Hawkish Inflation Chorus

After last week's hawkish central bank chorus, ten-year Treasury rates are already up 8 basis points this week, leading a worldwide surge up in government borrowing costs.

Go Deeper (2 min read)Beijing Is Preparing For Evergrande's Downfall

Evergrande, the Chinese property developer, has yet to confirm whether it would make interest payments on its US-dollar bond, a critical milestone that investors have been watching.

Go Deeper (2 min read)Evergrande, The Tip Of The Iceberg?

China's most indebted property developer could fail to pay interests on its debt. The company might then default on its $ 305B in liabilities, sending shock waves through the Chinese real estate market.

Go Deeper (4 min read)An Ugly September, Again?

Investors are preparing for more market volatility in the coming weeks even if equities hoover near fresh highs after seven months of straight gains.

Go Deeper (2 min read)The Tech Boom Is Over?

Despite reporting stellar results for the second quarter, many tech companies were punished by investors for their more cautious forecasts. Major lockdown-winners are now warning that growth going forward might be pressured as consumers get back to their pre-pandemic lives.

Go Deeper (2 min read)More from Markets

A Warm Summer For The Fed

Excess savings and the approach of the summer could lead consumers to direct their “revenge buying” on categories long shunned: alcohol, cosmetics and perfumes.

Go Deeper (2 min read)

Tapering Talks?

The Fed took a hawkish turn on Wednesday as they pencilled two potential rate hikes in 2023, sooner than previous estimates.

Go Deeper (1 min read)

Volatility Is Gone... According To Big Banks

Jamie Dimon, the CEO of JPMorgan Chase, said that trading revenue will drop to around $ 6B as the market volatility prompted by the pandemic fades away

Go Deeper (1 min read)

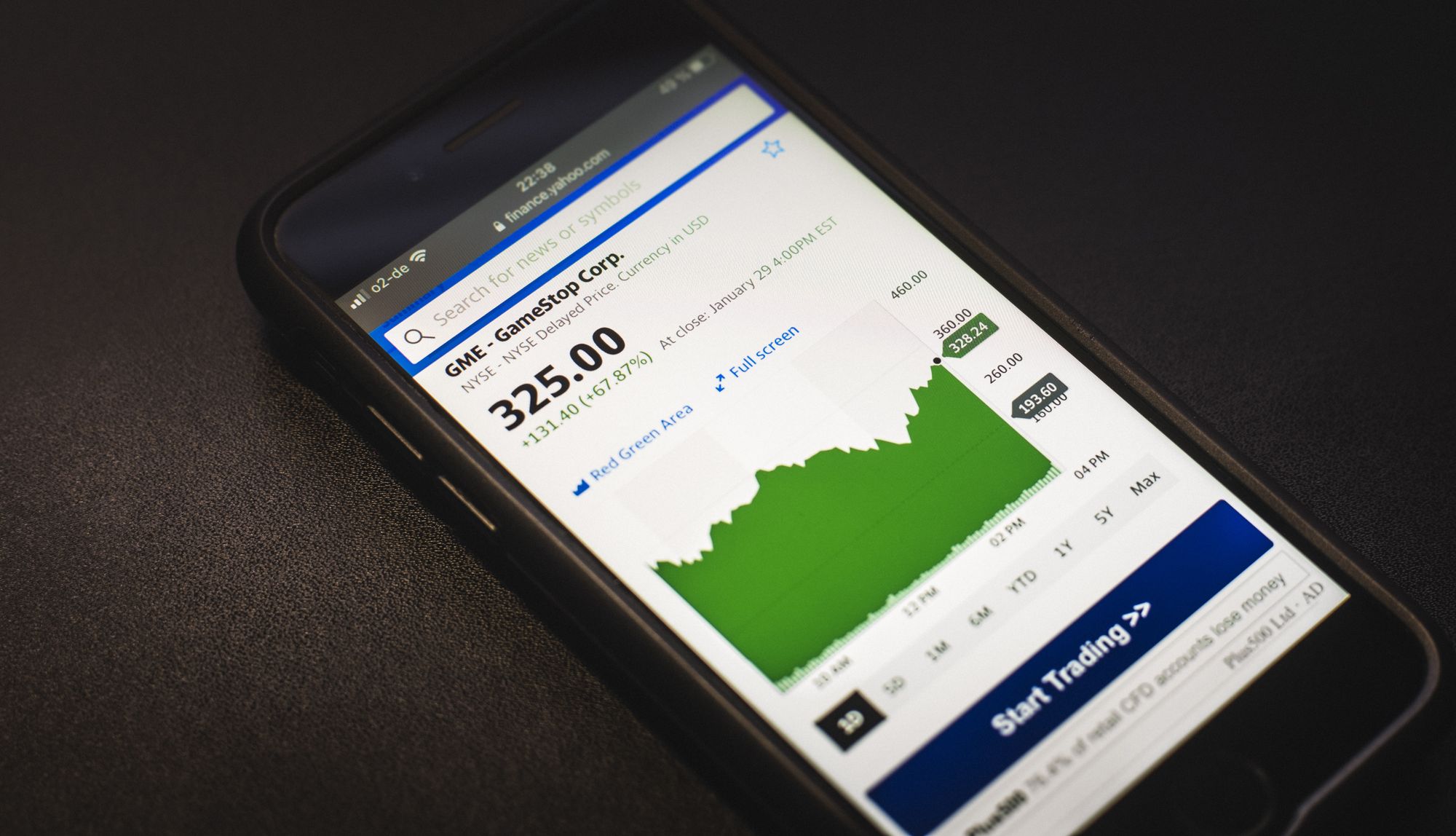

Cryptos And New "MEME" Stocks?

Recent months have been interesting, even by Wall Street standards. Back in February, this took the form of extreme speculation in heavily shorted stocks and unlimited optimism regarding the fate of many high-growth stocks.

Go Deeper (2 min read)

Emerging Markets, A Dangerous Bet?

A rise in rates in developed economies could lead to a considerable capital flight from riskier, emerging regions to safer, developed economies.

Go Deeper (2 min read)

Global Manufacturing Picks Up

Manufacturing activity is picking up in the U.S. as the economy re-opens. However, the market is still pressured by a lack of workers, a shortage of key products (semiconductors) and booming commodity prices.

Go Deeper (2 min read)