VoIP. And you know who can supply this technology at an affordable cost. Bandwidth.com again 👇

"Bandwidth provides local VoIP phone numbers together with outbound and inbound calling that power popular platforms including Microsoft Teams/Skype for Business, Zoom Phone, and Google Voice […]." From Bandwidth.com

According to Global Market Insights, the VoIP market is set to reach $ 55B by 2025 - up from around $ 20B in 2018. Driven by:

- Considerable adoption of cloud services

- Advanced telecommunications infrastructure

- Rising popularity of workforce mobility

Furthermore, the report states that:

"The technology is rapidly replacing expensive traditional phone services as it eliminates the need to invest in massive telecom hardware equipment."

Healthy Company

The pandemic gave a boost to online communications and the market is set to reach $ 25B by 2025. How is that moving Bandwidth? Well, Bandwidth experienced a higher growth rate in the last quarter and generated an EBITDA of $ 5.5m. Here is a snapshot:

- Revenue grew 35.2% to $76.8m in Q2 ’20 YoY (vs 28.5% in Q2 ’20 YoY)

- Gross margins at 46% (stable QoQ)

- EBITDA at $5.5m and positive FCF of $2.7m

- Active customers at 1900 (up 30% YoY)

- Dollar based net retention rate at 133% (from 113% in the period ended June 30, 2020)

Remember, the company is still founder led and it may be hard to find a CEO that benefits from a better rating than David Morken:

- David Morken enjoys a 99% approval rating

- Company score of 4.5/5

In order to support its growth, the company is actively recruiting and expanding its offices in North Carolina. It plans to recruit over 1.100 employees over the 2020 - 2028 period. Up from 750 employees active today.

BENCHMARK'S TAKE

- The 2010s were the years of Twilio, were apps seamlessly integrated communication tools. The 2020s are the Bandwidth years, were massive online communications becomes the norm and phone services are replaced with internet communications

- The market Bandwidth is tackling is set to grow to $ 25B by 2025 - CPaaS is still nascent and boosted by the shift to “Remote Everything”

- With its Tier-1 Network Bandwidth can undercut its competitors and offer the scale solution Zoom, Google and Microsoft need

- Bandwidth should not be compared directly to Twilio. Bandwidth acts as an enabler of voice, messaging and video communications for businesses that rely heavily on communications. Twilio serves businesses that want to add communication services to their apps

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.